Accounts Receivable

Tip

Only releases with enhancements or resolved issues for this module have content below.

2024.3

2024 Year-End Enhancements in 2024.1.0.1 Patch

Year-end enhancements for the 2024 IRS 1098-T tax form were included in the 2024.1.0.1 patch. There are no updates in the 2024.2 release, and 2025 IRS 1098-T tax form updates will be included in the 2025 year-end release.

Generate Register Reports in J1 Web

The AR Register and History Register reports can now be generated from the Receivables Management Reports hub.

AR Configuration Options In J1 Web

Certain configuration settings can now be managed in J1 Web. The following pages are now available in the Receivables Administration hub.

New permissions to access these pages are available in the Receivables Administration Role.

Additional Enhancements

Improved performance to functionality to access another student's information from the Student Account Details page.

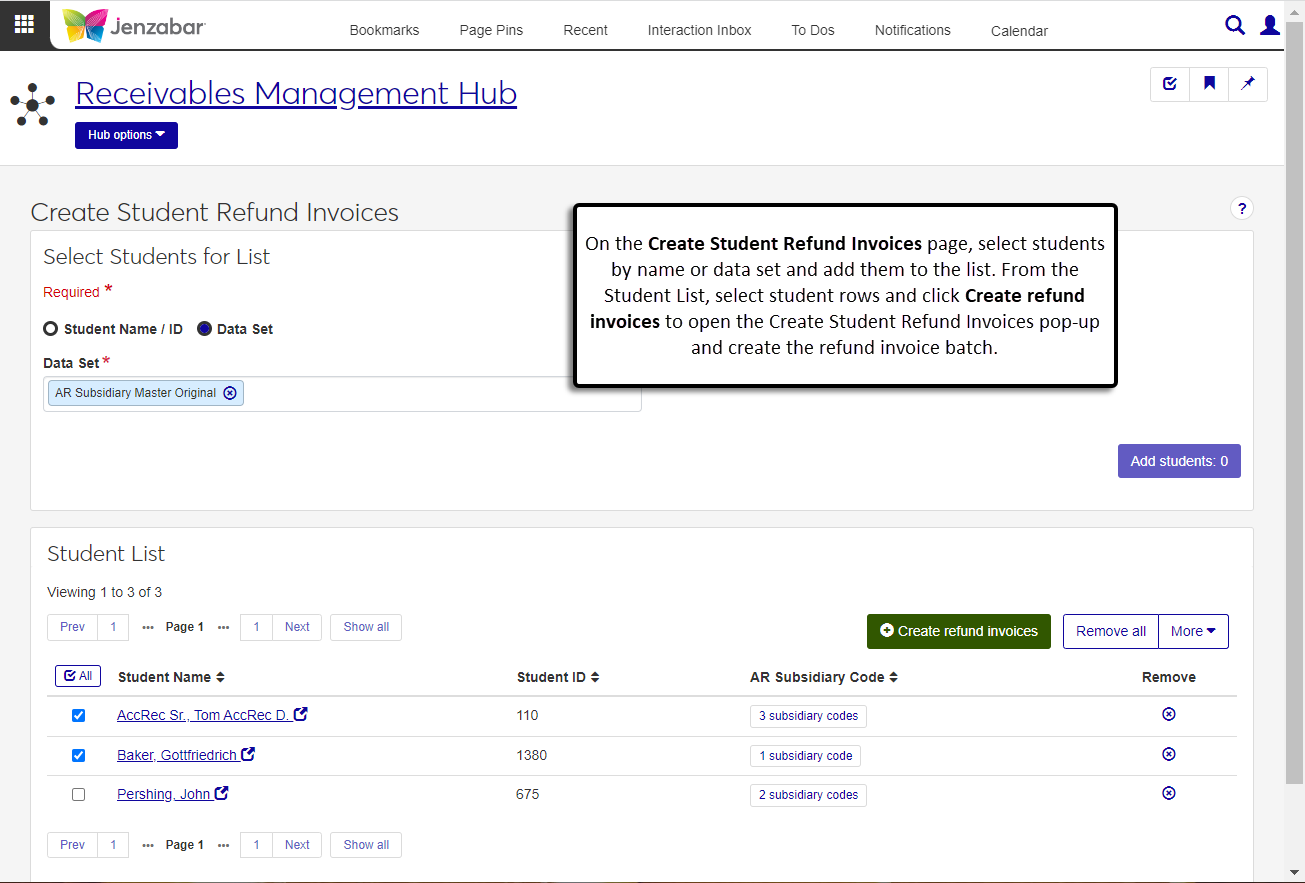

To improve performance, the system now limits the number of records for certain processes. When data sets return more than 10,000 results on the following pages, you'll need to modify the data set to return fewer results and run the process multiple times to process all the records.

Account Statements

Create Student Refund invoices

Generate Charges

Payment Plan Availability and Assignment

Transfer Subsidiary Balances

Register Report

History Register Report

New Fields for Calculating Payment Plan Dates

A new field and checkbox on the Payment Plan window provide options to specify when payment plans start for students.

The First Payment Start Year field defines the year in which the payment plan payments start.

The Set first payment due date to the date after the student signs up checkbox is used to define the first payment date for students who sign up for a payment plan after the plan's start month, day, and year.

These options determine the payment dates for plans added to students in Desktop and J1 Web and when students select a plan on the Campus Portal. For more information, see the online help for the Payment Plan window.

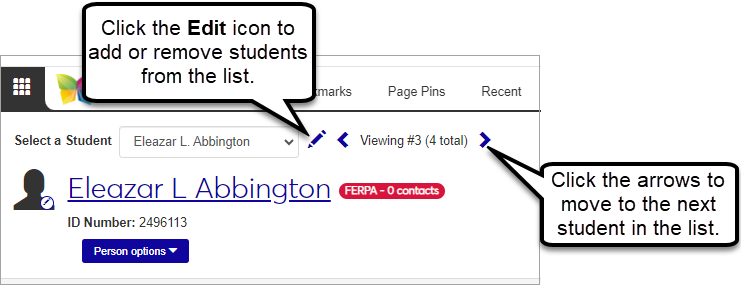

Enhanced Options to View Account Details for Multiple Students

The Student Account Details page now includes options to quickly switch to another student's details and select a list of students to view. A new Select a Student drop-down field at the top of the page above the student name lets you select another student and view their account details. You can click the Edit icon  to add or remove students from the list. You can also use the left and right arrows next to the student's name to quickly switch to another student's account details.

to add or remove students from the list. You can also use the left and right arrows next to the student's name to quickly switch to another student's account details.

Assign Payment Plans to Students in J1 Web

From the new Payment Plan Availability and Assignment page, you can select multiple students and make payment plans available for selection on the Campus Portal. You can also select individual students and assign a payment plan to them.

For more information, see Payment Plan Availability and Assignment.

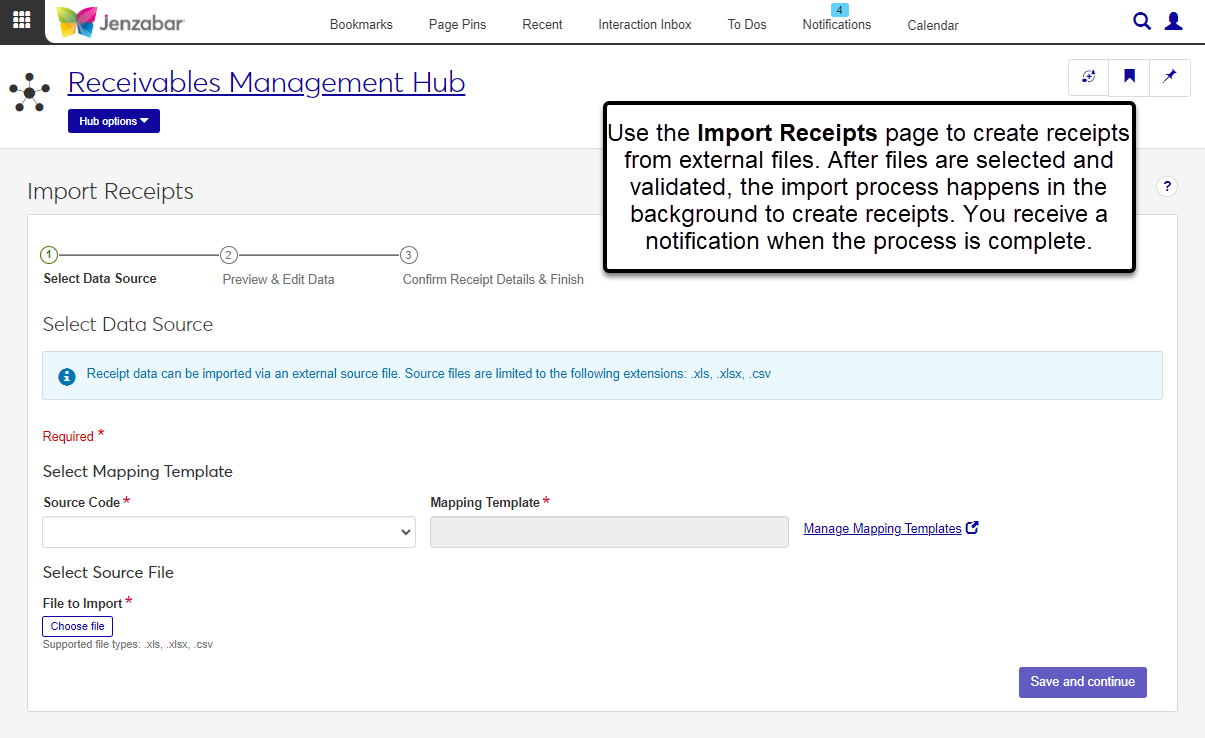

New Import Receipts Feature

Use the new Import Receipts page to create receipts from an external file. This 3-step wizard guides you through each part of the process and uses mapping templates to ensure the imported data is accurately added to the system.

Select Data Source. Select the file and mapping template, then preview the data to be imported. (Mapping templates are managed in the new Data Management Hub. For more information, see Data Mapping Templates.)

Preview & Edit Data. Review the imported data, assign an RC batch description and date, and make updates to any rows with errors.

Confirm Receipt Details & Finish. Review a summary of the receipts to be created and start the import process. The process runs in the background, so you can continue working in J1 Web and you'll receive a notification when the process is complete.

Permission to import receipts is in the Receipts section of the default Receivables Management role.

For more information about the process, see Import Receipts.

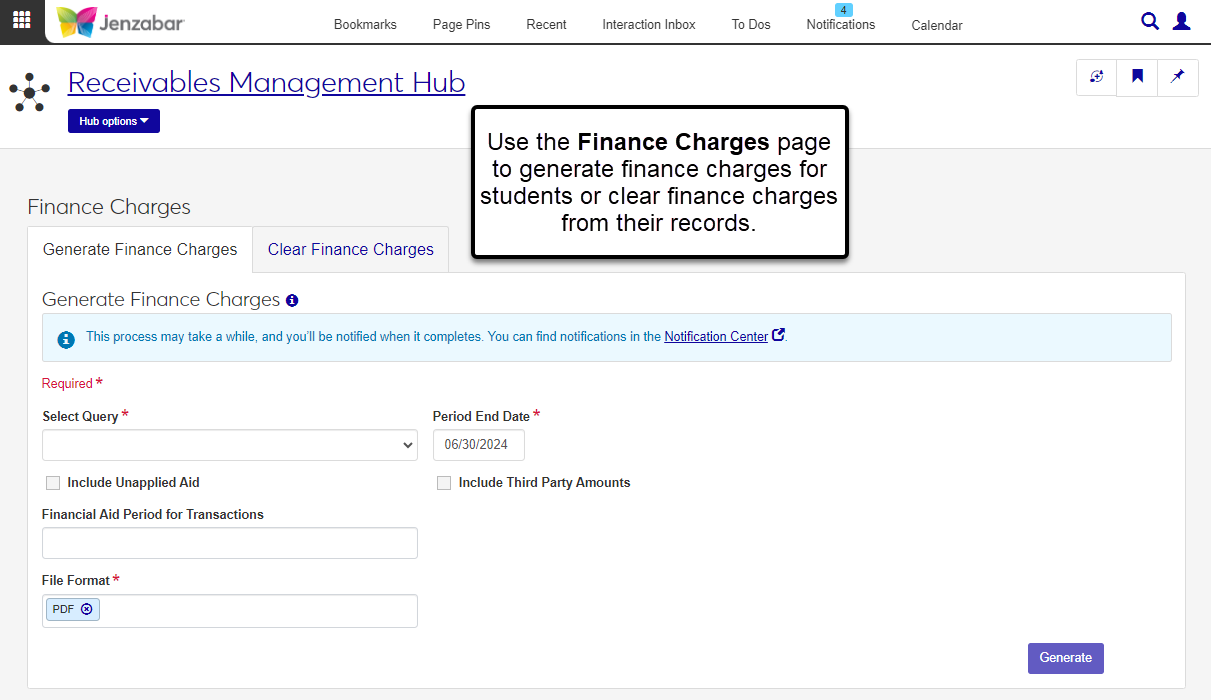

Generate Finance and Late Charges in J1 Web

From the new Finance Charges page, you can generate finance charges and clear finance charges from student records. For more information, see Finance Charges.

Additional Enhancements

The permissions to view and edit holds in the default Receivables Management role were removed. Permission to view holds is now managed in the Person Management role. For more details, see the online help for the Person Management role.

A new default Receivables Administration role provides permissions to manage Accounts Receivable settings and custom content blocks on the Receivables Management Hub Summary page. (Custom content blocks can be used to display announcements or important metrics based on J1 Web data sets.)

Note

At this time, most of the accounts receivable settings are managed in the Desktop from several windows, including A/R Configuration, Billing Periods, Subsidiary Control, and Subsidiary Definition for A/R. Additional configuration functionality will be available in J1 Web in future releases.

The ID Number / Name field now fills in the person's name when users enter an exact ID Number and tab to the next field. This update is available on pages throughout the Receivables Management hub.

2023.3

1098-T Year-End Updates

Form Changes

There are no form changes this year.

The image file for the Copy A 1098-T form has been updated to the red image for 2023 tax year processing.

Note

Jenzabar One Desktop users who do not have a Student Finance license may use preprinted forms or the form image report, which includes the image, instructions, and data.

Jenzabar One Desktop users who have a Student Finance license may use preprinted forms, the form image report (which includes the image, instructions, and data), and display PDF reports in the Campus Portal.

Media Changes

There are no media changes this year.

IRS 2023 Filing Links

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

2023 1098-T Form: https://www.irs.gov/pub/irs-pdf/f1098t.pdf

2023 Instructions for Forms 1098-E and 1098-T: https://www.irs.gov/pub/irs-pdf/i1098et.pdf

New Enhanced Student Billing Option on the A/R Configuration Window

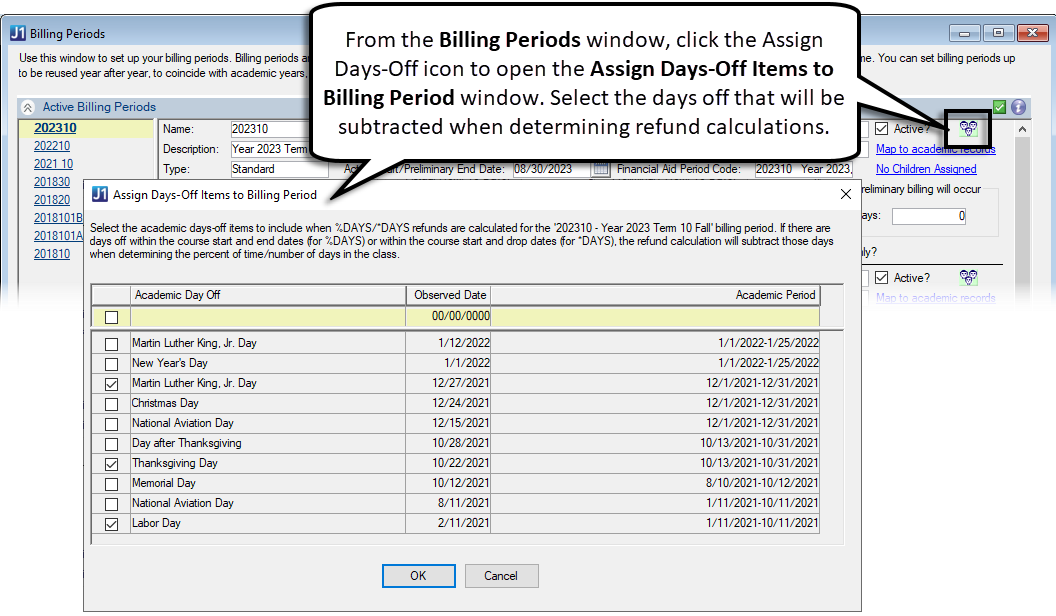

A new "Subtract Academic Days-Off when calculating %DAYS/*DAYS refund?" checkbox on the A/R Configuration window lets you choose whether to subtract academic days-off when determining the percentage or number of days to be used in the refund calculations..

