Fixed Assets

Tip

Only releases with enhancements or resolved issues for this module have content below.

2024.3

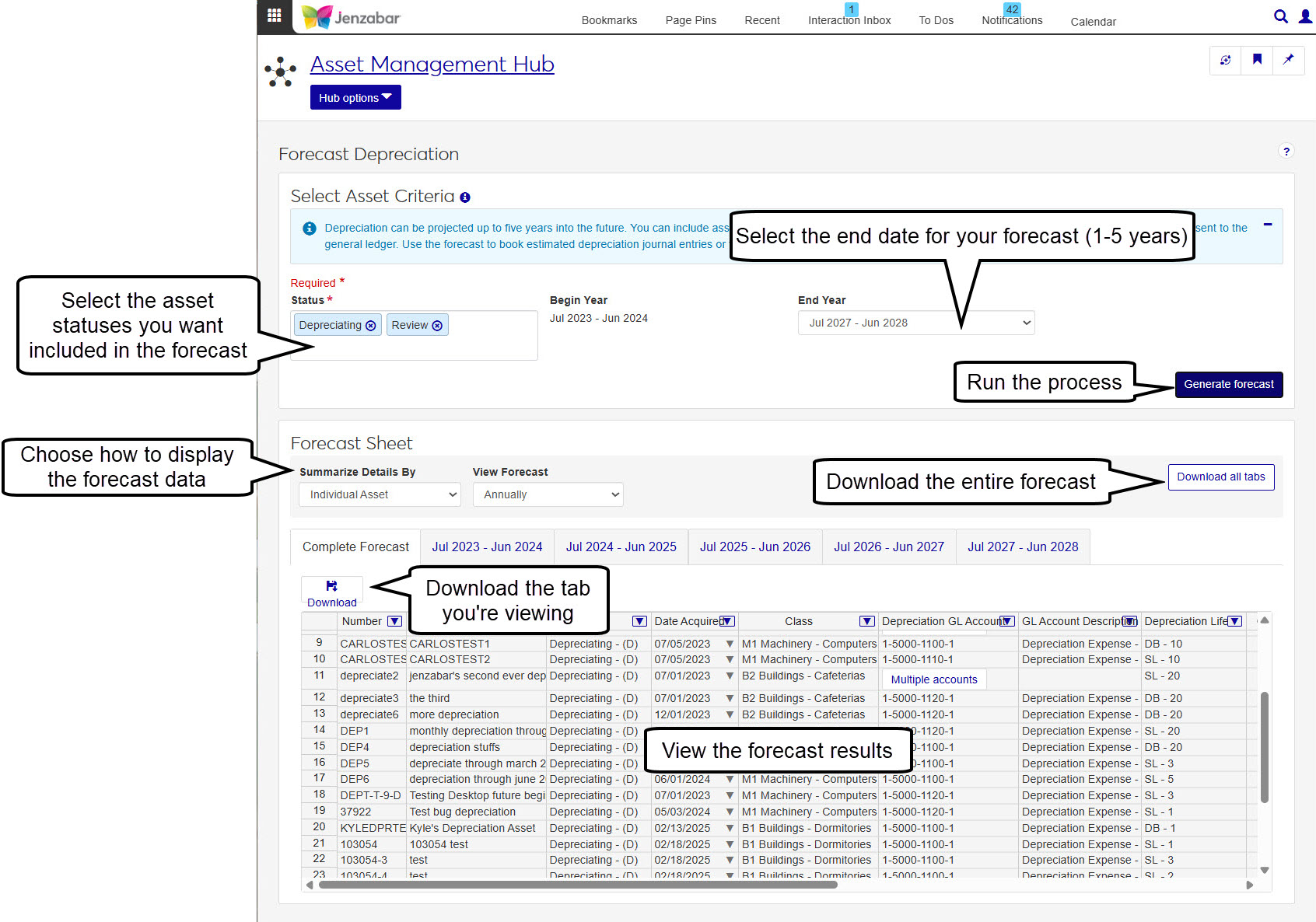

The new J1 Web Forecast Depreciation feature allows you to project the depreciation of your assets for up to five years. This feature will allow you to track your asset depreciation, predict when items will be fully depreciated or need replaced, and download to Excel. To forecast depreciation, follow the following steps:

Select the asset statuses you want to include from the Status drop-down.

