Accounts Payable

Tip

Only releases with enhancements or resolved issues for this module have content below.

2024.3

2024 Year-End Enhancements in 2024.1.0.1 Patch

Year-end enhancements for 2024 IRS 1099 tax forms were included in the 2024.1.0.1 patch. There are no updates in the 2024.2 release, and 2025 IRS1099 tax form updates will be included in the 2025 year-end release.

2024.1

2023.3

1099 Year-End Updates

Form Changes

There are no form changes this year.

The image file for Copy A has been updated to the red image for Jenzabar supported 1099 forms 1099-MISC, 1099-NEC, 1099-INT, and 1099-R for the 2023 tax year. The 1099-Q form wasn't updated since the IRS prefers that form to be submitted online. If the 1099-Q is printed, the black text image is allowed.

Tip

Jenzabar One Desktop users may use preprinted forms or the form image report which includes the image, instructions, and data.

Media Changes

There are no media changes this year.

IRS 2023 Filing Links

Full List of Updates: https://www.irs.gov/pub/irs-prior/i1099gi--2023.pdf

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

1099-INT

2023 Form: https://www.irs.gov/pub/irs-pdf/f1099int.pdf

2023 Instructions: https://www.irs.gov/pub/irs-pdf/i1099int.pdf

1099-MISC

2023 Form: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

2023 Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

1099-NEC

2023 Form: https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

2023 Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

1099-Q

2023 Form: https://www.irs.gov/pub/irs-pdf/f1099q.pdf

2023 Instructions: https://www.irs.gov/pub/irs-pdf/i1099q.pdf

1099-R

2023 Form: https://www.irs.gov/pub/irs-pdf/f1099r.pdf

2023 Instructions: https://www.irs.gov/pub/irs-pdf/i1099r.pdf

New Company ID Field on the Electronic Payment Configuration Window

A new Company ID field has been added to the Electronic Payment Configuration window. This field lets you enter a separate company ID for situations when the Immediate Origin should not be used as the Company ID in the NACHA file output.

Issue | Description |

|---|---|

143167 | When editing student refund invoices with multiple invoice detail lines, a budget check error was returned for Accounts Receivable subsidiary accounts. Budget checking should only occur on non-subsidiary accounts. Budget checking will no longer run if the vendor ID is the Jenzabar default ID #999999999, since this is an indicator that these are student refund invoices and the account numbers on the invoice detail will be subsidiary accounts. |

25222 | The payments process allowed for the same check number to be used twice when it was previously added to the system by a manual or immediate check invoice. |

RN36522 | The Checks/Electronic Payments process sometimes ended in a deadlock error if other processes were writing data to the transaction history table while the process was running. |

RN36722 | When multiple invoices were selected on the Checks To Be Issued and Electronic Payment To Be Issued reports, the Payment Totals were incorrect. |

RN40400 | In some cases, payable offset transactions were not being created in Regular Payment invoice batches upon editing. Instead, due to/from balancing transactions were created to balance the batch. This caused the payments process to not pick up those invoices for payment. |

RN46637 | The AP Register report was timing out in some cases. |

RN50366 | The OK Miscellaneous Claims report did not work properly for invoices to the state fund code 701. |

RN52044 | The "Date to be on Electronic Payment" column has been moved to the "Select Invoices for Payment" window and disabled on the "Checks/Electronic Payments to be Issued Report". This date will be used to update the e-Payment Date this Run field (EPAY_DTE_THIS_RU) upfront, prior to the retrieval of the invoices and will be used throughout the payment processing. Previously, the payment type results may have changed between the Payments to be Issued and the Print Payments processes, sometimes generating a check for what previously showed as an electronic payment on the Electronic Payments to be Issued report. |

RN52060 | Searching for a large number of purchase orders on the Purchase Order Search and Status window caused performance issues. |

1099 Year-End Updates for 2022

Form Changes

The Government Forms Filing Wizard includes the necessary updates for all 1099 forms.

Forms 1099-MISC, 1099-INT, 1099-NEC, 1099-Q are now continuous use.

1099-MISC Form

Box 13 is now the Foreign Account Tax Compliance Act (FATCA) checkbox.

Box 14 is now Excess golden parachute payments.

Box 15 is now Nonqualified deferred compensation.

Box 16 is now State tax withheld.

Box 17 is now State/Payers state no.

Box 18 is now State income.

No changes to the 1099-R form.

Media Changes

There are no media changes this year.