When the checkbox is selected in the A/R Configuration window, a new group icon is visible on the Billing Periods window. When clicked, the new Assign Days-Off Items to Billing Period window opens. From this window, select which days-off will be subtracted when determining the percent or number of days to be used in the refund calculations.

For additional information, see the help for the A/R Configuration window.

Warning

J1 Web does not currently support the Open Items configuration. If your school is configured for Open Items in the Desktop A/R Configuration window, continue working in J1 Desktop as you will not be able to use J1 Web Finance at this time.

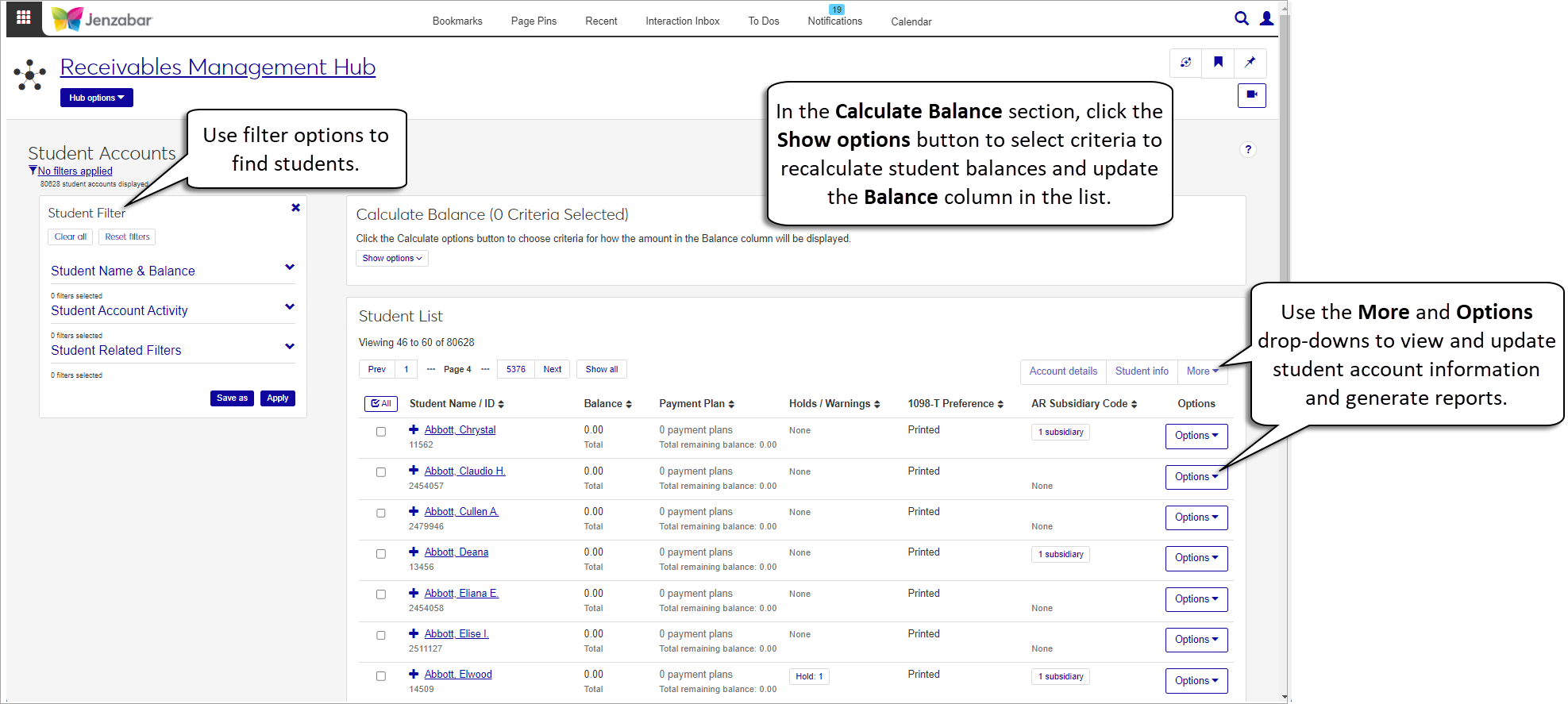

The Receivables Management hub manages accounts receivable information, including student account information, receipts, and charges. Access to this hub is granted via the Receivables Management role and permissions.

Most information related to student accounts can be accessed from the Student Accounts page, which lets you view and search for student account details based on various criteria. From this page, you can:

Filter the list of students based on financial or student information.

Calculate and display account balances based on criteria like 1098-T year/term, billing period, subsidiary code, and subsidiary group code.

Add discounts, exemptions/waivers, and holds.

Generate the A/R Inquiry report.

Access additional account and student information pages for one or multiple students.

Note

The Receivables Management hub grants access to the Student Account Details page; permissions to access the Student Information Details and Person Information Details pages is granted via the Common and Registration hub roles.

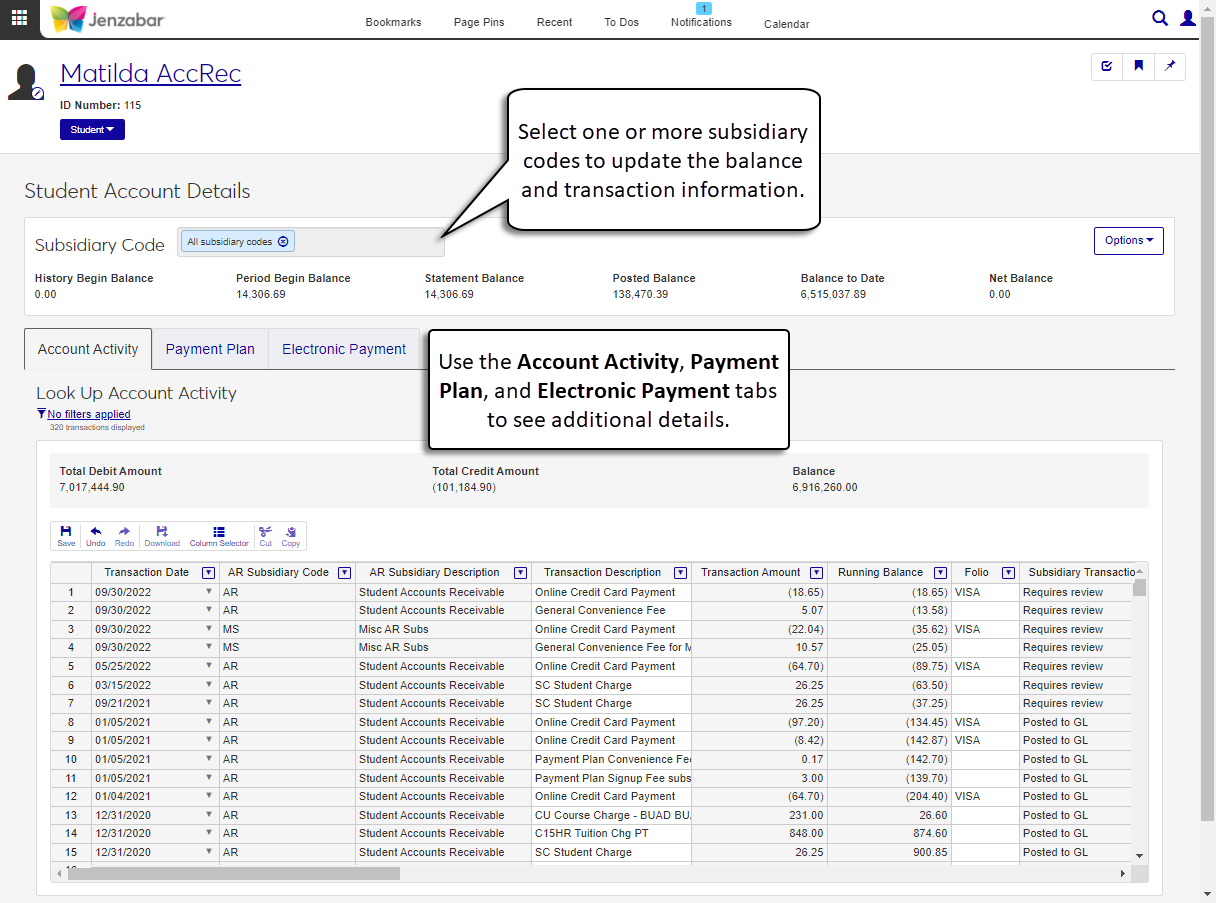

The Student Account Details page lets you view and update account activity, payment plan details, and electronic payment information for one or more students. You can view information for all subsidiary codes associated with the student, or for a single or subset of the associated subsidiary codes. Additionally, you can associate another subsidiary record with a student from this page.

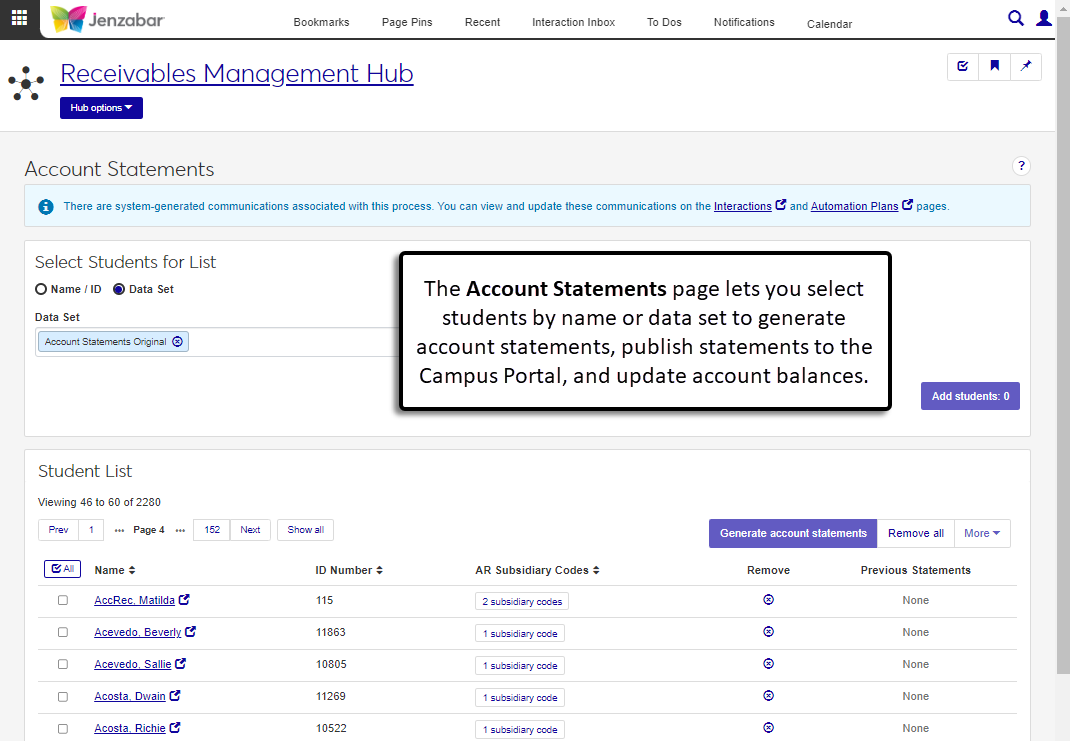

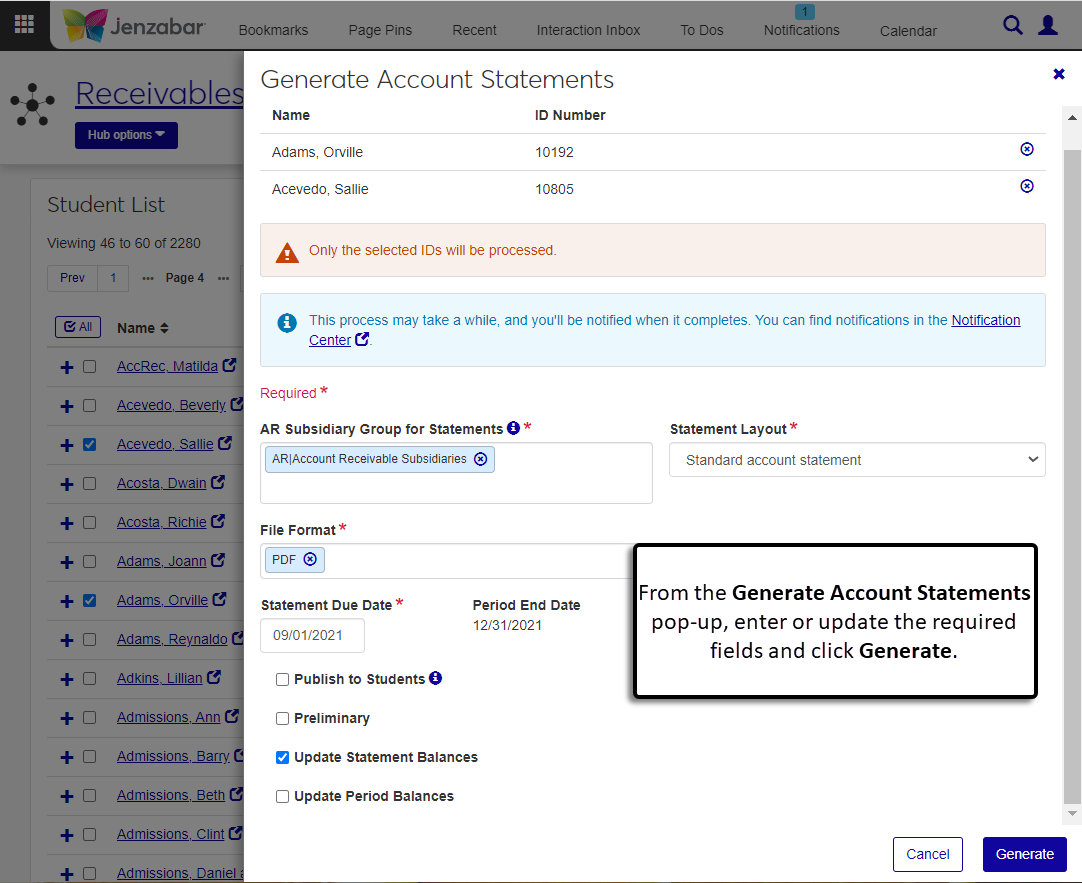

The Account Statements page lets you generate statements, publish them to the Campus Portal, and update account balances. You can add student to the list based on data sets (i.e., queries) or you can add students individually. Then select the students you want to generate statements for, click the Generate account statements button, and enter the required information to start the process.

Note

Jenzabar provides four default account statement layouts:

Standard account statement

Account statement with schedule

Account statement - year/term

Account statement - billing period

The "Account statement with schedule" statement layout is specific to J1 Web, and any versions of this layout that were customized in Desktop are not available in J1 Web. To customize this layout for J1 Web, follow the steps in Working with Reports in J1 Web.

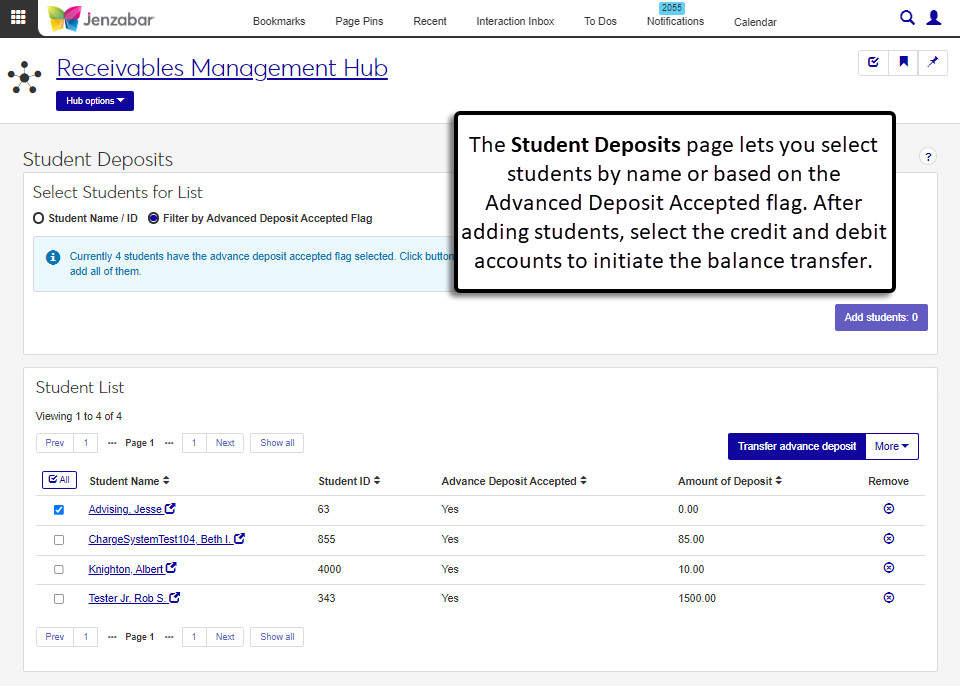

The Student Deposits page lets you transfer advance deposits to the appropriate subsidiary associated with the student. You can select students by name or based on the Advance Deposit Accepted flag. The process is initiated after the credit and debit account information is entered.