Select an End Year.

Click the Generate forecast button.

Your results appear in the Forecast Sheet where you can change how the data is displayed and use the tabs to view specific years.

Tip

A new "Can generate forecast" permission was added to the Asset Management Fixed Asset Access role in the new Forecast Depreciation section.

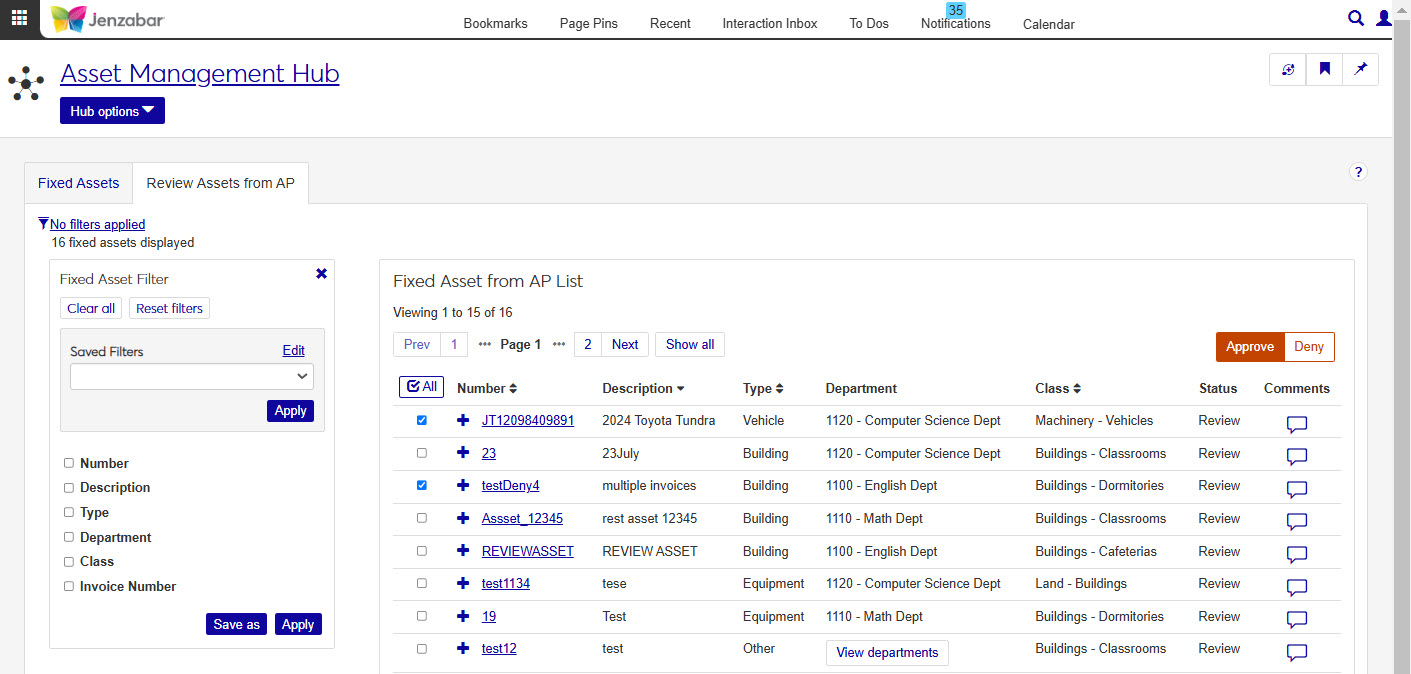

The new Review Assets from AP tab on the Fixed Assets page allows you to review and Approve or Deny assets added through the J1 Web Accounts Payable (Procurement hub) module. If your school is licensed for Fixed Assets, Accounts Payable, and Procurement, you can associate invoice line items (in CIP or Review status) from the Invoices page with an existing asset in the Fixed Asset Number column.