IRS 2022 Filing Links

Full List of Updates: https://www.irs.gov/pub/irs-prior/i1099gi--2022.pdf

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

1099-INT

2022 Form: https://www.irs.gov/pub/irs-pdf/f1099int.pdf

2022 Instructions: https://www.irs.gov/pub/irs-pdf/i1099int.pdf

1099-MISC

2022 Form: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

2022 Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

1099-NEC

2022 Form: https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

2022 Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

1099-Q

2022 Form: https://www.irs.gov/pub/irs-pdf/f1099q.pdf

2022 Instructions: https://www.irs.gov/pub/irs-pdf/i1099q.pdf

1099-R

2022 Form: https://www.irs.gov/pub/irs-pdf/f1099r.pdf

2022 Instructions: https://www.irs.gov/pub/irs-pdf/i1099r.pdf

Government Forms Filing Wizard

On Step 6: Print Forms, new report formatting options let you print Copy A and Copy B of the form on pre-printed forms or blank paper. Each formatting option also allows customization of the data and form images. For additional information, see the online help for Step 6: Print Forms.

Note

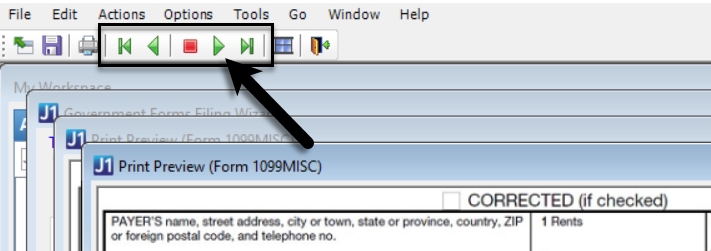

Due to this year's updates, you’ll need to use the green arrows at the top of the Desktop navigation to scroll through vendor 1099s.

Tip

See the following resources on MyJenzabar.net for additional information about filing 1099 forms:

Issue | Description |

|---|---|

RN38244 | On the Government Forms Filing Wizard window, users were unable to run 1099s for 2022. |

RN42324 | The ORG_MASTER.ID_NUM check constraint has been updated to correctly allow ID_NUM values that are greater than 999999999. |

RN42360 | When there were several users in the system, the feedback data caused the Print Checks process to only retrieve invoices for vendors that received e-payments. A new Show Feedback checkbox in the Select Invoices for Payment window lets users decide how feedback data is used in the process. It is unselected by default. When selected, the Print Checks process may take longer to run and may not return the correct data. |

RN43254 | On the Invoices window, the Save & Create New button was available when opening posted or paid invoices from the Match Requisition, PO, Invoice and Check window and when clicked, set the status on the existing invoices back to unposted, allowing for posted or paid invoices to be deleted. |

RN45803 | If a vendor record had a Sole Proprietor/Additional Name, the media file for 1099 forms placed the business name instead of the sole proprietor name in positions 288-327 of the B record. |

Issue | Description |

|---|---|

RN26811 | The Select Invoices for Payment window didn't consistently display all invoices ready for payment. |

RN31473 | Tabs were not available on the Name Entity window when it was opened from the following windows:

|

RN31834 | The OK Misc Claims report did not work properly for the state code of 723. |

RN32005 | Vendor invoice payments weren't being added to the ACH file. |

RN32253 | Customized versions of the 1099-MISC InfoMaker report were not appearing in the Customize drop-down field of the Government Forms Filing Wizard window > Step 6 Print Forms tab. |

RN37596 | Student Refund invoices for subsidiaries that didn't have epayments set up showed up in the check run process as epayments, but students weren't added to the epay file or sent a check. |

1099 Year-End Updates for 2021

Form Changes

The Government Forms Filing Wizard will include the necessary updates for all 1099 forms.

The Summary Report and Form Data Report generated from the Government Forms Filing Wizard were also updated to improve consistency with the 1099 forms.

No changes to the 2021 1099-INT, 1099-Q, and 1099-R forms.

1099-MISC

The title for form 1099-MISC has been changed from Miscellaneous Income to Miscellaneous Information.

Box 11 includes any reporting under section 6050R regarding cash payments for the purchase of fish for resale purposes from an individual or corporation who is engaged in catching fish.

1099-NEC

Box 1 will not be used for reporting under section 6050R regarding cash payments for the purchase of fish for resale purposes.

Box 2 on Form 1099-NEC (or box 7 on Form 1099-MISC) is used to report any sales totaling $5,000 or more of consumer products for resale, on buy-sell, deposit-commission, or any other basis.

1099-NEC form has been resized to accommodate 3 forms on a page.

Media Changes

Updated field positions to accommodate the increased length of several field positions.