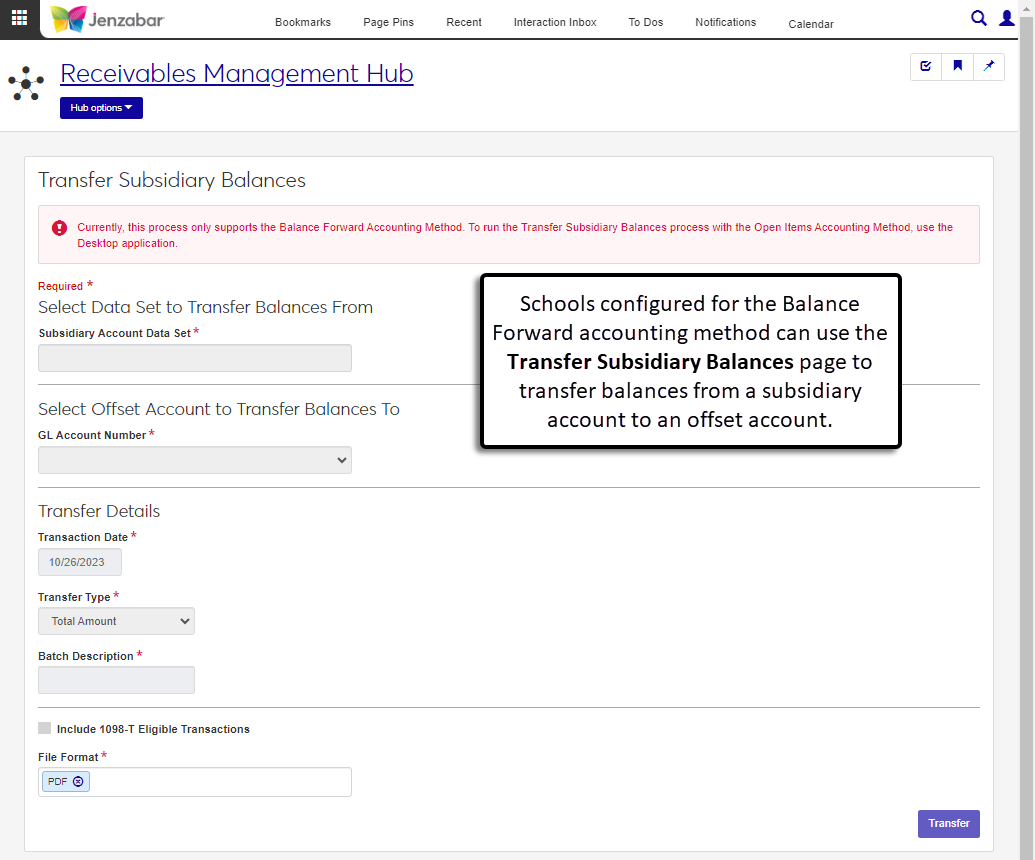

Use the Transfer Subsidiary Balances page to transfer balances from one subsidiary to another.

Warning

At this time, J1 Web supports this process only for schools configured for the Balance Forward accounting method. Schools configured for the Open Items accounting method must run the Transfer Subsidiary Balance process in Desktop.

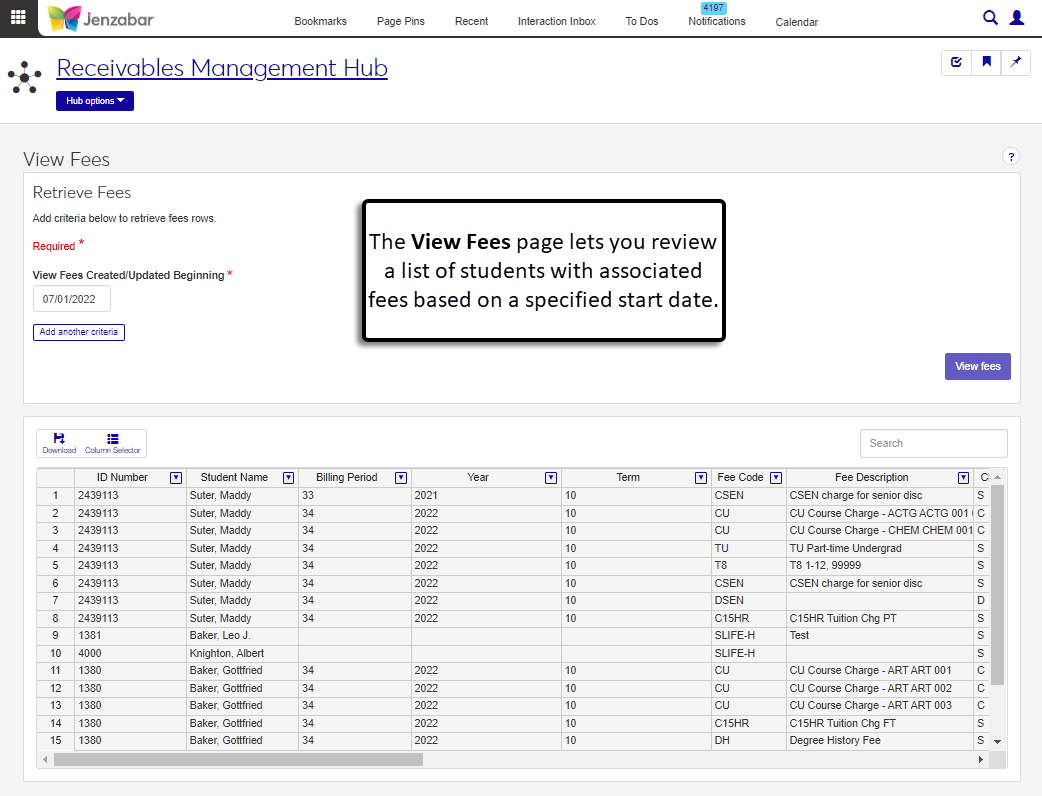

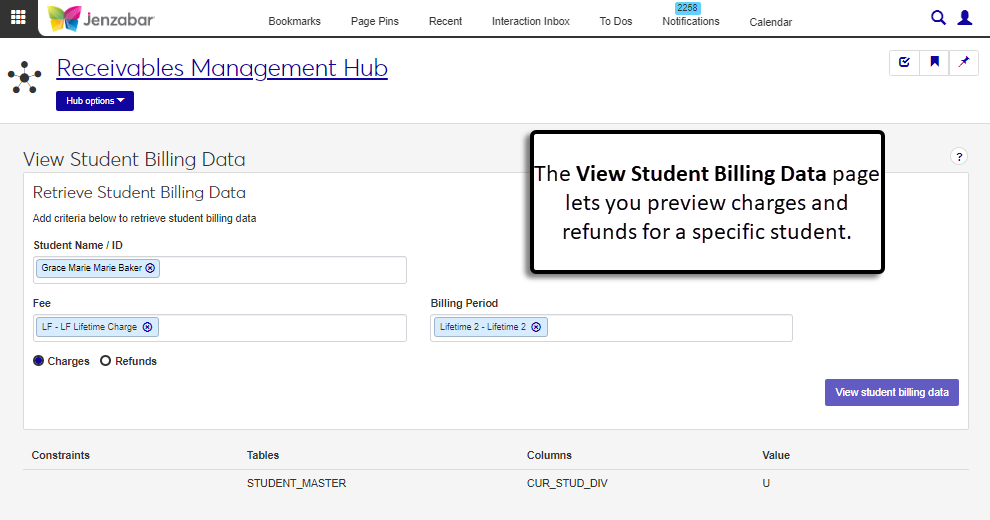

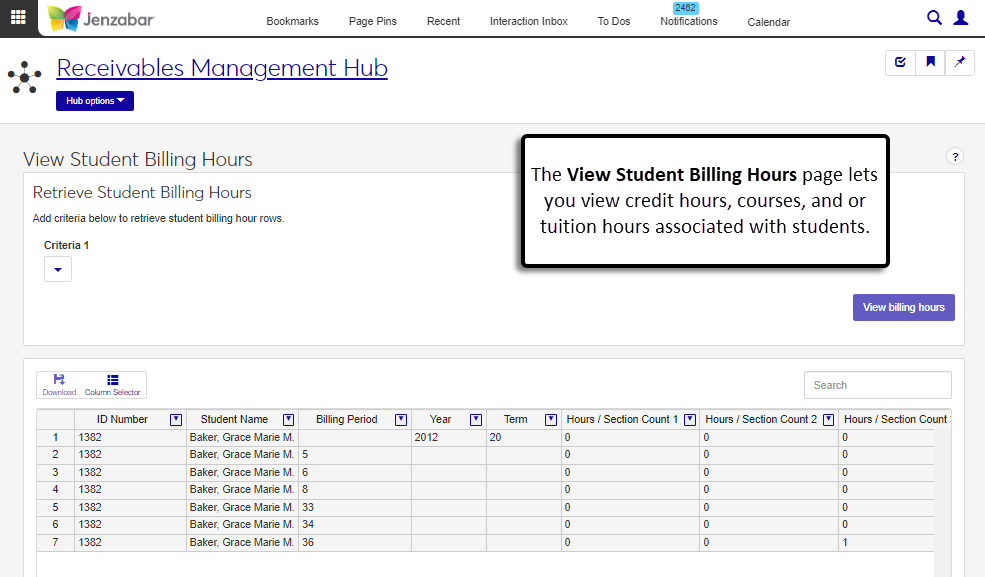

The View Fees, View Student Billing Data, and Student Billing Hours pages let you view student charge related information to help troubleshoot billing issues. You can enter criteria on each page to generate specific results.

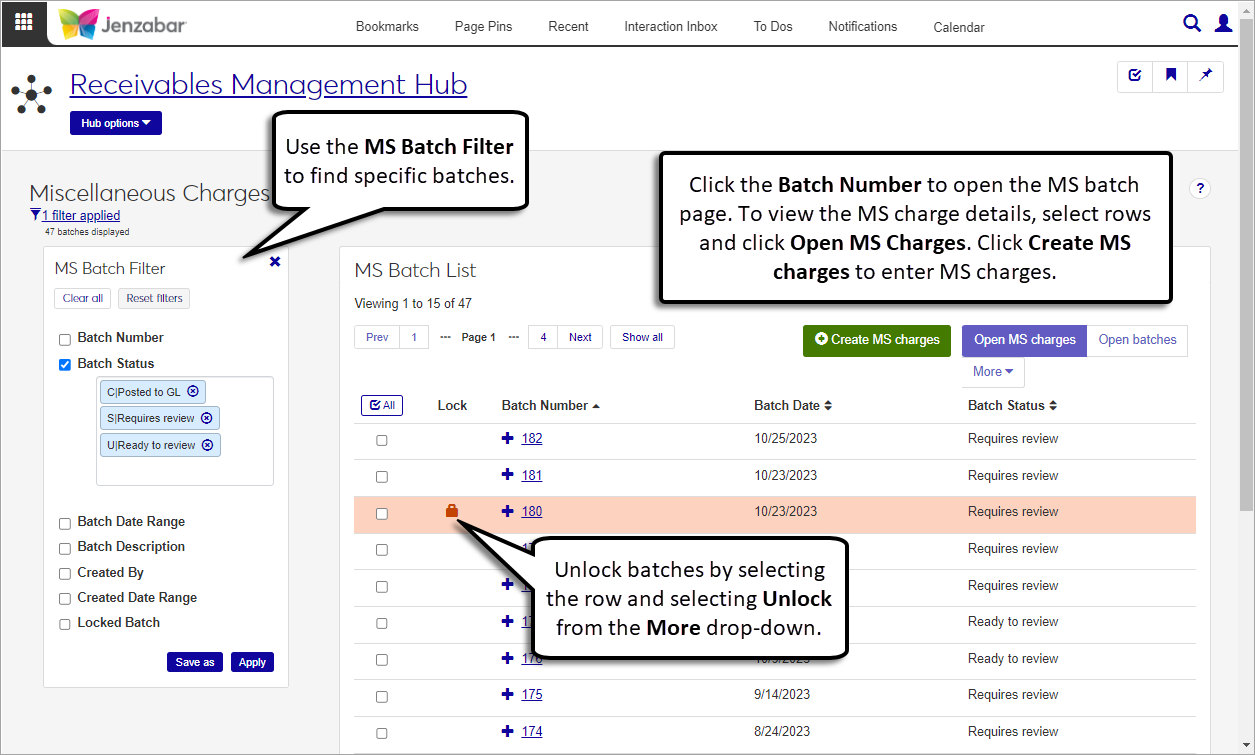

The Miscellaneous Charges page displays a list of miscellaneous (MS) charge batches. You can filter the list based on various criteria, including batch status and number. From this page, you can access the MS charge details, MS batch details, create new MS charges, and unlock MS batches.

Note

The MS Batch List page lets you access both the MS charge details page and the MS batch details pages with the right permissions. Access to the MS batch pages is granted from the General Ledger Accounting hub.

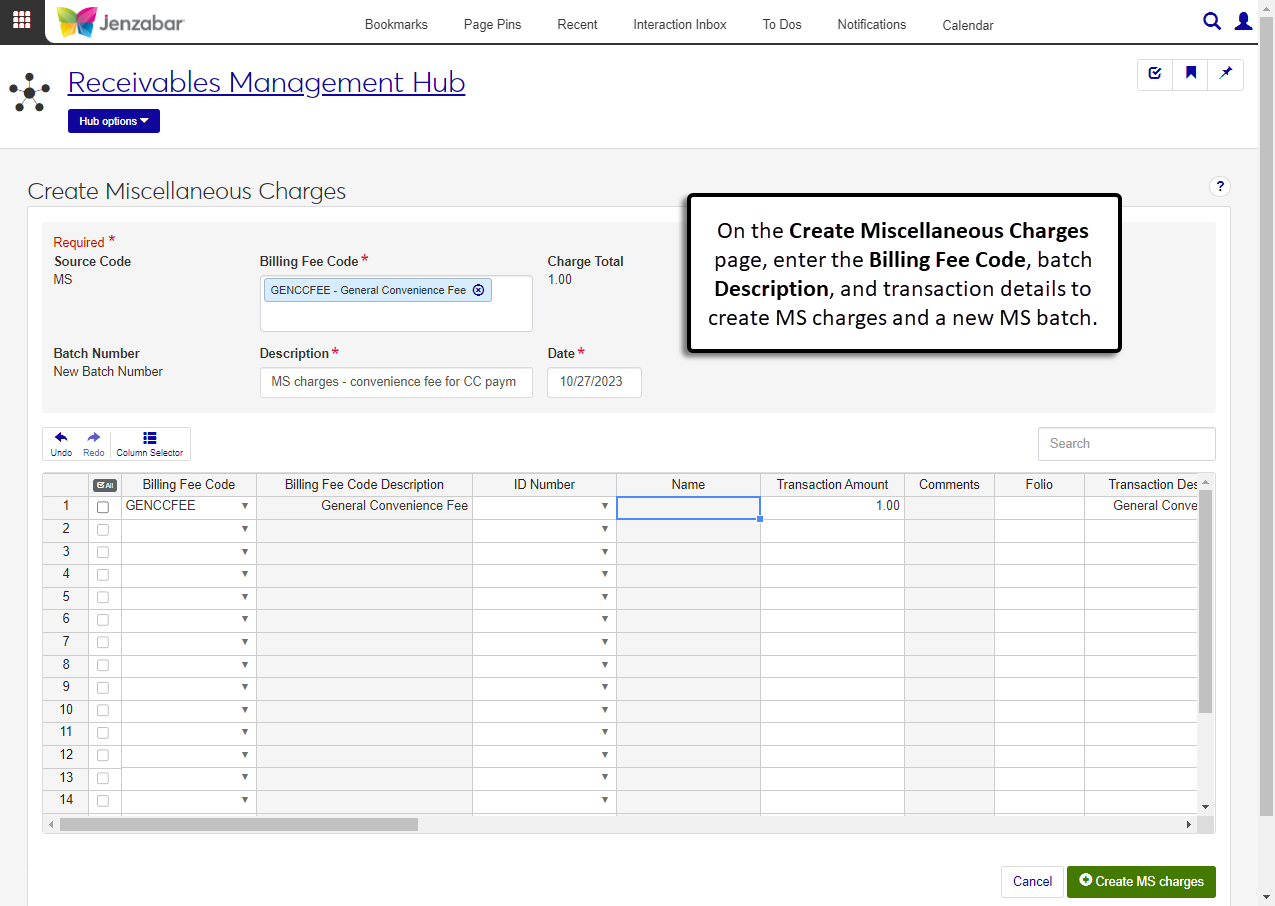

The Create Miscellaneous Charges page lets you add MS charges to the system and create MS batches.