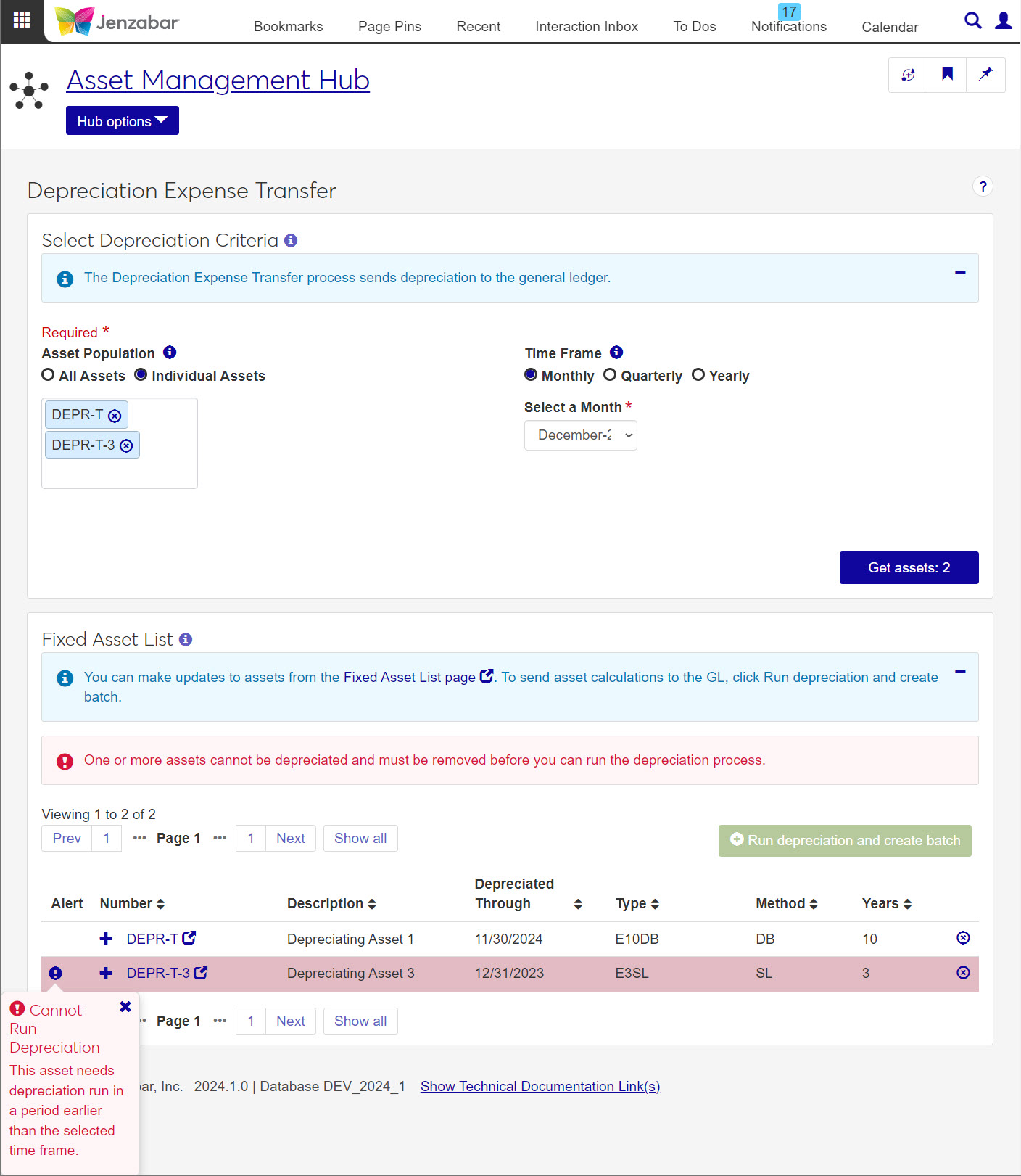

The Depreciation Expense Transfer process calculates depreciation expense for depreciating assets then sends the amounts to the general ledger. J1 Web allows you to run the asset depreciation process on a monthly, quarterly, or annual basis.

User Defined Fields are now available on Fixed Assets pages in J1 Web.

Enhanced options to view details for multiple fixed assets is now available on the Fixed Assets page. Select one or more asset from the list section and click the Open option. You will notice a switcher at the top of the Details page with arrows to move between the selections. No more than 50 selections can be viewed on the switcher.

