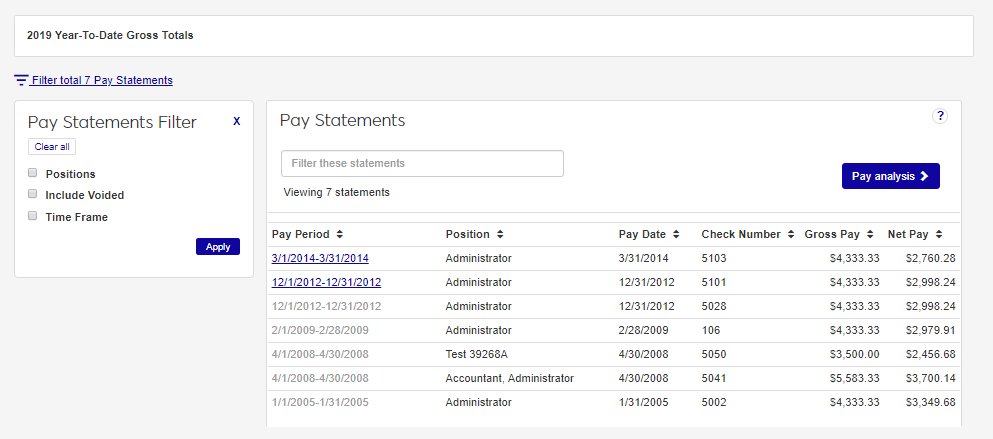

Pay Statements

Use this page to review your pay statements and year-to-date total and for any and all positions you hold at your institution. Using the Pay Statements page, you can:

View your current year-to-date totals.

Search for a specific pay statement.

Sort statements by position, date, and pay.

Access the Pay Analysis features.

Download a PDF of your pay statement.

Note

Some pay statements may not be available in PDF form.

Note

Use the Pay Statements Filter to limit your search results. You can filter by Position, Voided, and/or Time Frame.

To search by position:

Select the Positions checkbox.

Click in the text box that appears and select an option (e.g., Faculty, Engineer).

Click Apply.

To include voided statements in the list, select the Include Voided checkbox.

To search by time frame:

Select the Time Frame checkbox.

Select year or date range options.

Click Apply.

Select View pay statements from the Hub options. The Pay Statements page appears.

To view your most recent pay statement, click on the associated pay period dates for that statement.

Tip

The most recent pay statement appears at the top of the list.

To sort your pay statements, click on any of the column headings.

To filter the list of statements, use the Pay Statements Filter or search by using the text field. You can enter a full or partial date, check number, pay amount, or position title into the box marked Filter these statements.

You may not be seeing your pay statement if something went wrong with the update payroll process. Contact your supervisor or HR representative for more information.

If there is an error on your pay statement, contact your HR representative as soon as possible.

Gross pay is the amount you earn before deductions. Net pay is the amount you are paid after deductions, such as taxes, benefits, and other voluntary deductions.

Note

You can see all your deductions on the Deductions page. Contact your Human Resources department to adjust your deductions or get more information.

Year-to-date includes all of your pay amounts up to the most recent pay statement date.

Notice

If you receive pay statements on the 15th and 30th of the month, and it is March 20th, your year-to-date total will include January-February plus the first half of March.