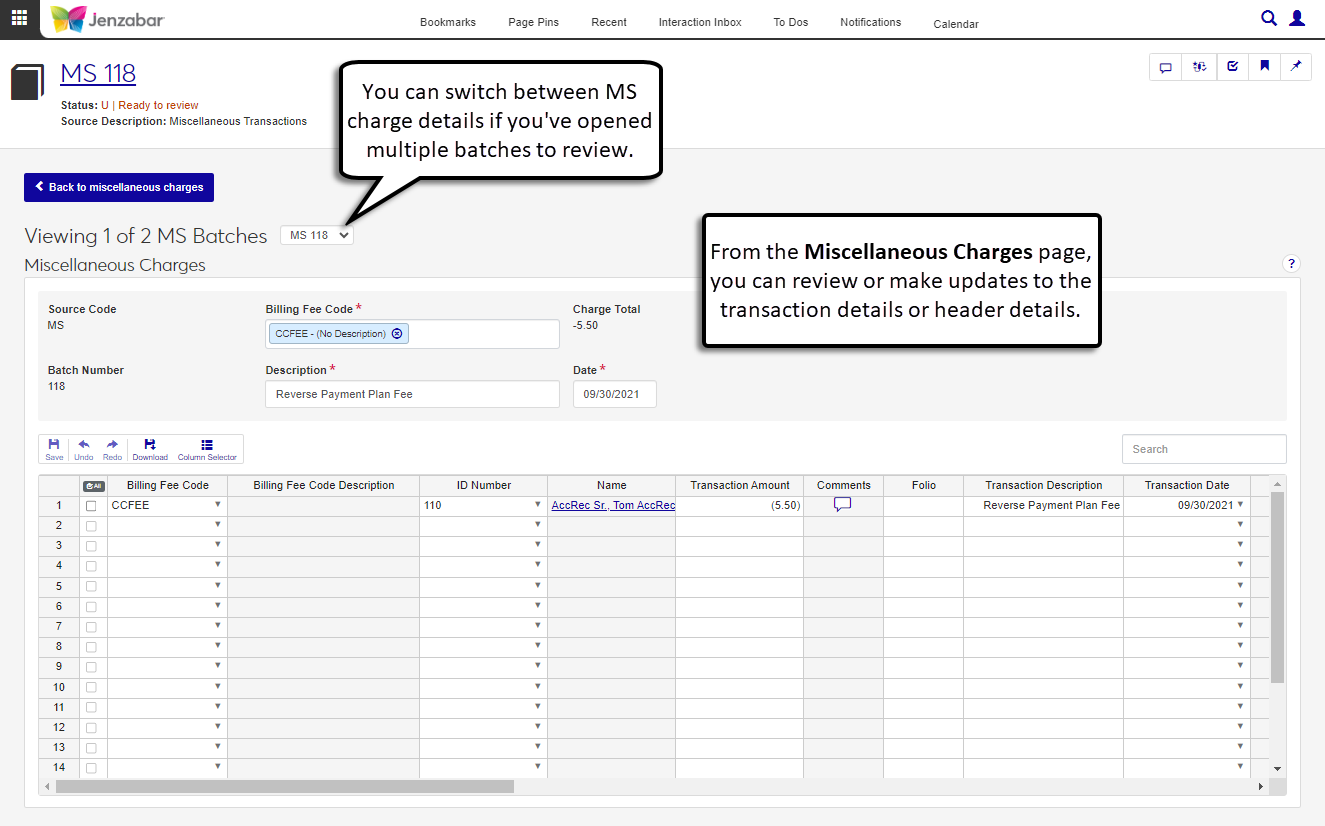

After you've created MS charges, you can review them from the Miscellaneous Charges page, which is accessed from the MS Batch List page by selecting one or more rows and clicking Open MS charges.

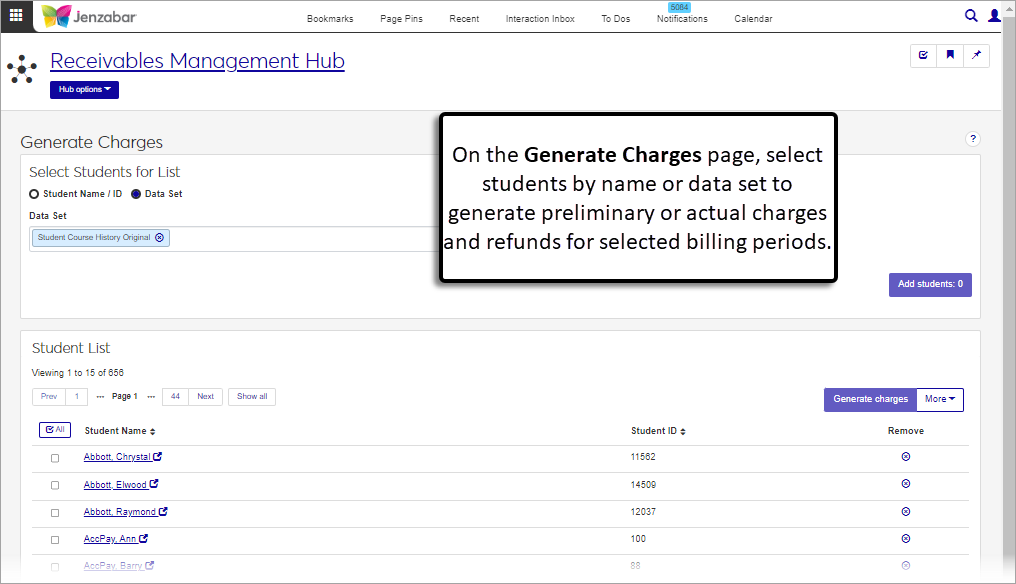

The Generate Charges page lets you generate preliminary or actual charges and refunds for selected billing periods. You can add students to the list individually or use a data set to retrieve multiple students based on predefined criteria.

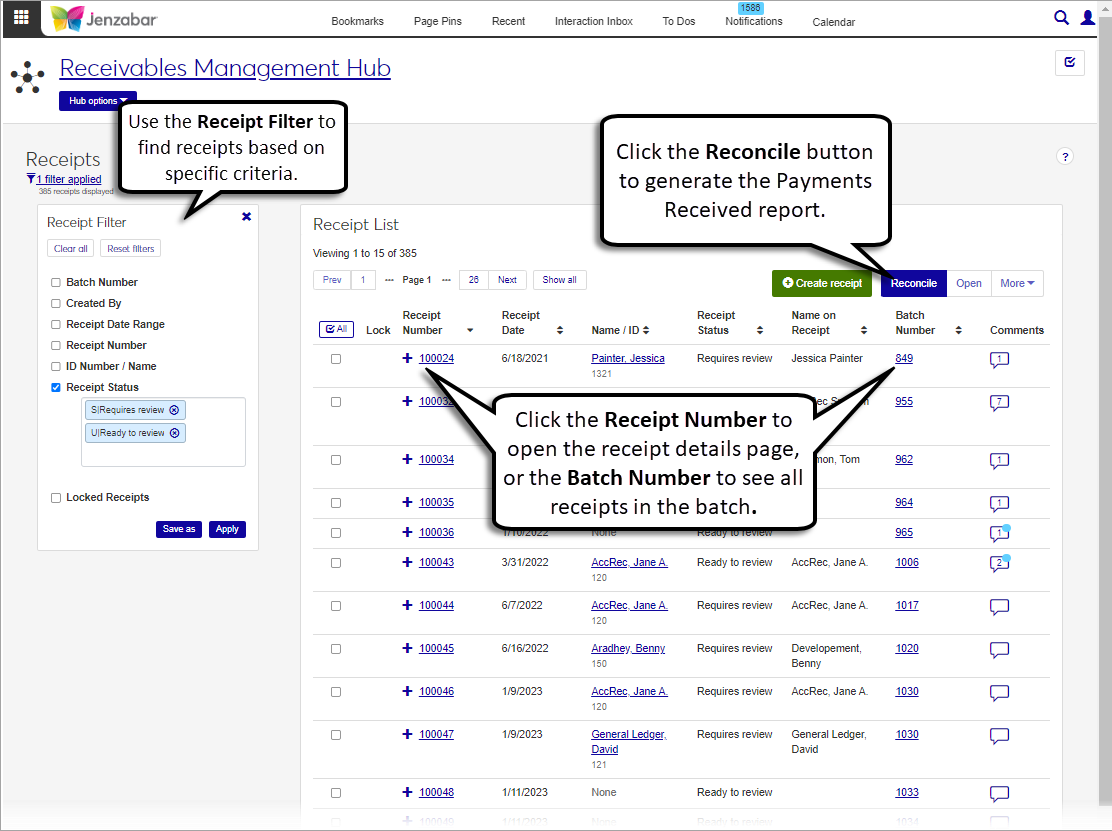

The Receipts page lists the receipts in your system and the batches they are included in. From this page, you can access receipt details, create new receipts, and generate receipt PDFs and the Payments Received report. You can also view and add comments to receipts from this page.

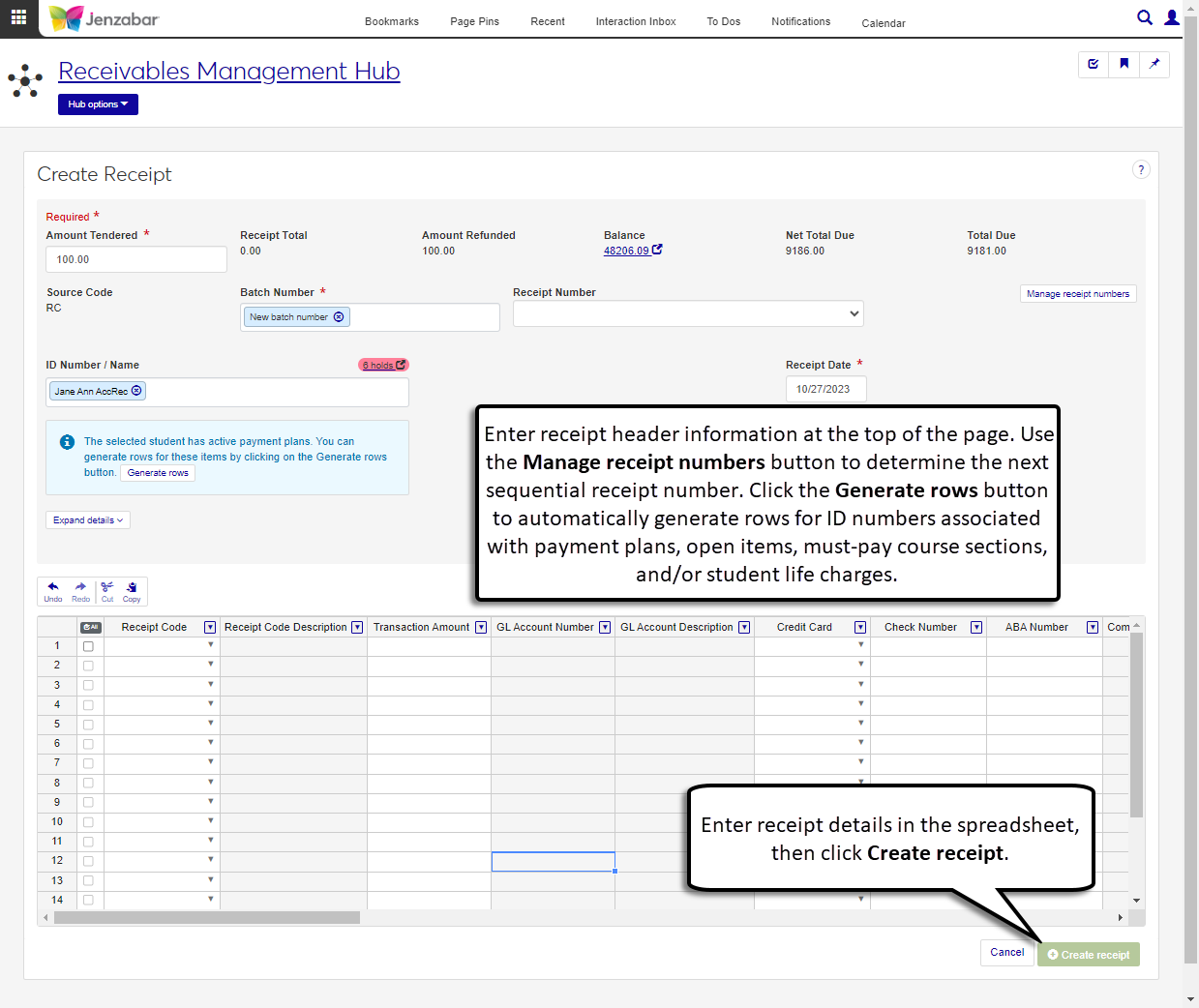

You can open the Create Receipt page from the Receipt List or by clicking Create receipt from the Receivables Management Hub options drop-down. The Create Receipt page lets you enter transactions manually and also provides options to generate receipt detail rows for students associated with payment plans, must-pay course sections, and/or student life charges. Use the Manage receipt numbers button to create receipt groups and determine which number is assigned to the new receipt.

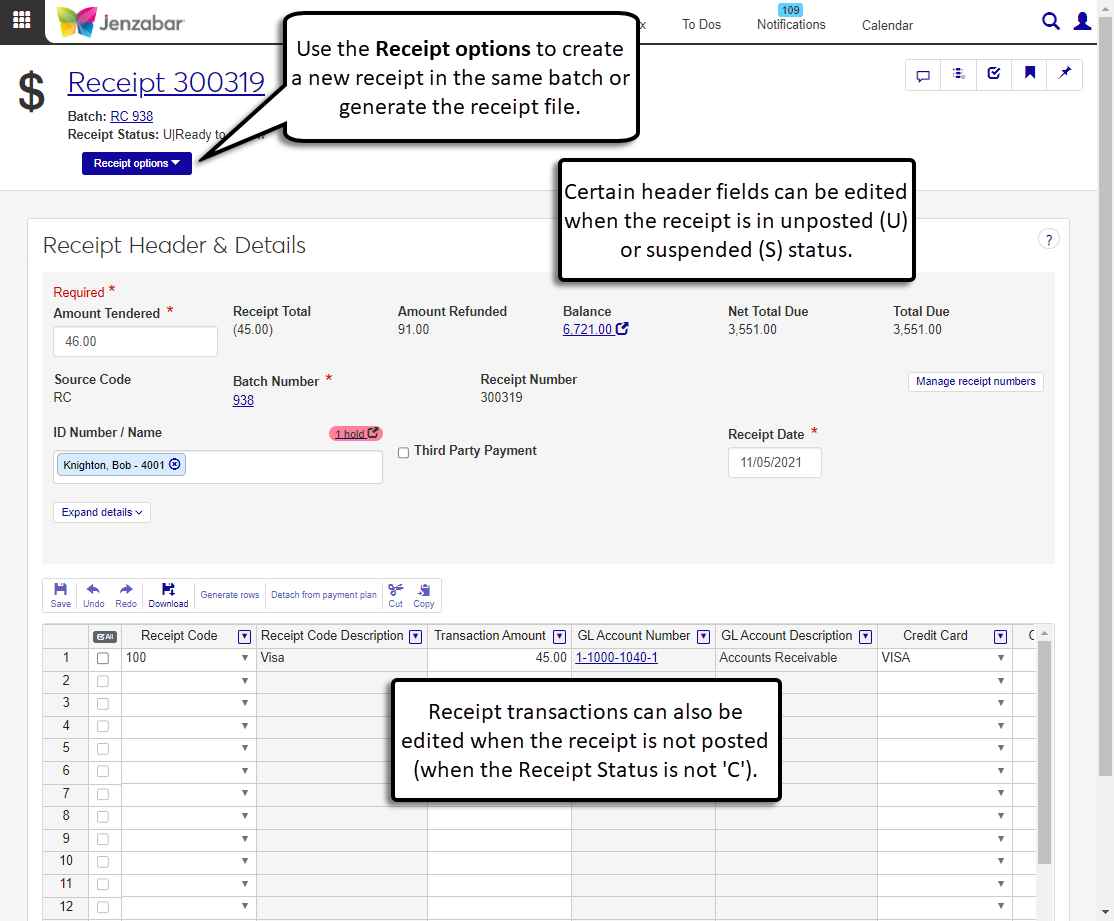

The Receipt Details page lets you review and update header and transaction details for payments. From this page, you can view and update receipt header and transaction details, as well as delete, create, and generate receipt files.

Note

The J1 Web receipt report is specific to J1 Web and therefore customizations made in Desktop are not available for selection. To customize the receipt report for J1 Web, see Working with Reports in J1 Web.

The Create Student Refund Invoices page lets you select students by name or by data set and generate refund invoices for them. After the process runs, you'll receive a notification that an invoice (IV) batch has been created.

Note

Access to the IV batch page is granted from the General Ledger Accounting hub.

Many reports in the Receivables Management hub are generated during a process or from a specific page (e.g., receipt reports and A/R Inquiry reports). At this time, the Reports section of the Receivables Management hub lets you generate the AR Exceptions report. Additional reports are planned for future releases!

Updates to Record Campus Marketplace Transactions

Jenzabar One now receives financial information when students enroll in course sections in Campus Marketplace. The new Campus Marketplace Account Settings window identifies the receipt code used for Campus Marketplace payments, and the debit and credit accounts used for journal entries to record Campus Marketplace fees.