IRS 2021 Filing Links

Full List of Updates: https://www.irs.gov/pub/irs-prior/i1099gi--2021.pdf

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

1099INT

2021 Form: https://www.irs.gov/pub/irs-pdf/f1099int.pdf

2021 Instructions: https://www.irs.gov/pub/irs-pdf/i1099int.pdf

1099MISC

2021 Form: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

2021 Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

1099NEC

2021 Form: https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

2021 Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

1099Q

2021 Form: https://www.irs.gov/pub/irs-pdf/f1099q.pdf

2021 Instructions: https://www.irs.gov/pub/irs-pdf/i1099q_19.pdf

1099R

2021 Form: https://www.irs.gov/pub/irs-pdf/f1099r.pdf

2021 Instructions: https://www.irs.gov/pub/irs-pdf/i1099r.pdf

Tip

For more information about working with these forms, see the Accounts Payable 1099 Reporting Process Guide on MyJenzabar.net, or the 1099 Form Overview in the online help. You can also visit our Help Hub Youtube channel to watch the Year-End process videos. Be sure to subscribe to our channel to stay up to date with new videos as we add them!

Issue | Description |

|---|---|

RN31453 | The ACH bank file was not being updated for Student Refund Invoice types. |

Updates to Address Code Drop-down Options

The Address code options were updated for the following windows.

Desktop Window | Description of Change | Contact Types Available |

|---|---|---|

Create/View Vendor > A/P Current Address field | Removed phone and email records from drop-down options | Address |

Student Subsidiary > Address Code field | Removed phone and email records from drop-down options | Address |

Issue | Description |

|---|---|

RN15690 | An error message displayed when the Create Regular Payment Invoices process was run for businesses whose vendor name was longer than 45 characters. |

RN18106 | Tax refund amounts in TX batches were doubled in J1 2020.x versions. Versions prior to 2020.x are correct. |

RN18318 | On the Create/Edit Purchase Orders window, invoices could be created for POs not yet received, even when the Receiving setting on the Purchasing Module Setup window was set to mandatory before 'Invoice can be created'. |

RN18795 | Deleting an invoice did not delete the associated due to/due from transactions. |

RN20221 | Miscellaneous Claims file, position 208, showed 'P' followed by zeros for State Code = 700. It now correctly shows 'N' followed by the check number. |

RN20682 | 1099-NEC information was adjusted to fit the form appropriately, including the amount for Box 1. |

RN20683 | A record, positions 28-43 of the 1099-MISC media file, contained incorrect characters that caused it to be rejected by the IRS. These characters have been removed from the file to meet IRS submission guidelines. |

RN20874 | The following issues with 1099-MISC media file have been corrected:

|

Issue | Description |

|---|---|

RN15690 | An error message displayed when the Create Regular Payment Invoices process was run for businesses whose vendor name was longer than 45 characters. |

RN18106 | Tax refund amounts in TX batches were doubled in J1 2020.x versions. Versions prior to 2020.x are correct. |

RN18318 | On the Create/Edit Purchase Orders window, invoices could be created for POs not yet received, even when the Receiving setting on the Purchasing Module Setup window was set to mandatory before 'Invoice can be created'. |

RN18795 | Deleting an invoice did not delete the associated due to/due from transactions. |

RN20221 | Miscellaneous Claims file, position 208, showed 'P' followed by zeros for State Code = 700. It now correctly shows 'N' followed by the check number. |

RN20682 | 1099-NEC information was adjusted to fit the form appropriately, including the amount for Box 1. |

RN20683 | A record, positions 28-43 of the 1099-MISC media file, contained incorrect characters that caused it to be rejected by the IRS. These characters have been removed from the file to meet IRS submission guidelines. |

RN20874 | The following issues with 1099-MISC media file have been corrected:

|

1099 Year End Updates for 2020

Form Changes

There is a new 1099-NEC (non-employee compensation) form that replaces box 7 of the 1099-MISC form.

Media Changes

Updated to comply with the new 1099-NEC form and changes to the 1099-MISC form.

IRS 2020 Filing Links

Full List of Updates: https://www.irs.gov/pub/irs-prior/i1099gi--2020.pdf

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

1099MISC

2020 Form: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

2020 Instructions: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf

1099NEC

2020 Form: https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

2020 Instructions: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf

1099INT

2020 Form: https://www.irs.gov/pub/irs-pdf/f1099int.pdf

2020 Instructions: https://www.irs.gov/pub/irs-pdf/i1099int.pdf

1099R

2020 Form: https://www.irs.gov/pub/irs-pdf/f1099r.pdf

2020 Instructions: https://www.irs.gov/pub/irs-pdf/i1099r.pdf

1099Q

2020 Form: https://www.irs.gov/pub/irs-pdf/f1099q.pdf

2020 Instructions: https://www.irs.gov/pub/irs-pdf/i1099q.pdf

2020.2

Create Vendor Invoices Window

New Function security permissions on the Create Vendor Invoices window have been added to provide more control over user permissions. Instead of one permission for all invoice actions, they are now divided in to three functions: Enter Invoices, Immediate Check Invoice, and Manual Check Invoice. For example, If you don’t want a user to have the ability to create an Immediate check on the fly, remove the Immediate check action permission for that particular user group.

