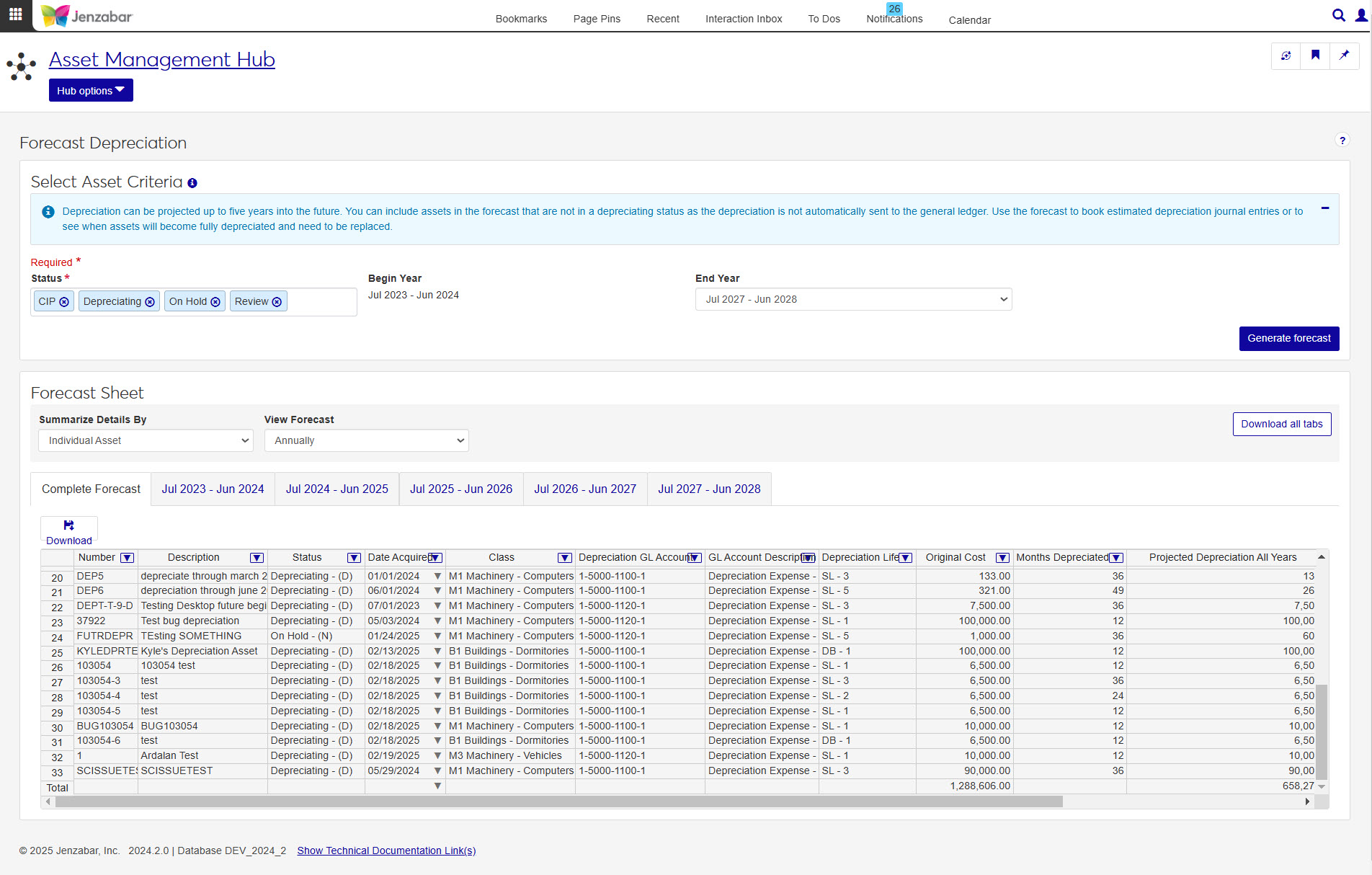

Forecast Depreciation

Important

Information and features vary according to the roles to which you belong and the permissions associated with those roles. For more information, contact your module manager or your campus support team.

With Forecast Depreciation you can project assets up to five years into the future and understand the depreciation of your assets. You can include assets in the forecast that are not in a depreciating status as the depreciation is not automatically sent to the general ledger.

Tip

Assets that are not in a depreciating status and are not ready to depreciate may not be included in the calculation if needed information has not yet been entered.

Notice

An asset in review or on hold may not have a begin or end depreciation date yet. Since depreciation cannot be accurately calculated without these dates, this asset would not be included in the forecast.

Depreciation forecast can be used for several helpful bits of information:

Create a capitol budget by projecting new capital expenditures for future long range budgets.

Identify when assets will be fully depreciated and may need to be replaced.

Review how much depreciation is occurring on different groups of assets and plan replacement purchases for each year, quarter, or month.