Custom Content Blocks are now available on the Fixed Assets Hub Summary page.

2023.3

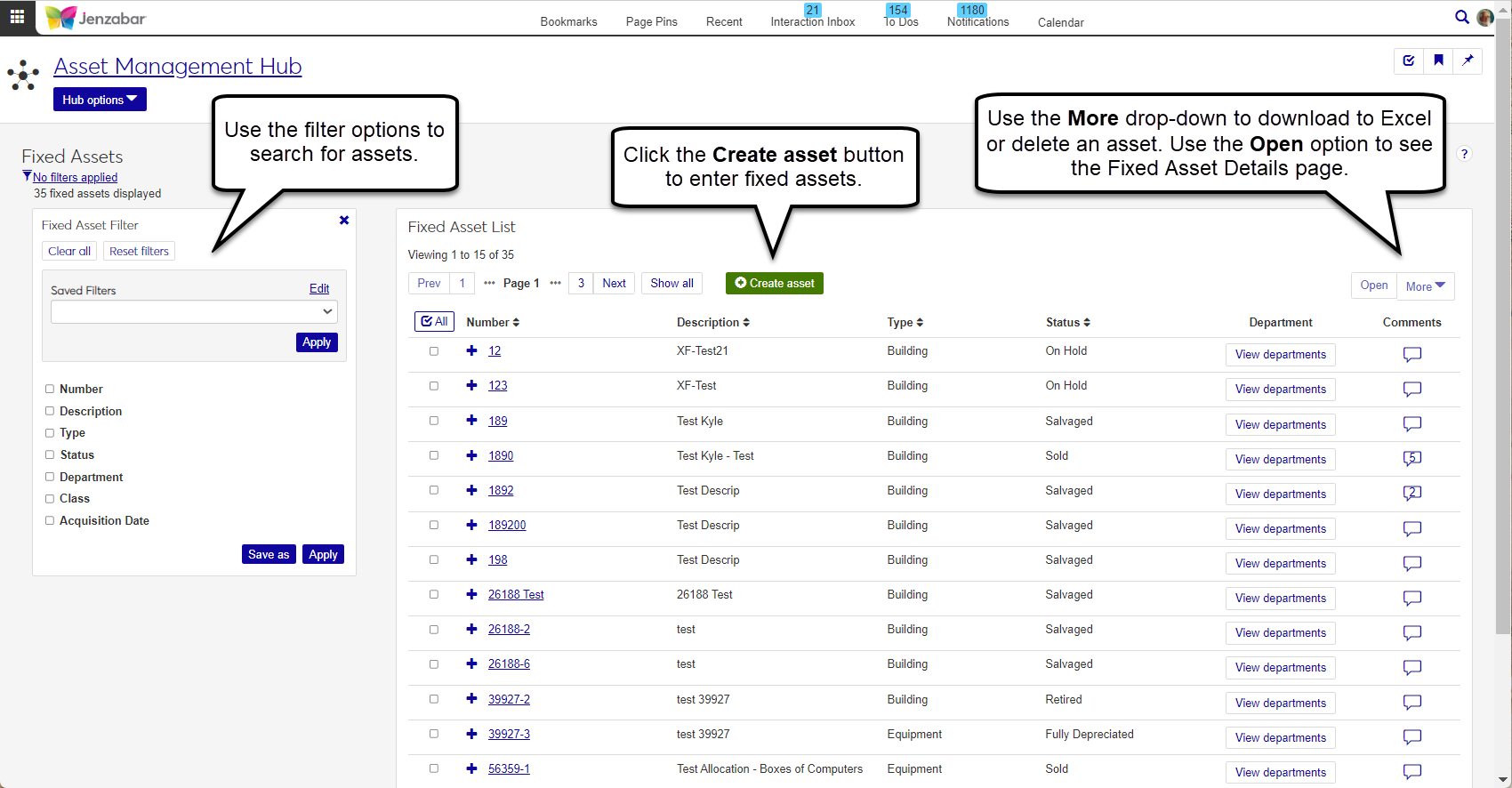

The Asset Management hub allows you to inventory and track your capital assets as well as maintain and process depreciation of your capital assets. Access to the this hub is granted via the Asset Management roles and permissions.