The Campus Marketplace Account Settings window is available in the new Settings - Campus Marketplace activity center. Access to this activity center is provided by default to users in the J1_ARMANAGER, J1_ADMIN, and J1_TRAINEE groups.

A new Campus Marketplace Fee Type is available in the Miscellaneous Charge Code Entry window. The charge code with the Campus Marketplace Fee Type is tied to a receipt code, and that receipt code is selected in the Campus Marketplace Account Settings window.

For additional information about the process and settings, see the following help topics:

Issue | Description |

|---|---|

RN36898 | When deleting a receipt from a batch that has due to/from transactions, the due to/from transactions created were not also being deleted. |

RN49022 | Customers not licensed for Campus Portal Student Finances received an error when extracting 1098-T data. |

RN49059 | Paying against Must Pay courses generated an error when there were more than 32,767 rows in the ONLINE_PAYMENT table. |

RN49060 | Database triggers were removed because they were causing performance issues in Purchasing. |

RN49140 | Users were unable to delete receipts from Receipt Entry. |

RN49713 | When selecting the 1098-T "Copy A Data & Form (Printed Preference)", students with Electronic preference were also printing. |

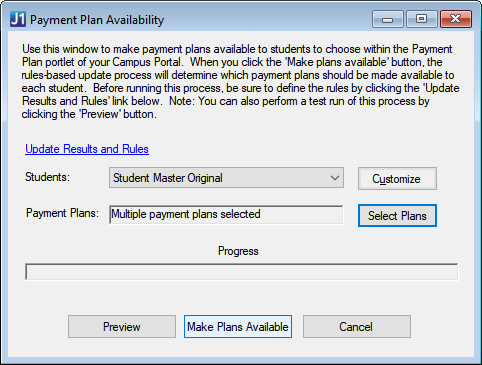

Updates to Payment Plan Assignments

The Payment Plan Availability window now lets you assign a payment plan directly to selected students, and there are new checkbox and button options available when running the payment plan assignment process.

The Preview/ Preliminary checkbox replaces the Preview button and lets you review payment plan assignments or options available to students.

The Use Rules Based Updates checkbox tells the process to use the rules for the PMT Update Type to determine which students are eligible for payment plans.

The Assign Plan button adds the selected payment plan to the students retrieved from the query.

The Schedule button lets you use the system's scheduling process to determine when the process to assign a plan or make plans available runs.

Note

If you've scheduled payment plan availability jobs in previous versions, you'll need to reschedule those jobs with these enhancements.

For additional information, see the online help for the Payment Plan Availability window.

Payment Plan Billing Period and Year/Term Updated with Receipt Entry

When payment plan payments are entered in the Receipt Entry Details window, the billing period or year/term associated with the plan is automatically updated in the receipt row.

Convenience Fees for Credit Card Payments

You can now define convenience fees that can be applied to any online credit card payment. Several windows have been updated to accommodate this functionality.

Miscellaneous Charge Code Entry: A new Fee Type called "General Payment Convenience Fee" has been added, and a new Percent field appears when that type is selected. You can enter an amount, a percentage, or both to define the fee to be applied to credit card payment transactions.

Receipt Code Control: A new Misc Charge Code field lets you link a general payment convenience fee charge code to receipt codes.

Receipt Entry Detail: When a general payment convenience fee is accepted for transactions associated with the appropriate receipt code, the transaction amount is updated to include the fee. A miscellaneous charge batch is automatically created to charge the general convenience fee and offset the payment of the general convenience fee when credit card payments are entered in Desktop or via the Campus Portal payment checkout.

Internet Configuration: A new row for the AR module called misc_charge_batch_duration defines the timeframe (in minutes) for creating MS batches for general payment convenience fee transactions.

Transaction Groups: Deleting a transaction group also deletes general payment convenience fee transactions from the miscellaneous charge batch. If all transactions in a miscellaneous charge batch are deleted, that batch is also deleted.

For additional information, see the online help for each window.

1098-T Year-End Updates

Form Changes

Updated to support the current tax year.

Media Changes

There are no media changes this year.

IRS 2022 Filing Links

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

2022 1098-T Form: https://www.irs.gov/pub/irs-pdf/f1098t.pdf

2022 Instructions for Forms 1098-E and 1098-T: https://www.irs.gov/pub/irs-pdf/i1098et.pdf

Generate 1098-Ts Window

New report formatting options let you print Copy A and Copy B of the form on pre-printed forms or blank paper. Each formatting option also allows customization of the data and form images.

A new checkbox in the 1098-T Review Options section lets you include the carry over tuition amount from the previous year to determine if the tuition is less than scholarships and grants.

A new 1098-T audit report is available when 1098-Ts are generated. This summary report includes the following information:

Payment Cap

Current Tuition

Current Tuition (No Prior Year)

Carry Over Amount

Qualified Tuition and Related Expenses (QTRE)

Payment Amount

For additional information, see the online help to Generate 1098-T Forms.

Tip

See the following resources on MyJenzabar.net for more details about generating and filing 1098-Ts:

Issue | Description |

|---|---|

RN32545 | On the 1098-T Magnetic Media Control window, no vertical scrollbar appeared in the Payment Year drop-down, giving the appearance that there were no additional year options other than what was displayed. To see the additional year options, users had to use the mouse scroll or arrow keys. |

RN32739 | On the Generate 1098-Ts widow, when the Extract student data checkbox was selected, the options in Box 1 Payment Capping were sometimes accessible and editable when they should not have been. |

RN32742 | When students signed up for a payment plan with a sign-up fee, the 1098-T Eligibility field was not populated on the associated MS transactions. |

RN32835 | On the 1098-T Audit Report, Excluded Transactions, there was a typo in the label for Box 9. |

RN36822 | When generating 1098-Ts, the address priority set on the Maintain Address Priority window was not honored in some situations. |

RN39417 | When generating 1098-Ts, the process incorrectly generated 1098-Ts for students when their tuition was less than scholarships and grants, even when the "Include students with tuition less than grants & scholarships" checkbox was not selected. |

RN39531 | On the Recalculate Financial Balances window, when the Recalculate all students option was selected, the "Payment plan recalculated successfully for all students" message did not display in the Payment Plan section even though all self-service payment plans were recalculated. This occurred when Legacy Payment Plans was set to Off on the A/R Configuration window. |

RN40052 | When Academic Planning was in Setup mode on the Advising General Settings page in J1 Web, students were attached to Academic Plans. Students should only be attached to Academic Plans when Academic Planning is set to On. |

Issue | Description |

|---|---|

195549 | In certain scenarios, charge transactions are not created when the charge looked at hours based on Degree History information. |

RN25735 | For schools configured to apply aid first on open items, the Reallocate by Student process used the original transaction dates instead of the process run date to create transactions for the reversing Open Item transaction group. |

RN26157 | Users couldn't cancel automatic payments from the Self-Service Payment Plan window if an automatic payment had already been made. |

RN33230 | On the Checks Received report, Receipt Amount totals were categorized incorrectly in certain situations. |

RN33938 | When students paid Must Pay courses, the receipt transaction was applied as a debit instead of a credit. |

RN34502 | When legal name was very long, the Generate 1098-Ts process replicated the middle name in the 1098-T media file. |

RN35256 | The Schedule button didn't honor the System function: Schedule Process Button permission on various windows. |

1098-T Year-End Updates

Form Changes

Updated to support the current tax year.

The Service Provider value was added to both the PDF and the non-PDF version of the 1098-T form.

Media Changes

Updated field positions to accommodate the increased length of several field positions.

IRS 2021 Filing Links

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

2021 1098-T Form: https://www.irs.gov/pub/irs-prior/f1098t--2021.pdf

2021 Instructions for Forms 1098-E and 1098-T: https://www.irs.gov/pub/irs-prior/i1098et--2021.pdf

Tip

For more information about working with this form, see the Accounts Receivables 1098-T Reporting Process guide on MyJenzabar.net or the 1098-T Overview in the online help. You can also visit our Help Hub Youtube channel to watch the 1098-T Process Overview video. Be sure to subscribe to our channel to stay up to date with new videos as we add them!

Generate 1098-Ts Window

Box 1 Payment Capping options will now be locked if you select a tax year that has already been processed on the Generate 1098-Ts window. The section displays the capping option used previously in the 1098-T processing.

A new customization button was added to the Generate 1098-Ts window to allow users to customize the PDF version of the 1098-T form. This option is available when the 2021 tax year is selected.

The Service Provider field will appear on the PDF and non-PDF 1098-T forms.

The Generate 1098-T process has been updated to be more dynamic when populating the ‘working’ tables rather than hardcoding the tax years.

Issue | Description |

|---|---|

RN27059 | Payments Received List report showed cash amounts in the credit total, instead of in the cash total. |

RN27577 | On the 1098-T, Box 7 was checked even when the payment was not included in box 1. |

RN31212 | The Generate 1098-T's process included actual charge transactions (CG) for the current tax year in the box calculations when preliminary charge transactions (@C) were already included in the previous tax year's calculations. |

Updates to Generate 1098-Ts Window

Capping Options Locked for Prior Year 1098-Ts

When you open the Generate 1098-Ts window and select a prior year where 1098-Ts have already been processed, the capping options will be locked. You will see the capping option used to generate the prior year displayed as a read-only label. This is done to prevent you from accidentally selecting a capping option different from what was previously selected and reported.

Note

The system will check both the capping option flag and the 1098-T working tables to determine which capping option was used in the prior year.

Warning

Running the Generate option again using a different capping option would overwrite prior year box amounts and differ from what was actually produced for that tax year and what was sent to the government and to your students.

Updates to Payment Plan Window

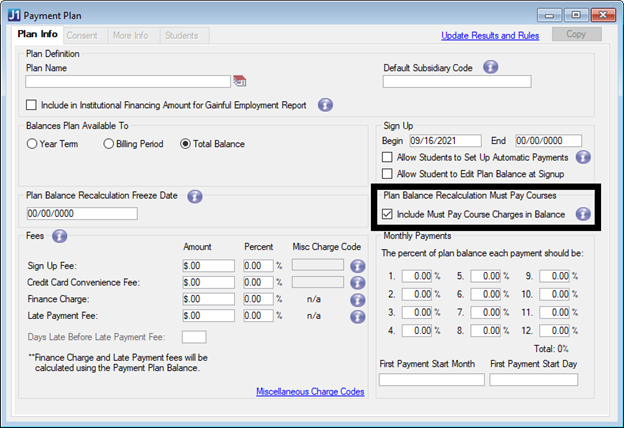

Include Must Pay Courses Option

There is a new Include Must Pay Course Charges in Balance checkbox on the Payment Plan window. When this box is checked, any actual charges related to Must Pay courses will be included in the payment plan’s balance. If this box is unchecked and the A/R Configuration is set to include preliminary transactions, preliminary charges for Must Pay courses will still be included in the plan balance.

Note

The Include Must Pay Course Charges in Balance checkbox will be checked by default when a new Payment Plan is added.

Issue | Description |

|---|---|

RN24512 | When a Must Pay Course had multiple charges, the payment generated more than one receipt transaction, but only the first receipt transaction contained a year/term. |

Issue | Description |

|---|---|

170456 | The billing process was not honoring the preliminary charges settings for the billing period when run from the Campus Portal. |

205614 | On the Student Account Statements and Generate 1098-Ts windows, email notifications were sent to students who do not have the Institution Email and Notification Enabled checkboxes selected on the Address tab of the Name Entity window. |

RN15136 | On the Print A/R Statements, Select Billing Periods window, when the checkbox beside a billing period was selected or deselected, the Include on A/R Statements? checkbox on the Billing Period window was also selected/deselected. Changing the Billing Period selection on the Print A/R Statements window should only change it for the current statement run, not update the actual Billing Period table. |

RN19268 | The State and ZIP Code were misplaced in the 1098-T filer's box. |

RN20296 | The Payment Status for Online Gifts records was not set properly on the Process Internet Submissions window. |

RN20869 | When the Generate 1098-T process was run for individuals with a hyphen in their ZIP Code, the ZIP Code was formatted incorrectly on reports and forms for 2020 tax year. |

1098-T Year End Updates for 2020

Form Changes

Box 2 will remain empty on the 2020 1098-T forms.

Box 3 will remain empty on the 2020 1098-T forms.

Media Changes

There are no media changes this year.

IRS 2020 Filing Links

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

2020 1098-T Form: https://www.irs.gov/pub/irs-pdf/f1098t.pdf

2020 Instructions for Forms 1098-E and 1098-T: https://www.irs.gov/pub/irs-pdf/i1098et.pdf

Self-Service Payment Plan Updates

Updates have been made on three windows:

Receipt Entry - Attach to Payment Plan window

The Attach to Payment Plan window now allows receipts to be attached to more than one month when payments for multiple months are made at one time.

Payment Plan window

The new First Payment Start Month drop-down in the Monthly Payments section on the Payment Plan window allows users to select both the month and day of the month to define when payment plan payments begin.

Add New Payment Plan window

The new First Payment Start Month drop-down on the Add a New Payment Plan window allows users to select both the month and day of the month to define when payment plan payments begin.

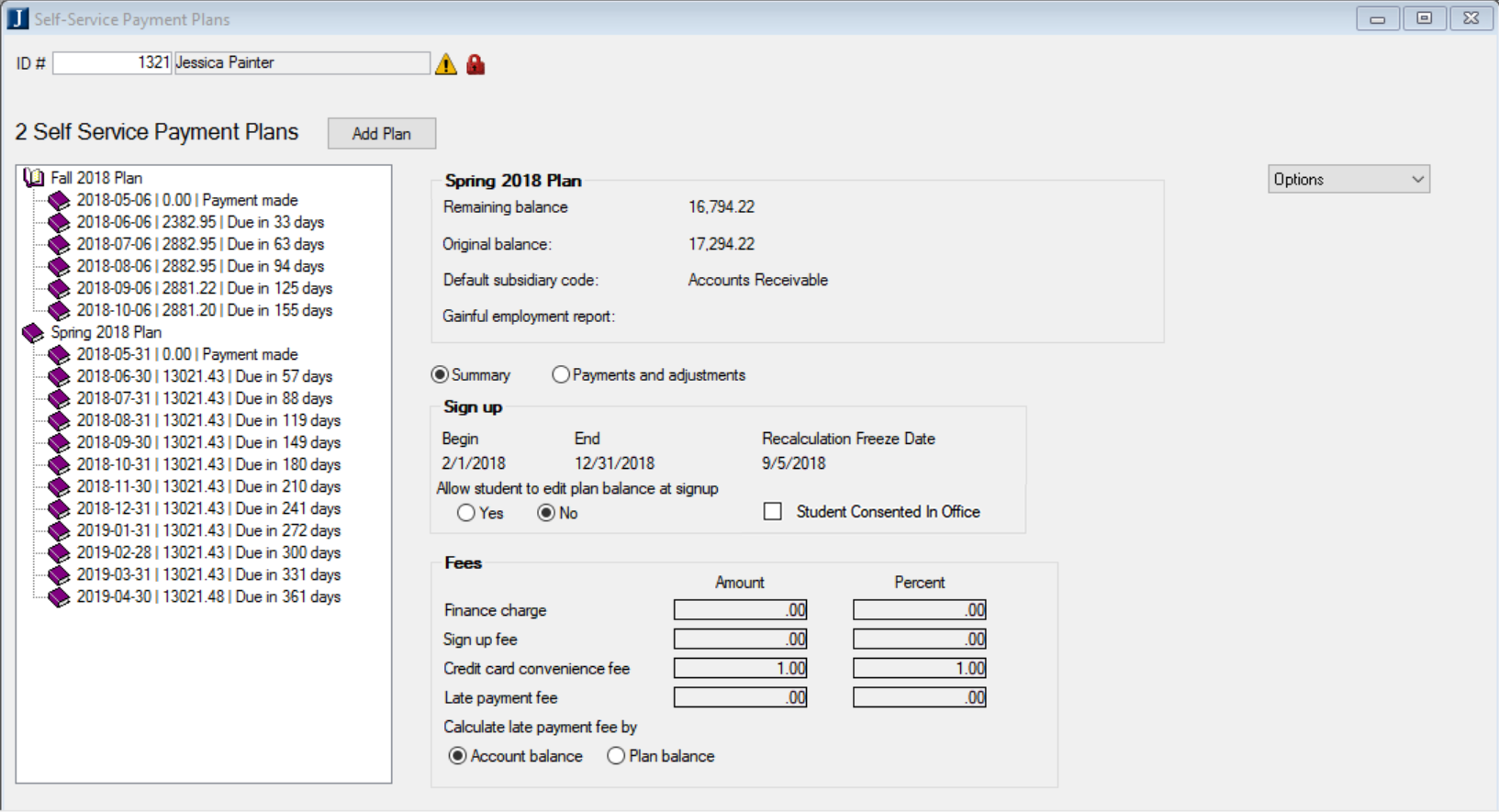

Self-Service Payment Plans window

There is a new Balance Locked checkbox on the Self-Service Payment Plans window. This checkbox allows users to prevent updates to the remaining plan balances during the recalculate process when changes affect the student's account balance. This option is only available prior to the plan's Recalculation Freeze Date.