Download to Excel to add planned assets, chart expected asset replacement needs, and distribute to decision makers.

For a user to use the Forecast Depreciation feature, at minimum, they will need to have the role Asset Management Fixed Asset Access with the Can view assets, Can download to Excel, and Can generate forecast.

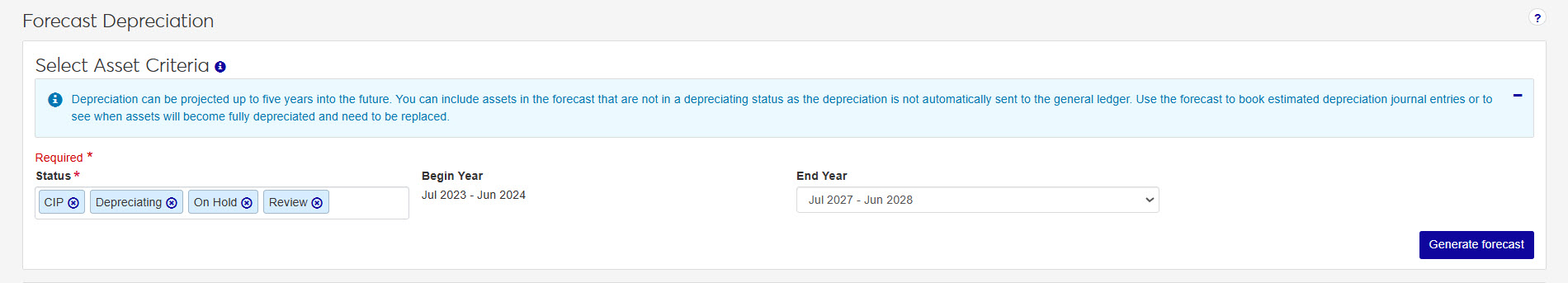

Select Asset Criteria

The Select Asset Criteria will determine which assets will appear in your forecast. There are two criteria options to narrow your results: Status and End Year.

First, you'll need to determine which asset statuses you would like to include:

Construction Under Progress (CIP)

This status indicates the asset is not in service or ready for use. It can be used for current building construction and machinery installation.

Depreciating

This status indicates the asset is in the process of depreciating or decreasing in book value.

On Hold

This status indicates the asset has met capitalization requirements, but needs an additional transaction in order to apply all associated costs to the asset and the depreciation process can begin.

Review

This status indicates the asset is newly submitted from Accounts Payable and is being reviewed to ensure it meets capitalization requirements.

While the Begin Year will be automatically populated with the current active GL year, you can choose the End Year to limit the number assets included in your forecast. There are five years to pick from, the current year and the next four years. Use the drop-down to select an available year.