1099 Update

A new 1099-NEC form, will be introduced for the 2020 tax year and will replace box 7 of the 1099-MISC form. While the new 1099-NEC form is not yet available on the Government Forms Filing Wizard, the default data that will allow you to start tagging transactions (invoices & vendor records) with the new government form & label code(s) required for the 2020 tax forms.

Issue | Description |

|---|---|

109783 | The detail tab of the Invoice Entry window incorrectly displayed an error message that certain items had not been received, when they actually had. |

198669 | System error message appeared when generating the 1099 MISC form while the Over_600 (d_trans_hist_govt_form_ds_over_600) query was selected on the Government Forms Filing Wizard window. |

205387 | Clicking the Print button on the Select Invoices for Payment window and selecting a PDF printer created a report that contains blank pages. |

1099 Year End Updates for 2019

Form Changes

All 1099 forms will display legal names for any selected IDs.

Media Changes

There are no media changes this year.

IRS 2019 Filing Links

Full List of Updates: https://www.irs.gov/pub/irs-prior/i1099gi--2019.pdf

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

1099MISC

2019 Form: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

2019 Instructions: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf

1099INT

2019 Form: https://www.irs.gov/pub/irs-pdf/f1099int.pdf

2019 Instructions: https://www.irs.gov/pub/irs-pdf/i1099int.pdf

1099R

2019 Form: https://www.irs.gov/pub/irs-pdf/f1099r.pdf

2019 Instructions: https://www.irs.gov/pub/irs-pdf/i1099r.pdf

1099Q

2019 Form: https://www.irs.gov/pub/irs-pdf/f1099q.pdf

2019 Instructions: https://www.irs.gov/pub/irs-pdf/i1099q.pdf

1099 Permissions Updated

All 1099 forms will display legal names for any selected IDs. Users will not be able to access the Government Forms Filing Wizard unless they have the appropriate permissions to view legal names.

Issue | Description |

|---|---|

193867 | The sort order was incorrect on the Checks To Be Issued Edit Report. |

194741 | Incorrect fiscal year was being returned for the first month of the fiscal year |

Issue | Description |

|---|---|

142424 | The payments process was not producing an appropriately formatted electronic payment file to meet conventional banking requirements. |

148974 | Several business office windows are experiencing performance issues related to the Project Code drop-down and upgrades to SQL2016. |

178915 | When a user double-clicked on a purchase order from the Match Requisition, PO, Invoice and Check window instead of clicking the View button, the wrong purchase order would open. |

184068 | The Date of Last Invoice field on the Create/View Vendors window was not updated when an invoice was created or paid. |

Issue | Description |

|---|---|

154300 | Invoices paying only a partial amount on a purchase order would occasionally unencumber the entire amount. When the invoice was saved, an additional line item would appear on the invoice detail which needed to be deleted. |

1099 Year End Updates 2018

Form Changes

New Date of Payment box on the 1099R form to show the date of payment for reportable death benefits

Media Changes

Value from the new Date of Payment box will go into Field Position 557-564 and will be formatted as YYYYMMDD

Field Positions 565-662 are now blank

Field Positions 663-722 are for Special Data Entries

IRS 2018 Filing Links

Full List of Updates: https://www.irs.gov/pub/irs-pdf/i1099gi.pdf

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

1099MISC

2018 Form: https://www.irs.gov/pub/irs-prior/f1099msc--2018.pdf

2018 Instructions: https://www.irs.gov/pub/irs-prior/i1099msc--2018.pdf

1099INT

2018 Form: https://www.irs.gov/pub/irs-prior/f1099int--2018.pdf

2018 Instructions: https://www.irs.gov/pub/irs-prior/i1099int--2018.pdf

1099R

2018 Form: https://www.irs.gov/pub/irs-prior/f1099r--2018.pdf

2018 Instructions: https://www.irs.gov/pub/irs-prior/i1099r--2018.pdf

1099Q

2018 Form: https://www.irs.gov/pub/irs-prior/f1099q--2018.pdf

2018 Instructions: https://www.irs.gov/pub/irs-prior/i1099q--2018.pdf

New Date of Payment Column for 1099-R Forms

On the Government Forms Filing Wizard window, if you are creating a 1099-R, there is a new column on the Step 2 tab for Date of Payment. This new column appears after 14 State distribution in step 2 of the wizard.

Issue | Description |

|---|---|

163835 | A system error occurred during the post process of a student refund invoice batch for customers set to open items when the Apply Aid First setting was turned on. The posting of the batch doesn't complete because of the error This issue has been corrected. |

167700 | Invoice entry incorrectly displayed “fully unencumbered” message on Detail tab because it was looking at the most recently entered PO, even if it was for a different vendor. This has been resolved. |

Issue | Description |

|---|---|

163835 | For clients using Open Items accounting with Apply First Aid enabled, a system error appeared when posting student refund batches. |