Two new buttons at the bottom of the Self-Service Payment Plans window are enabled when an individual payment row is selected. The Detach Existing Payment button allows users to detach that payment from the plan it’s attached to. The Attach Existing Payment button allows users to select an existing posted receipt that was not originally attached to the payment plan when the payment was made.

The new Recalculate Plan button will run the recalc process for that student/plan combination to recalculate the remaining plan payments. This is the same recalc that automatically occurs when there is an event that affects the plan balance, such as new charges, adjustments, refunds, etc. Plans with the Balance Locked checkbox selected will not be recalculated.

New Process and Updates for the Generate 1098-Ts Window

Several updates to the 1098-T window have been made for this release. The process flow has been updated to the following order: Extract &Review 1098-Ts, Validate 1098-Ts, and Generate 1098-Ts.

In the Extract & Review section, you can now extract student data and determine the 1098-T Review Options (previously in the Generate 1098-Ts section).

In the Validate 1098-T section, you can customize and preview the Included Transactions, Excluded Transactions and Error/Warning reports after data has been extracted.

The Generate 1098-Ts section is now limited to choosing a 1098-T format, masking SSN, generating media, and publishing to students. All extracting, reviewing, and validation must be done from the other sections.

In addition, the following enhancements have been made in preparation for processing 2020 1098-T forms:

The Student Information Impacting Charges link is now available at the top of the Generate 1098-T window regardless of the section you’ve selected.

The Included Transactions, Excluded Transactions, and Error / Warnings reports have been organized and grouped by student. Each student will have a header section with student information, followed by a details section with any data populated for the student.

The Maintain Student Year Reporting Data window has a new read-only column, “Data changed since last extract” that will automatically be checked if a user updates data in the row.

The last used capping option will be captured and stored in the TaxYearDef table.

The 1098-T process has been updated for several box calculations in preparation for the upcoming 2020 year-end tax forms. See the Student Year Reporting table in the online help for more information.

The 2020 1098-T form is available from the Generate 1098-T’s window and with the Student Finance license you can publish PDF versions to students via the Campus Portal.

Legal Names for Account Statements

Updates have been made for several reports to show Legal Names instead of Campus Names, for the selected ID numbers. Changes have been made to the following windows:

Student Account Statements

View Previous Statements

Note

Only users with access to Legal Names can access these windows.

Issue | Description |

|---|---|

RN12414 | When a payment was made against a payment plan, the sign-up fee and convenience fee (MS) transactions were not updated with the billing period and year/term associated with the payment plan. |

RN15010 | When a student's account balance was updated and the payment plan freeze date was in the future, the payment plan payments were not recalculated correctly in some cases. |

Non-Refundable Aid Funds for JFA Users With Open Items

The Create Student Refund Invoices process now supports schools using JFA with Open Items. A school configured for award funds that are non-refundable to the student awards a maximum amount and the fund is configured to be applied to specific charge fees. If the student does not use the maximum award amount, the Create Student Refund process updates the Financial Aid disbursement transactions on their receivable account and the student’s record in JFA accordingly.

Issue | Description |

|---|---|

146604 | The Receipt Entry window was not consistently setting the default value for the Distribution Priority field. |

194921 | The Transfer Subsidiary Balances process was not updating the new transaction with a 1098-T code, year, and term. |

199363 | An "Open Items Engine" error message appeared in certain data scenarios. |

199408 | The Generate 1098-Ts window was slow to open at some customer sites. |

199991 | Payment Plan Register, Payment Plan Aging, and Overdue Payment Plans windows only used the original query even when a custom query was selected. The updated code now allows the user to select and execute their custom version of the report and not run the Original. NoteAs of 2019.4 this window no longer appends the report prompt criteria to the WHERE clause. Reports customized before 2019.4 must be re-customized to ensure the retrieval arguments are used as prompt criteria and not the appended where criteria. Customer reports created before 2019.4 that are not re-customized will not function correctly. |

200231 | The Generate 1098-T process displayed an error message when the Use Rules Based Update for PT/FT Definition checkbox was selected on the Registration Configuration window. |

200286 | The 1098-T Box 7 (Include Next Year's Amounts) calculation was not honoring the 1098-T Eligible designation on the Setup A/P & A/R Subsidiary Definition window. |

200293 | When generating 1098-Ts, half-time student calculations were incorrect when the Cap Payments By: Year option was selected. |

200306 | The 1098-T Post Process Warning Listing displayed the wrong name next to the ID number for some errors. |

200434 | The 1098-T Box 4 (Adjustments to Prior Year) amount didn't include transactions from certain source codes. |

200845 | The 1098-T Box 1 amount incorrectly included eligible charges for a prior year/term when there were no associated payments in the year being processed. |

201498 | Programs that weren't eligible to be copied for the selected catalog year weren't always being displayed in the "Not available to copy" section in the Copy Program Requirements wizard. |

203321 | The 1098-T Year Capping option was not consistently calculating amounts correctly. |

205375 | There was a performance issue in the Student Account section of the Student Home page portlet and the My Financial Accounts portlet. |

205431 | Several general security issues were addressed in this release. |

206555 | The payment plan recalculation process was not correctly adjusting the plan balance amount and unpaid payment detail amounts prior to the freeze date. |

472560 | There was a performance issue in the Student Account section of the Student Home page portlet and the My Financial Accounts portlet. |

1098-T Year End Updates for 2019

Form Changes

Box 2 will remain empty on the 2019 1098-T forms.

Box 3 will be empty on the 2019 1098-T forms.

2019 1098-T forms will be available to students as a PDF on the Financial Document Center within the Campus Portal (JICS).

Media Changes

Field Position 550 in the Payee “B” Record will now contain a “blank” character.

IRS 2019 Filing Links

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

2019 1098-T Form: https://www.irs.gov/pub/irs-prior/f1098t--2019.pdf

2019 Instructions for Forms 1098-E and 1098-T: https://www.irs.gov/pub/irs-prior/i1098et--2019.pdf

Define the 1098-T Column in Fund Master

Previously, the Fund Master window cleared the 1098-T field and automatically assigned values based on the fund payment type. The column no longer operates this way. Now you should select the required value in the 1098-T Eligibility column of the Fund Master window when creating or editing a fund. Work with your business office to confirm that the fund code assigned is the appropriate code for 1098-T reporting.

Additional Updates for 1098-Ts

A new Custom Query checkbox on the Generate 1098-T’s window will allow customizing the student selection for generating 1098-Ts. When selected, users will be able to choose a custom query from a drop-down or create a new query.

All 1098-T forms will display legal names for any selected IDs. Users will not be able to access the Generate 1098-T’s window unless they have the appropriate permissions to view legal names.

The Reporting Method checkbox was removed from the Maintain Student Year Reporting Data window.

New Automatic Payment Plan Payments

Students can now set up automatic, recurring payments on their self-service payment plans. This feature will allow students to be billed automatically and help them save time and prevent late payments. Used in conjunction with the Authorize.Net Automated Recurring Billing functionality, Jenzabar One’s automatic payment plan payments will provide a reliable and convenient way for students to work with their payment plans.

Several windows in J1 Desktop have been updated for this feature:

Payment Plan window

Allow Students to Set Up Automatic Payments option lets you determine if students can set up automatic payments for each payment plan.

Self-Service Payment Plans window

New indicators for automatic payments will appear next to the payment plan name when a plan set up for automatic payments is selected on a student’s account.

Customer Profile ID, Payment Profile ID and Subscription ID information from Authorize.net will appear next to the payment plan balance information that will allow the staff/administrator the ability to reference the plan information tied to the student when they are viewing payment information on Authorize.net.

You can adjust automatic payment plan payments for a student using the Adjust Plan Payments button, and the adjusted amounts will update the corresponding Authorize.Net account.

There is a new Cancel Automatic Payments option available that will allow an admin to cancel a student’s automatic payments in the event a student is unable to do so from their Campus Portal.

Payment plans set up for automatic payments will not be auto-recalculated. Any changes causing the plan balance to be changed will need to be updated through the Adjust Plan Payments option on the Self-Service Payment Plans window.

Receipt Entry Detail window

Users will now see an info icon next to payments that are part of a reoccurring automatic payment. Automatic payments cannot be included in the distribution of a new payment unless an automatic payment is late.

New Copy Payment Plan Feature

A new Copy button is available on the Payment Plan and Maintain Payment Plans windows. When you select an existing payment plan and click the Copy button a new plan is created with default data from the original plan. You can then edit the details and make any adjustments before saving. The plan name will be the same as the original with (Copy) at the end of the title. This feature will make it easier to create annual and reoccurring plans.

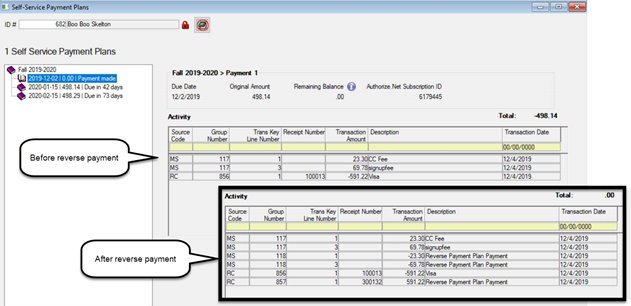

New Reversing A Payment Plan Payment

Payment plan payments with a posted receipt can now be reversed with the click of a button. When you click the Reverse Payment button for eligible payment plan payments, a receipt batch will be created to offset the original transaction, including any fees associated with the original payment.

Additional Updates to Payment Plan Windows

Drop-down options on the Maintain Payment Plans window for editing or deleting a payment plan were removed. Options now appear as buttons at the bottom of the window.

Drop-down options on the Self-Service Payment Plans window for making a payment, adjusting plan payments, or deleting a payment plan were removed. Options now appear as buttons at the bottom of the window.

The Add Plan button on the Self-Service Payment Plans window was moved to the bottom of the window along with the new options buttons.

Radio buttons for Year/Term, Billing Period, and Total Balance removed from the Add New Payment Plan pop-up window. The plan type will now appear in the drop-down when selecting an available new plan.

The Payment Made notification was updated to not show the Finance Charge and Late Payment Fees since they do not apply to the event.

Issue | Description |

|---|---|

173877 | For the 2018 tax year, customers reported issues with the 1098-T process because the 1098-T Eligibility flag was set to 'P' on both sides of the transaction (in rare cases). The 1098-T collection process should only look at the transaction history rows with the offset_flag of 'R'. |

174595 | In certain cases, some ID's were missing from the Included Audit Report. |

194281 | Performance issues related to the Generate 1098-Ts window have been resolved. CautionBefore running the 1098-T audit reports, verify the Payment Year on the 1098-T Magnetic Media Control window is a four-digit number. If the Payment Year isn’t a four-digit number, the 1098-T audit reports will not run. |

195557 | The list of students on the Generate 1098-Ts window was displaying un-formatted Social Security Numbers. |

196121 | The Anticipated Aid and Disbursements & Adjustments process no longer populates the chg_yr_tran_hist and chg_trm_tran_hist columns on the non-receivable side of the transaction. |

197904 | Box 1 Amount was incorrect with 1098-T year capping in certain data scenarios. |

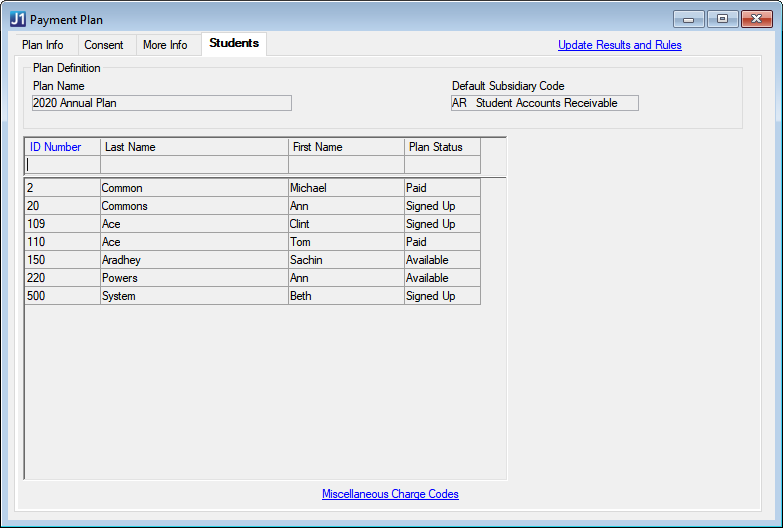

New Student Tab on the Payment Plan Window

The Payment Plan window now includes a Students tab, where you can view a list of students that are either eligible (Available) or already signed up (Signed Up or Paid) for the payment plan. From this tab, you can see the list of students, and remove that plan from being available to a student if they still have the Plan Status of Available.

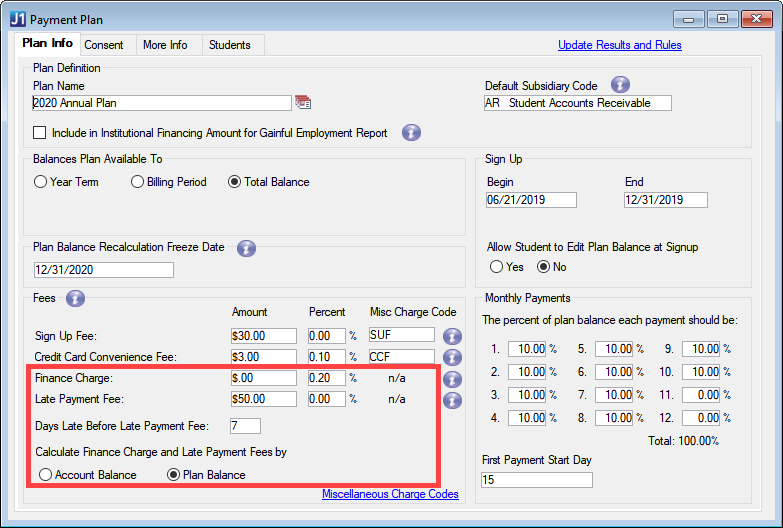

New Fee Options for Self-Service Payment Plans

New fee options for the self-service payment plans gives schools more control over the set up and cost of payment plans. There are two new fees, and two new settings:

Finance Charge: This fee is applied if the total amount of the plan balance is not paid in full. Finance charges are calculated by the Generate Finance Charges process.

Late Payment Fee: Currently late fees are calculated when the Generate Finance Charges process is ran.

Days Late Before Late Payment Fee: Use this setting to choose the number of days past the due date a student can make a payment before the Late Payment Fee is applied to their account.

Calculate Finance Charge and Late Payment Fees by: Use this setting to determine if you want the student’s late fee or finance charge to be calculated on their outstanding account or plan balance.

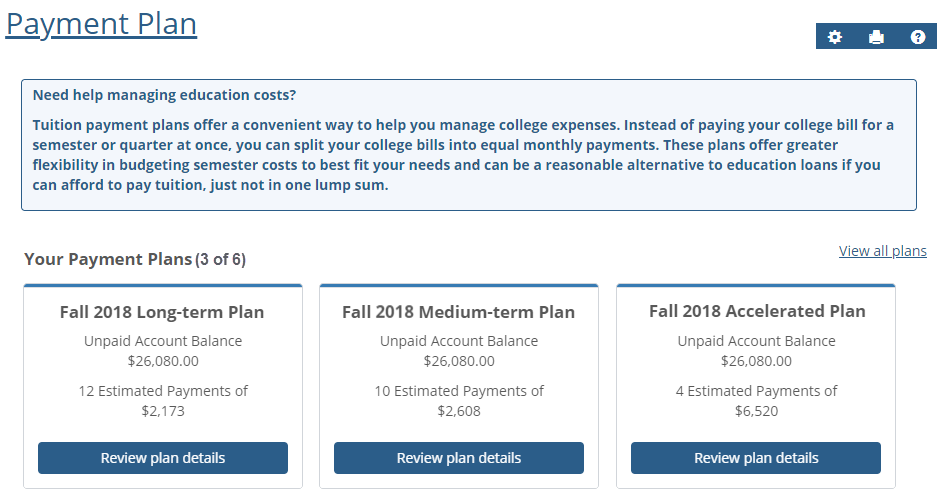

Improvements to the Payment Plan Assignment Window

The Payment Plan Assignment window has been renamed and redesigned for clarity. The newly re-named Payment Plan Availability window now allows you to select specific payment plans instead of all payment plans for each run of the process. You can also use the Preview button to do a test/preliminary run of the student and payment plan combination to ensure the results are as expected before posting eligible plans to students on the Campus Portal.

Additional Updates to AR Features

Additional updates for Accounts Receivable includes:

The Generate Finance Charges process will now include Self-Service Payment Plans during the run.

