Year Close Exceptions Report

Important

Information and features vary according to the roles to which you belong and the permissions associated with those roles. For more information, contact your module manager or your campus support team.

Note

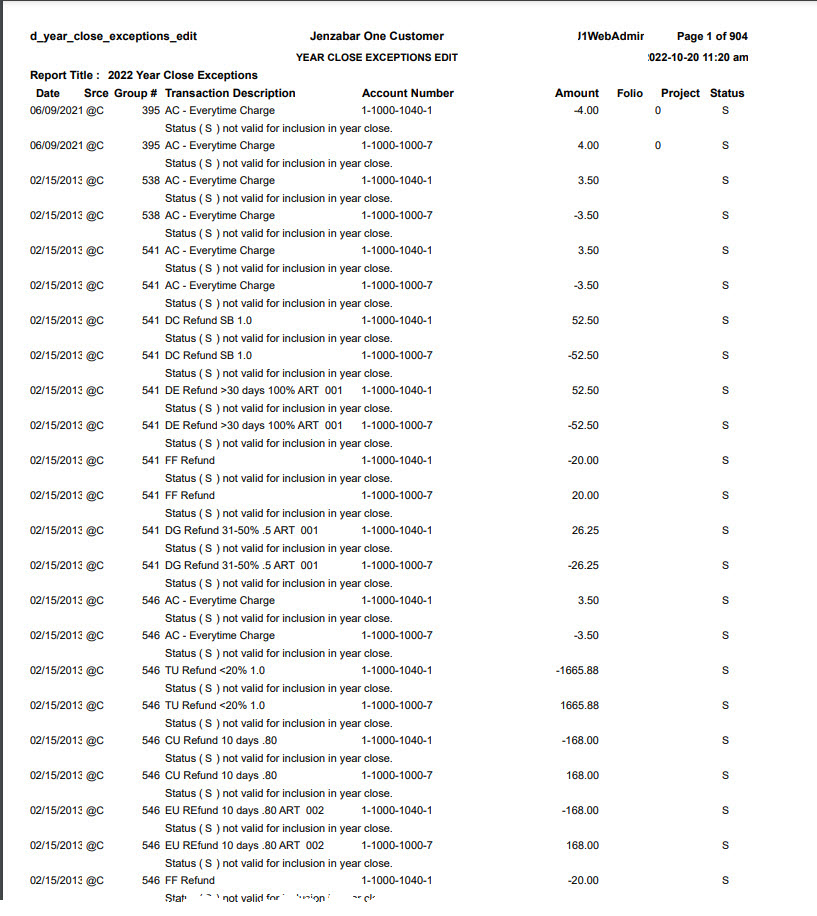

The Year Close Exceptions report is called the Year Close Exceptions Edit report in Desktop. The same information is included in both reports.

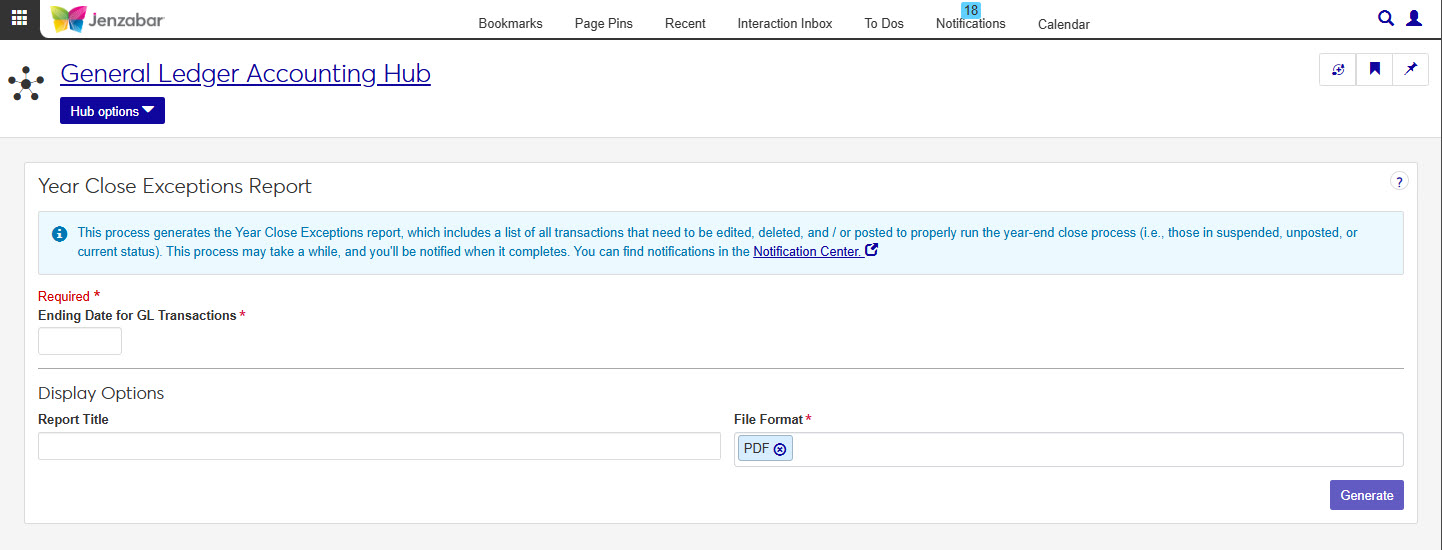

Use this page to generate the Year Close Exceptions report, which includes a list of all transactions that need to be edited, deleted, and/or posted to properly run the year-end close process (i.e., those in suspended, unposted, and current status).

Tip

The goal for the Exceptions Edit report is to have an empty report. To complete the year close, you must resolve any issues by either posting or fixing the transactions listed in the Exceptions Edit report.