Note

In J1 Web, asset security is managed via security roles and permissions.

The Fixed Assets page allows you to inventory and track your capital assets as well as maintain and process depreciation of your capital assets.

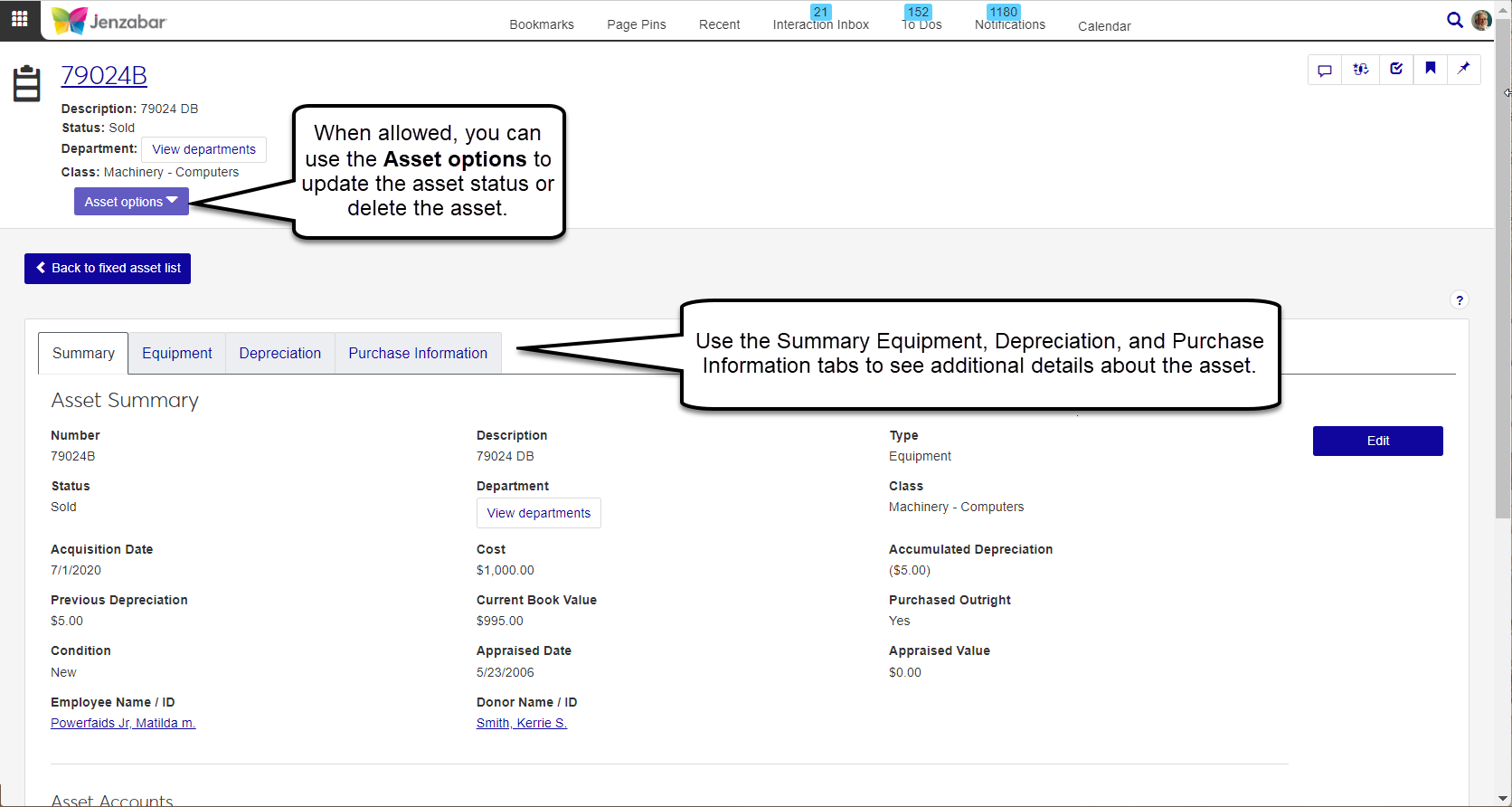

The Fixed Asset Details page lets you see all the asset details. At a glance, you can see the main details on the Summary tab. You can also jump to the Equipment, Depreciation, and Purchase Information tabs to view or edit the asset information.