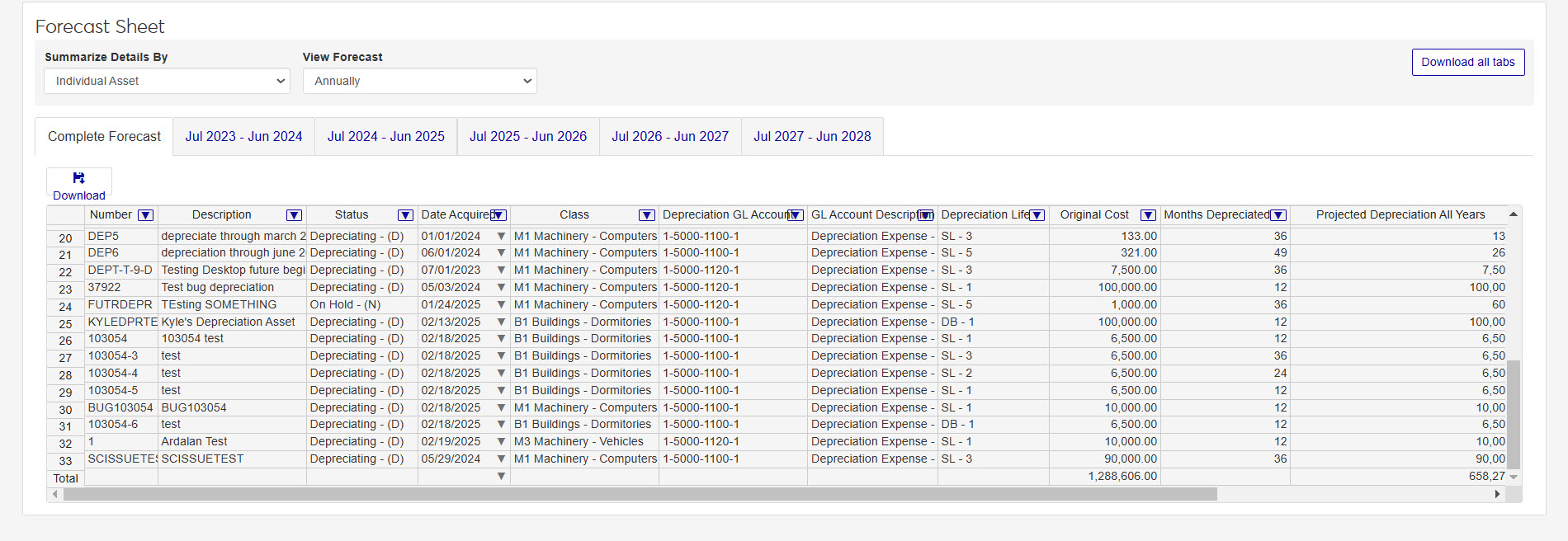

Forecast Sheet

When you generate a forecast the results will appear in the Forecast Sheet. The results can be sorted and downloaded once the forecast is run. You can sort the results using the two filters at the top of the datasheet: Summarize Details By and View Forecast.

Tip

The Forecast Sheet will show you six tabs. Five year tabs and one Complete tab.

Choose how you want your forecast to appear.

Summarize Details By: you can have the forecast organize your asset information by Asset Class, Depreciation GL Account, Depreciation Type, or Individual Asset (default).

View Forecast: You can choose to view your asset information Annually, Quarterly, or Monthly.

The information presented in the Forecast Sheet includes the following:

Note

You can rearrange columns by dragging and dropping them in any desired order.

Number

Description

Status

Date Acquired

Class

Depreciation GL Account

GL Account Description

Depreciation Life

Original Cost

Months Depreciated

Projected Depreciation All Years

Ending Accumulated Depreciation

Ending Book Value

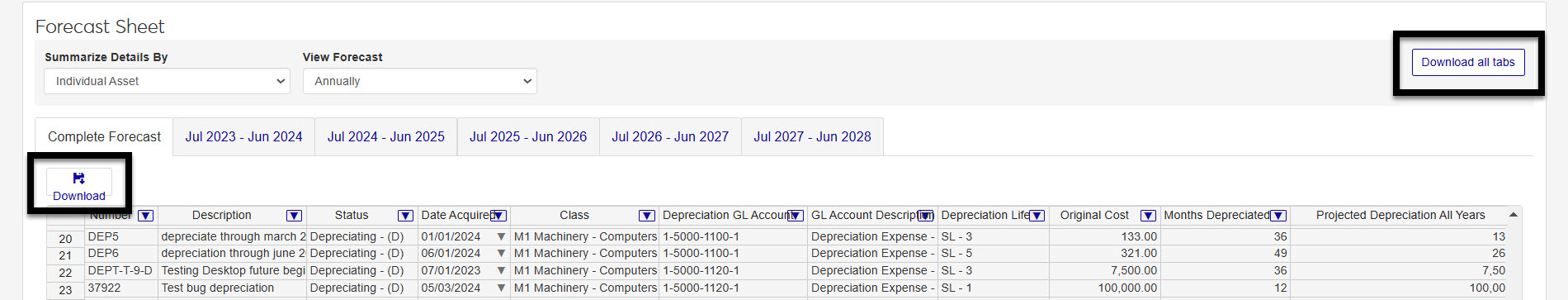

When your forecast is displaying the information in the format you prefer, you can download the tab you're viewing, or all five of the tabs to an Excel spreadsheet.

To download one tab, click the Download button just below the tabs on the left side of the sheet. To download all the tabs at once, click the Download all tabs button at the top-right of the Forecast Sheet across from the filters.

How To

Access the Depreciation Forecast page from the Asset Management hub.

Select the asset statuses to include in the forecast.

Select an end year from the drop-down options.

Click Generate forecast.

After the Depreciation Forecast is generated, results will appear in the Forecast Sheet.

Select how you want to view the information.

Summarize Detail By: Select Asset Class, Depreciation GL Account, Depreciation Type, or Individual Asset

View Forecast: Select Annually, Quarterly, or Monthly

Select the tab for the year you want to download.

Note

Remember that you can only view five years of forecasting.

Click the Download button.

After the Depreciation Forecast is generated, results will appear in the Forecast Sheet.

Select how you want to view the information.

Summarize Detail By: Select Asset Class, Depreciation GL Account, Depreciation Type, or Individual Asset

View Forecast: Select Annually, Quarterly, or Monthly

Click the Download all tabs button at the top of the Forecast Sheet.

FAQ

There are a few reasons that an asset may not appear in your forecast:

Does the expected asset meet your Asset Criteria selections?

Does the asset have a begin and end depreciation date?

Is the begin and end date outside the five year forecast?

When an asset is associated with more than one department, the Multiple Accounts link will appear in the Depreciation GL Accounts column. Click the link to open a View Multiple Accounts window to see all GL Accounts/Descriptions associated with the asset.