Reporting for payment plans will now include both legacy and the new self-service payment plan information on the following windows:

Overdue Payment Plans Report

Payment Plan Aging Report

Payment Plan Register

Student Account Statements

Standard Account Statement

Account Statement with Schedule

Account Statement – Year/Term

Account Statement – Billing Period

Issue | Description |

|---|---|

173880 | The Generate 1098-T window was not using updated queries, so the process did not always display a correct list of students. |

176501 | When a payment was made against a self-service payment plan on the Receipt Entry window, any Sign-Up and Convenience fees (miscellaneous charges) were not automatically created as new subsidiary master rows if they didn’t already exist for the student. |

176892 | When generating the 1098-T magnetic media file, the country description was being included in the B records, which caused the files to be rejected by the IRS. |

180663 | Users encountered the following issues on the Receipt Entry Detail window:

|

183655 | When a receipt batch was posted, the RECEIPT_HEADER.RECEIPT_STS column remained set to 'U' instead of updating to the proper 'C' status. |

New Flag for 1098-T Eligible Subsidiaries

With the new 1098-T Eligible flag on the Setup A/P & A/R Subsidiary Definitions window, the Receipt Entry Detail window will only require the year and term to be entered if there is an ID Number entered and the Subsidiary Code associated with the A/R Code (Receipt Code) is flagged as 1098-T Eligible.

Issue | Description |

|---|---|

124919 | Declined payments were included in the RC batch. |

171015 | Both sides of the Voided Refund transaction were incorrectly being reported in the 1098-T Audit reports and in Box 1 of 1098-T. |

171130 | Customers reported that the 1098-T process should only include eligible charges that have the same year/term as payments made during 2018. |

171784 | This resolved issue includes the following changes:

FAQ How does the process work for a 2018 payment that pays off a balance from 12/31/17? If a payment transaction is dated in the 2018 calendar year and the year/term on the payment transaction is for a balance on a year/term in 2017, the payment is included in Box 1. The calculation process looks back in the prior years for QTRE if a payment exists in the current calendar year for charges in a prior year. It also looks forward if there is a payment in the current calendar year for a future year. Should a payment for a prior year be coded to the year/term it applies to even though it is from a different year? Would the payment only have an effect on Box 1 in the event QTRE for the current year did not exceed payments in the current year or is the QTRE cap getting bumped up to account for the unpaid QTRE in the prior year? Payments must be coded with a year/term so that we can properly grab the related QTRE. That is the only way to know what amount is their total QTRE in which their total payments can be applied. If there is a payment to a prior year, year/term, then we will be including that prior year/term's eligible charges/expenses in the calculation for the QTRE amount. If a school has not separated QRTE-payments from non-QTRE payments in the "P" code, does this mean Box 1 will be overstated? Will separate payments be needed in the future or will the C code still be there to allow a school to ensure payments do not exceed total QTRE? If all payments are coded with a ‘P’, that will be the total amount compared to the total QTRE. If a student’s total payments made in 2018 total $15,000, but their total QTRE is only $14,000, box 1 will only have $14,000. If that student’s total payments were really for non-QTRE, they should really be split to ensure the most accurate amounts are used when the calculation process runs. The ‘C’ eligible charge code will still be available as this allows the school to always know the total QTRE is and ensure an amount that exceeds that total is reported. How are RC or MC source codes used for G transactions handled? If those source code transactions should be included in both boxes 1 and 5, update the eligibility code to the new ‘B’ code. If they should only be included in Box 5, leave the eligibility code as ‘G’. Will all RC transactions coded as a ‘G’ need to be changed to a ‘B’ in order for them to be included in boxed 1 & 5? Yes, if you want those RC transactions coded with a ‘G’ to also be considered for inclusion of Box 1, they will need changed to a ‘B’. Your IT staff can run a mass update SQL script so you don’t have to manually edit each one. Will all FA Transactions that have a ‘G’ now be calculated within Box 1 & 5? There are no changes to FA source code transactions. As long as the funds are coded with a ‘G’, eligible grant/scholarship AND they have the “Apply to 1098-T Eligible Charges” checkbox selected on the Fund Master window, they will appear in Box 5 and be considered for inclusion in Box 1. Does a school need to do an adjusting entry for students in a credit at the end of the fall term with funds rolling forward to the spring term to properly allocate those funds to the spring term? If a payment was made to the fall term and that payment triggered an overpayment/credit on the student account and that amount is not being refunded but is being applied to the upcoming term, then yes an adjustment to reverse that amount of the payment from the fall year/term will need to be done so the amount is applied to the upcoming spring term. Then, as long as there are at least preliminary QTRE charges for the spring term, that payment will be picked up in the calculation of Box 1. Would room and board pre-payments for 2018 fall and spring be incorrectly picked up as prepayments for spring of 2019? Room and board are not eligible charges and are not picked up when calculating the total QTRE. |

171972 | Customers who applied the recent hot fix reported 1098-T audit reports were terminating prior to completion. To address this issue and improve performance, reports were modified. |

172225 | 1098-T Box 1 calculation updates:

Clarifications:

|

174997 | Budget notification roles were not visible in the Set Up Notifications window. |

176135 | The "Order Statements By" radio buttons recently added to the Student Account Statements prompt were overriding any sort order customizations made to the reports. The "Order Statements By" radio buttons were removed. |

1098-T Year End Updates 2018

Form Changes

New IRS requirements to populate Box 1 for the total payment amount of eligible charges

Box 2 should be empty

Check Box 3 since the reporting method changed from “amounts billed” to “payments received”

Box 4 has no changes this year

Box 5 has no changes, but note that the amount from Box 5 is included in the Box 1 total

Box 6 has no changes

Box 7 reflects pre-payments made within the 2018 year for eligible charges in a future academic period

Boxes 8, 9, and 10 have no changes this year

Media Changes

Amount Code 1 is used in positions 28-43 of Payer A record

Delete Amount Code 2

IRS 2018 Filing Links

Publication 1220: https://www.irs.gov/pub/irs-pdf/p1220.pdf

2018 1098-T Form: https://www.irs.gov/pub/irs-prior/f1098t--2018.pdf

2018 Instructions for Forms 1098-E and 1098-T: https://www.irs.gov/pub/irs-pdf/i1098et_18.pdf

Requirements for Box 1 on 1098-T Forms

For the 2018 filing year, Box 1 includes all payments received for qualified tuition and related expenses, from all sources, during the calendar year. The amount should exclude any reimbursements or refunds related to eligible expenses from the same calendar year, and the amount should not be reduced by scholarships or grants reported in Box 5. Any past-due eligible amounts from the previous year should be added to the Box 1 total if the student was previously billed by your school. Payments should be reported in the year they were made, including any pre-payments or late payments.

Note

The updates for the 1098-T form processing affects several Jenzabar products, including Accounts Payable, Accounts Receivable, Financial Aid Manager, and General Ledger. For more details see the Desktop Business Office Release News for 2019.3.

Publish 1098-Ts to Students

The Generate 1098-T’s window has been updated to include a Publish to Students button. The process was changed to allow more control over when students will receive a new electronic copy of their 1098-T form. The Generate 1098-T button creates the forms, and a new pop up window allows you to enter a name for the new 1098-T form that students will see in the Campus Portal Financial Document Center.

A Setup Student Account Notifications link was also added to the top of the window to allow for quick access to the Set Up Notifications window.

Tip

Do not lock the 1098-T year until you have sent the forms to the government and published to the students. The Publish to Students button is disabled once the year is locked.

Manage 1098-T Notifications

A new notification Delivered 1098-Ts is available on the Set Up Notifications window. Student Directors can define the subject and message that students receive as an email when a new 1098-T form is available. Once notifications are set up and turned on, the defined message is sent when the Publish to Students button is clicked on the Generate 1098-T’s window.

Updates to Student Account Balances

On the Setup A/P & A/R Subsidiary Definitions window, there is a new column for Include in Account Balance that allows an A/R Admin to choose the subsidiaries included in the student account balances online in the My Financial Account feature. When selected, the subsidiary is included for student balances. In order to select a subsidiary, the A/P Flag checkbox must be unchecked.

Issue | Description |

|---|---|

121472 | The 1098-T Eligibility Flag was not being set by the Auto-Generate Rows option in Receipt Entry. This has been resolved. |

142702 | Multiple issues were reported with the audit reports. Audit reports were redesigned to accommodate new reporting requirements. |

162552 | A batch lock in the Student Billing window is not created, allowing CG batches to be created without header records as well as allowing suspended transactions in a batch that has been posted. This issue has been resolved by changing the billing process to check the status of a batch prior to inserting new rows. |

164123 | The Charge Entry window opened instead of the Transaction Entry window when attempting to edit Miscellaneous Charge transactions. This issue has been resolved and the Transaction Entry window opens correctly. |

171015 | Both sides of the Voided Refund transaction were incorrectly being reported in the 1098-T Audit reports and in Box 1 of 1098-T. This has been corrected. |

Introducing Self-Service Payment Plans

J1 2019.2 introduces an updated payment plan process that allows students to review, consent, and pay on payment plans through the JICS Campus Portal. For full details, setup, and process flow, see the Payment Plans (Self-Service) process in the Online Help.

Important

The Self-Service Payment Plans require the Student Finances license. Without this license, you may not see the changes listed in the Quick Look at What's Impacted section below.

What are the benefits of self-service payment plans?

"Self-Service" means students can review, compare, and sign up/consent to payment plans online

Customizable online consent form and virtual agreement option for students

Plans can be built using year/term, billing period, or total amount

Additional fee options with automatic miscellaneous charges

Appointed contact information can be assigned to each plan

Streamlined payment checkout process

Plans are closely tied to the student's financial account for more visibility

Quick Look at What's Impacted

The self-service payment plan enhancements impact J1 Desktop Accounts Receivable and CRM Student.

Accounts Receivable

A new option for Legacy Payment Plans and one update for Course and Fee Statement options on the A/R Configuration window

New link to the Self-Service Payment Plans window on the Subsidiaries window

Updates to the following windows that allow payment plan balances to update in real time:

Disbursements and Adjustments

Financial Aid Transaction Entry

Miscellaneous Charge Entry

Recalculate Financial Balances

Receipt Entry

Student Billing

Transaction Entry

Four new windows for the self-service payment plans:

Payment Plan

Payment Plan Assignment

Manage Payment Plans

Self-Service Payment Plans

Student

New Payment Plan feature

Detailed Impact to Accounts Receivable

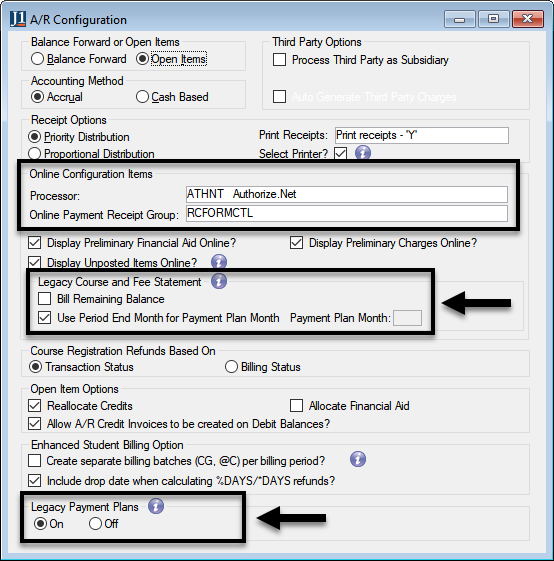

A/R Configuration Window

There is a new Legacy Payment Plans setting that allows you to choose between two methods of assigning payment plans to students. On uses current and new payment plans, while Off will only allow for the new payment plans. Off should only be selected if you've never used the legacy payment plans, or all legacy payment plans have a zero balance. By default, this setting is turned On.

Subsidiaries Window

From the Subsidiaries window, the Default Payment Plan Code on the Master tab and the Payment Plan tab don't appear if the Legacy Payment Plans option on the A/R Configuration window is set to Off.

A link to the Self-Service Payment Plans window appears in the top corner of the Subsidiaries window if the student has active payment plans on their account.

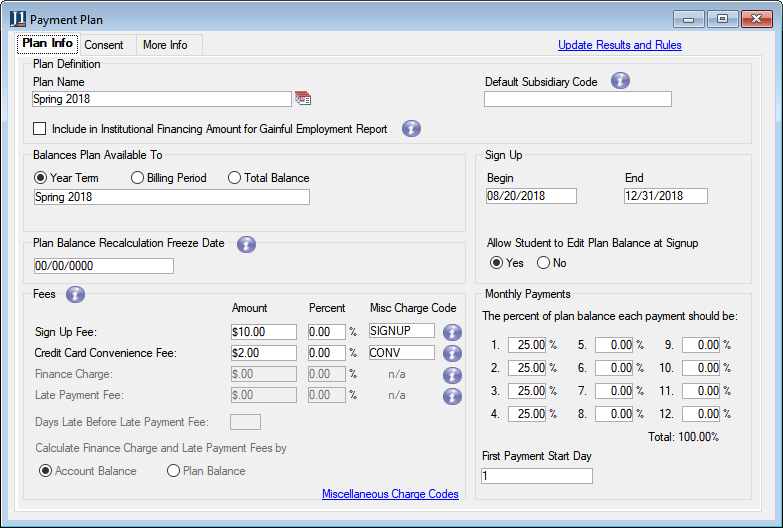

Setting Up Self-Service Payment Plans

There are four new windows that the self-service payment plans use to create, edit, assign payment plans.

Tip

See Self-Service Payment Plans in the Online Help for more information and a detailed checklist of the setup and payment plan process.

Payment Plan window

Use this window to create a new payment plan or edit an existing payment plan for the new Self-Service Payment Plan process. You will need to enter the payment plan details on the Plan Info tab and write messages on the Consent and More Info tabs that student's will read before selecting and consenting to the plan in the JICS Campus Portal.

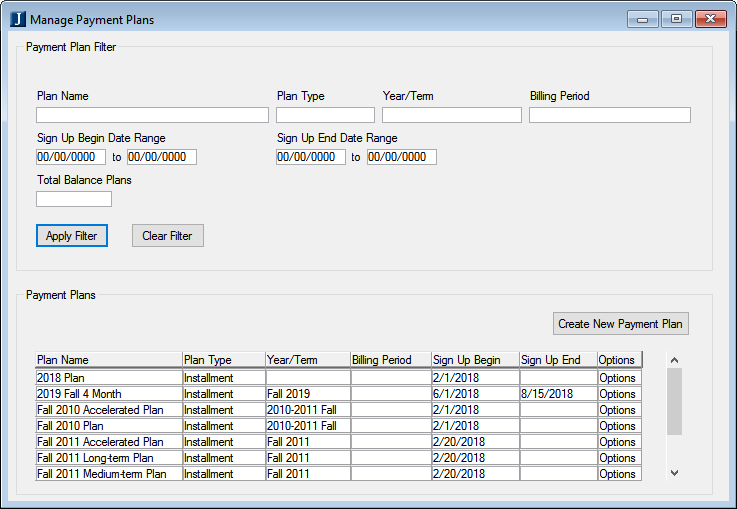

Manage Payment Plans Window

Use this window to search for payment plans, create new payment plans, and to review, edit, or delete existing plans.

Self-Service Payment Plans Window

This window can be used to look up students with payment plans and review plan information. From this window, you can also:

View all plans the student has consented to

See the status of the payments on the plan

Review a summary and details of the plan

Make a payment

Adjust plan payment amounts

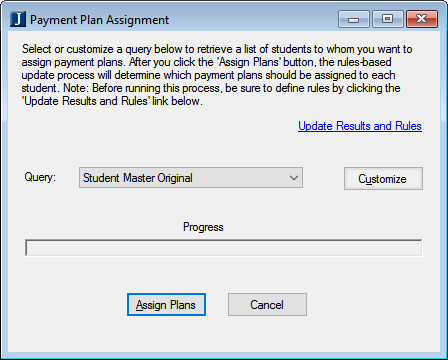

Payment Plan Assignment Window

This window is used to start the process of running rules-based updates for eligible plan assignments.

There are three standard queries available that will retrieve a list of students you want to assign payment plans to:

Student Master Original: This query will review all students in the student master table against the payment plan rules-based updates to determine if any of those students are eligible for payment plans.

Student Course History Original: This query will review all students in the student course history table against the payment plan rules based updates to determine if any of those students are eligible for payment plans.

Student Division Master Original: This query will review all students in the student division master table against the payment plan rules based updates to determine if any of those students are eligible for payment plans.

If students are eligible, the available payment plans will appear in the student’s Campus Portal and allow them to review and choose plans based on their need.

Campus Portal and Student Access

Once the payment plans are assigned to students (from the Payment Plan Assignment window), any plans students are eligible for appears on the JICS Campus Portal Payment Plan page. From the Payment Plan page, students can review, consent, and make payments on their plans.

A/R Configuration Window Updates

There are three changes to the A/R Configuration window:

Under the Online Configuration Items section, the Online and Offline options have been removed. The offline option has not been supported for several releases so the options were removed to avoid confusion.

With the new CRM Student Financial Document Center feature, the Course and Fee Statement section is no longer needed and has been changed to Legacy Course and Fee Statement. If your school is using the new Student Financial Document Center feature, this setting can be decided on the Student Account Statements window, and the Legacy Course and Fee Statement options should not be selected on the A/R Configuration window.