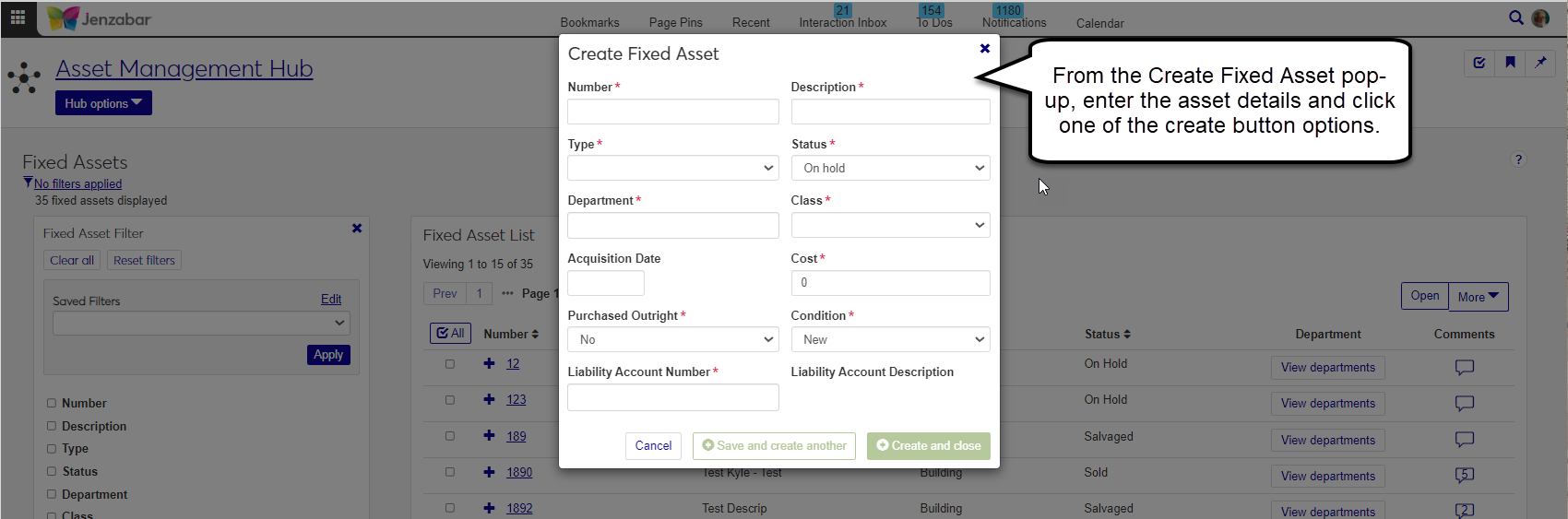

You can open the Create Asset page from the Fixed Assets List to add assets to the system.

Generate various reports from the Reports section of the Asset Management hub navigation. The following reports can be generated:

Accumulated Depreciation Summary

Construction in Progress (CIP) Summary

Depreciation Expense Summary

Disposition of Assets

Fixed Asset Analysis* (Previously named Fixed Asset Information report in Desktop)

Fixed Asset Summary

* These reports must be recustomized and saved to the J1 Web PBL; customizations made in Desktop will not work for these reports. For more information about customizing reports for J1 Web, see Working with Reports in J1 Web.

Issue | Description |

|---|---|

24210 | Some Asset Maintenance validations prevented users from successfully performing tasks. |

66999 | Forecast Depreciation excluded assets that had a depreciation begin or end date that fell outside the selected year range. |

Issue | Description |

|---|---|

RN34029 | The fxform.pbl form was missing the APPID column and could not be used to update the asset_master_udef table. |

Issue | Description |

|---|---|

77226 | Duplicate rows were created in ASSET_COST_HISTORY when an invoice was created and attached to an asset. |

RN33808 | Users weren't able to delete their unread comments from the Asset Number/Description field on the Asset Maintenance window. |

2021.3

2021.2

Issue | Description |

|---|---|

119648 | An error was generated during the depreciation expense transfer process due to a data duplication issue. |