The new Legacy Payment Plans setting allows you to choose between two methods of assigning payment plans to students. When legacy payment plans are turned On, you can continue using the legacy payment plans and the new Student Self-Service Payment Plans. By selecting Off, you are deciding to stop using the legacy payment plan features. All legacy payment plan processes, windows, options, reports, and references are disabled. If you have any plans that still have a balance, do NOT turn the legacy payment plans off. By default, this setting is turned On.

Tip

Schools that have used legacy payments should leave this feature ON until all payment plan balances are zero and students have completed all legacy payment plans. Schools that have never used the legacy payment plans should turn this feature OFF to hide legacy options and windows.

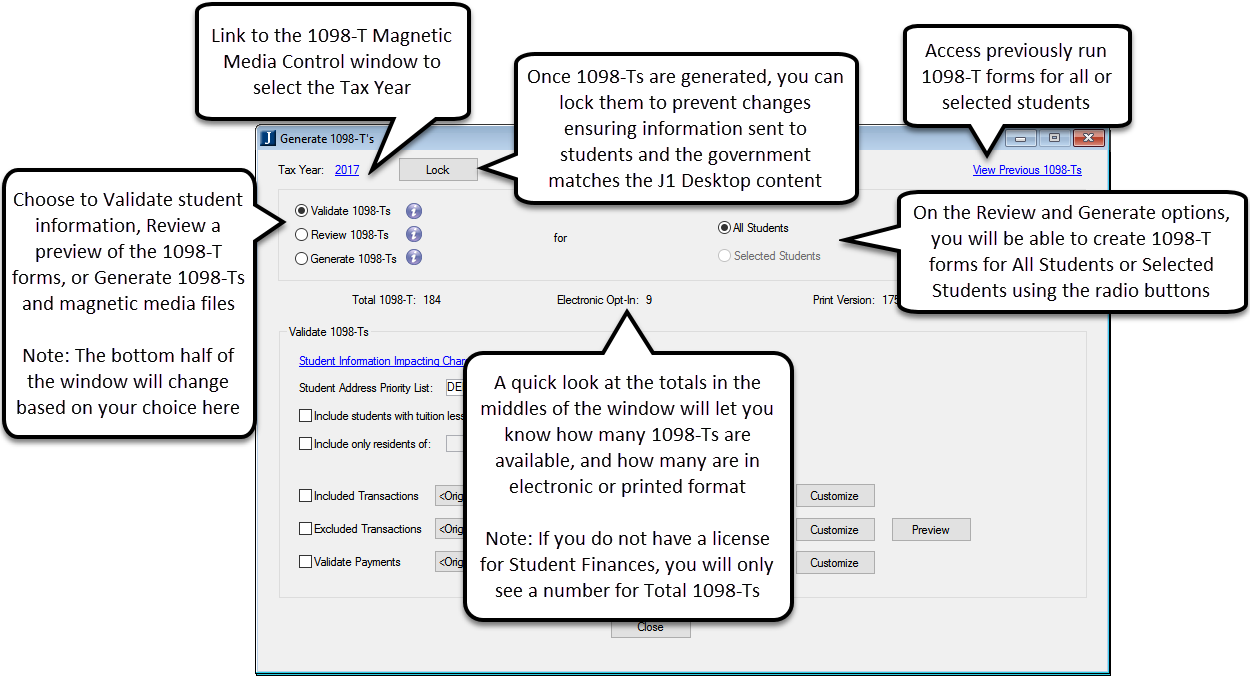

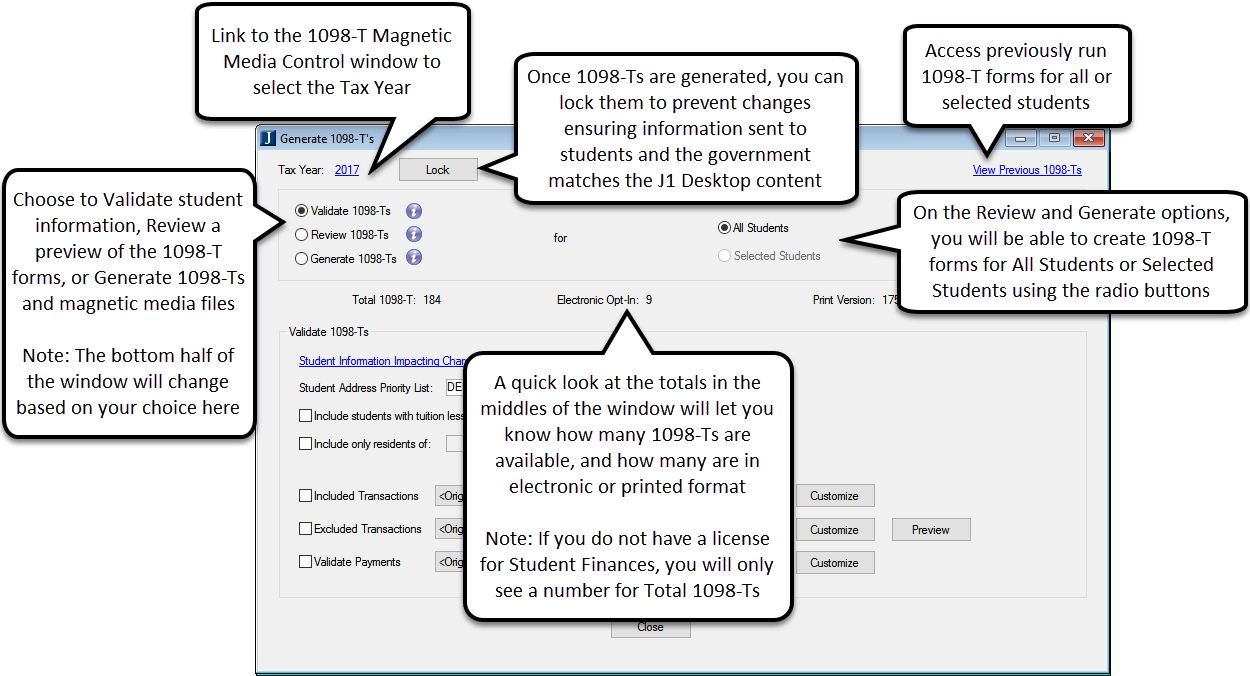

Student Finances Features for the Generating 1098-Ts Window

If you have the Student Finances license, 1098-Ts can now be sent as PDF files to students via the JICS Campus Portal Financial Document Center. There are also some additional options that appear:

Totals Bar: In the middle of the Generate 1098-T window, you see a row with Total, Electronic Opt-in, and Print Version. This shows you the number of students that have 1098-T forms, the number that have chosen to receive electronic 1098-Ts, and the number that will receive print-only versions of their 1098-T.

Electronic Consent: To see which students have opted into electronic forms, you can go to the Generate 1098-T window, click the Selected Students radio button on Review 1098-Ts or Generate 1098-Ts. In the Select Students section, you can see either Printed statements or Electronic statements.

PDF Files: When you generate or preview the 1098-T forms, you automatically get the printable forms that can be used with the pre-printed forms for 1098-Ts. In addition to the printable versions, you also see PDF files with the student data already inserted into the 1098-T form layout. For more details, see the examples shown in the Review 1098-Ts and Generate 1098-T sections.

View Previous 1098-Ts: When you generate 1098-T forms for all students, a master report is created as a PDF that includes all printable forms. Each master report shows the 1098-Ts for all students that have not consented to receiving their 1098-T forms on the JICS Campus Portal, listed in alphabetical order. You can access the master reports from the View Previous 1098-Ts link on the Generate 1098-Ts window.

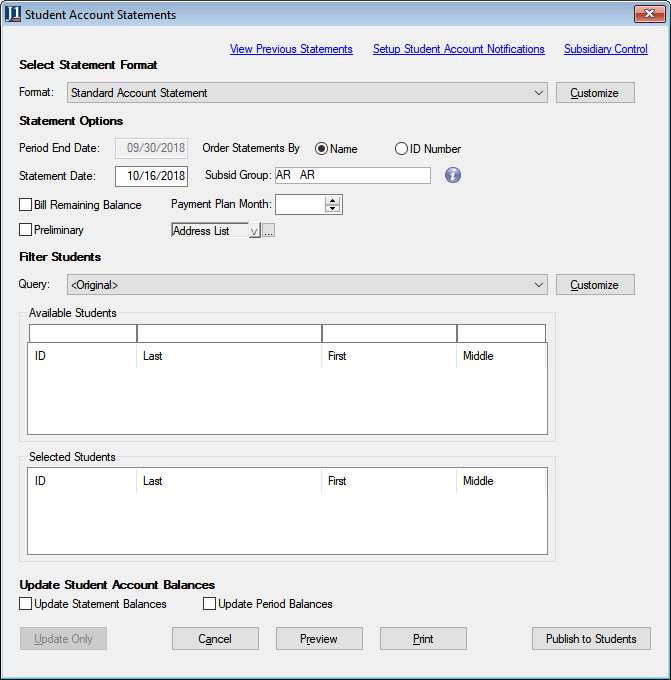

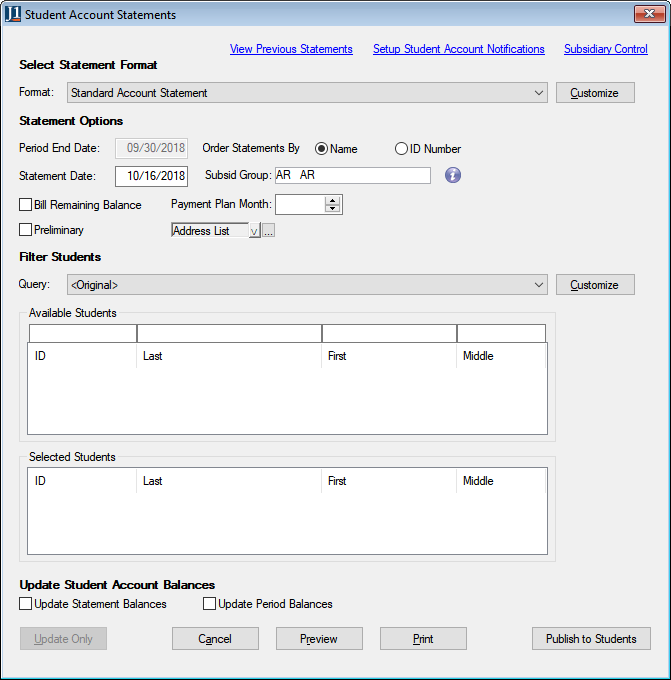

New Reports and Quick Links On the Student Account Statements Window

The Student Account Statements window (formerly called Print A/R Statements) is used to print statement forms, change transaction statuses, and update balances. You can also update the statement and period balances without running a report. Once statements have been created, you can use the Publish to Students button to send PDF versions of the statements to the JICS Campus Portal where students can access them in their Financial Document Center. Convenient links across the top of the window provide quick access to update subsidiary controls, notifications, and access to PDF versions of previously generated statements.

You can now select from five provided statement formats or you can customize your own format:

Standard Account Statement: this is the default report format that will organize the statements alphabetically by the student’s last name, then by subsidiary code.

Account Statement with Schedule: this report will organize the statements alphabetically by the student’s last name, then by subsidiary. The student's schedule for the selected billing period will display at the top.

Student Account Statement - Billing Period: this report will organize the statements alphabetically by the student's last name, then by billing period (descending order).

Student Account Statement - Year/Term: this report will organize the statements alphabetically by the student's last name, then by year/term (descending order).

2005_Statement: this report will open the 2005 Statement options and will organize the statements alphabetically by the student’s last name, then by subsidiary code.

Important

The Publish to Students button shown on the screen capture above requires the Student Finances license.

View Previously Generated Account Statements

From the Student Account Statements window you can now click the View Previous Statements link at the top of the window to access historical statements for individual students. From this new window you can select a student and view all statements or a statement from a specific statement date in a PDF format.

Notify Students Their Account Statement Has Been Delivered

You can also now set up a notification to be sent to a student when a student account statement has been published to them. These notification settings can be accessed by going to the Student Account Statements window and clicking the Setup Student Account Notifications link. Once the student statement notification is turned on, a notification will be sent to students when the Publish to Students button is clicked on the Student Account Statements window.

Student Information Impacting Charges Window

A new 1098-T Preference column is available on the Student Information tab. This option determines the 1098-T format the selected student will receive. Printed statements are mailed by the school, and Electronic statements are sent to JICS where the student can download and print their forms.

Caution

This preference is decided by the student. Students should give consent to change this option. If a change is made, the student must be notified.

New Options Payment Plans Rules-Based Updates

On the Update Results and Rules window, new SUBSID_MASTER columns have been added as rules based update options for Payment Plan Assignments. Having this table available allows your institution to build their payment plan rules and make plans available to students based on a balance that also meet the criteria of the rules you configure. You can add these to your payment plan assignment rules by selecting the PAYPLANS code (under PMT Payment Plans Assignment Rules), clicking on the Results Rules Definition tab, adding a new row, and selecting the table and column from the Rules Table / Column / Expression drop-down.

Issue | Description |

|---|---|

154257 | Online payments from Authorize.net were not always reflected in the ONLINE_PAYMENT table. This caused the inability to reconcile payments from the settlement report from Authorize.net. We enhanced tracking the Campus Portal payment feature by including the online payment ID as the invoice number. And we now create online payment rows in the database and add log messages to make it easier to track payment issues. |

1098-T Magnetic Media Control

The Payment Year column has changed from a text field to a drop-down date selection. When you select a four-digit year the Tax Year on the Generate 1098-Ts window will automatically be updated when you run the reports.

Generate 1098-Ts Window Redesign

The Generate 1098-Ts window has been redesigned to help you quickly process 1098-T forms for all or select students.

From this window, you can select from the following three options:

Validate: gives you the ability to generate audit reports prior to generating 1098-Ts for students, helping you identify possible data issues that need to be corrected prior to finalizing the 1098-Ts and allows you to check student consent preferences.

Review: allows you to preview and edit your 1098-T forms prior to actually generating them, and gives you the opportunity to verify that the formatting and student information is correct.

Generate: creates 1098-Ts for eligible students and the government required media file for electronic filing.

Note

Some features shown on the screen capture above require the Student Finances license and will be available in an upcoming release. For more information, on how to generate 1098-T forms, press F1 from the Generate 1098-Ts window or search the Online Help.

Year Term Subterm Window

There is a new column on the Year/Term and Year/Term/Subterm tabs for Payment Due Date. The date entered in this column will be used in the JICS Campus Portal to know when an account balance is due.

Note

This feature will be available for use in an upcoming release.

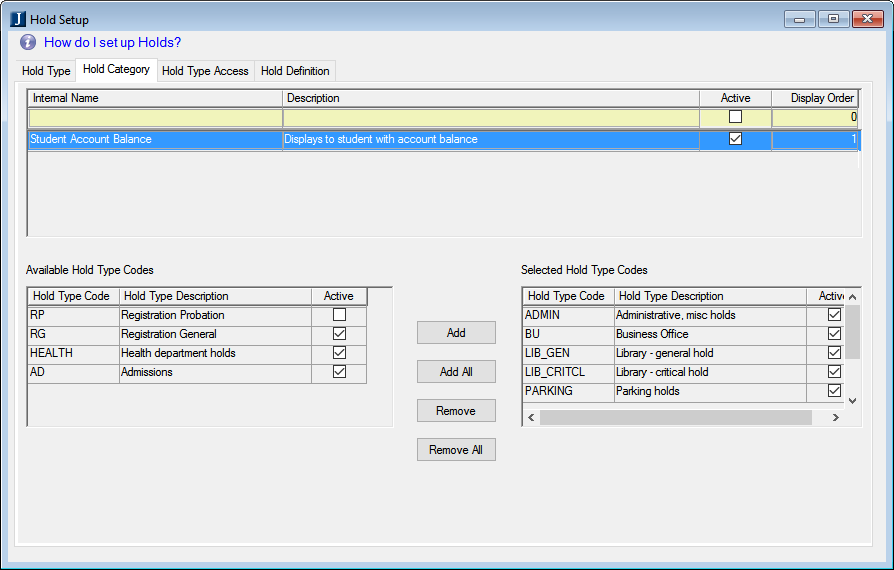

Holds Setup Window

There is a new tab on the Hold Setup window for Hold Category. Use this tab to map hold types to a specific category that will help associate the hold with specific requirements or conditions and allow the system to display holds automatically for students in appropriate locations of their Campus Portal.

Note

This feature will be available for use in an upcoming release.

Print A/R Statements Window Redesign

The Print A/R Statements window has been renamed and redesigned. The Student Account Statements window is used to print statement forms, change transaction statuses, and update balances. You can also update the statement and period balances without running a report. While the fields have been reorganized for a better process flow, the purpose and method of printing A/R statements remains the same.

Note

The Publish to Students button shown on the screen capture above requires the Student Finances license and will be available in an upcoming release. For more information, on how to print A/R Statements, press F1 from the Student Account Statements window or search the Online Help.

Issue | Description |

|---|---|

149711 | Previewing or customizing the 1098-T Validate Payments report incorrectly showed the original, model version of the report instead. |