In the General Ledger Accounting Reporting role, select "Can generate Year Close Exceptions report" in the Reports section. If this permission is not selected, users won't be able to access the Year Close Exceptions Report page.

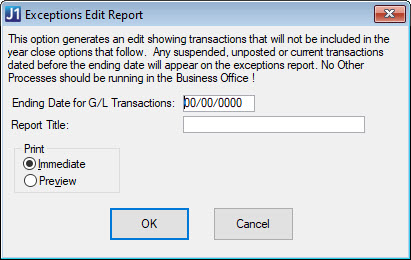

This report is generated on the Exceptions Edit Report window in Desktop.

Enter an Ending Date for GL Transactions.

Enter a Report Title (limited to 35 characters).

Select one or more File Format options. You can select from:

PDF

CSV

DIF

HTML

PSR

SQL

TXT

XLSX

XML

Click Generate. This process may take a while, and you'll be notified when it completes. You can find notifications in the Notification Center.

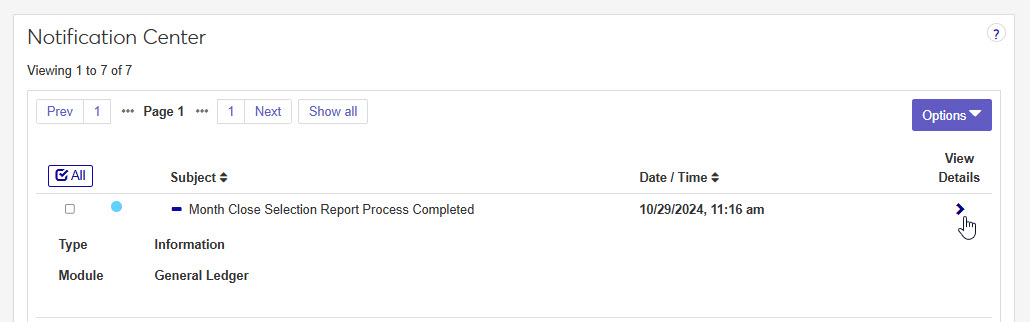

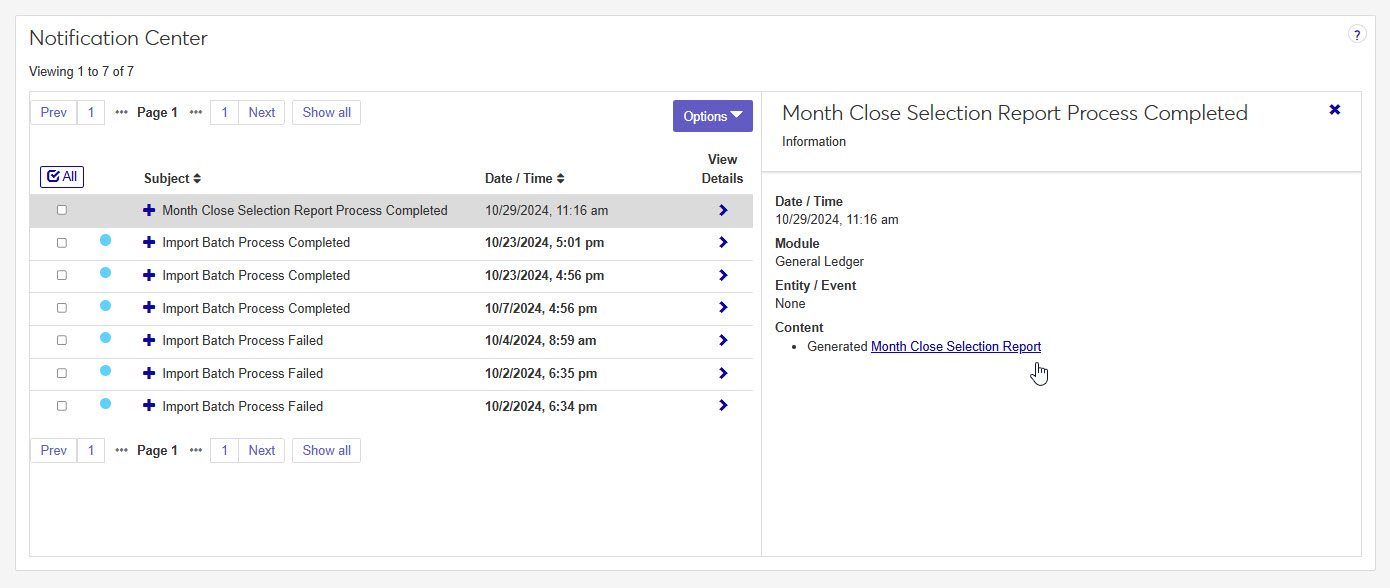

When the report has finished generating, you will receive a notification. You can click on the notification or go to the Notification Center to access the report.

Tip

Completed reports appear as Information Notifications. If the report process fails, it appears as an Error Notification.

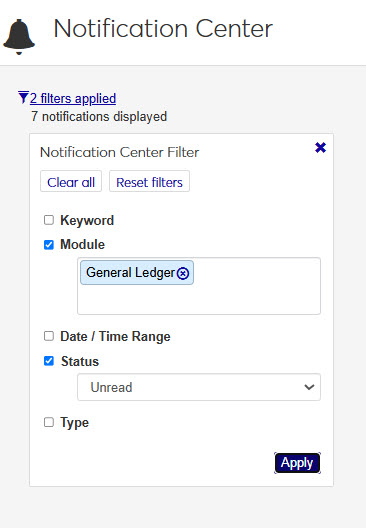

If your notification is not visible at the top of your Notification Center, use the Notification Center Filter to search for report.

When you locate your report notification, you can view the Type and Module by expanding

and closing

and closing  the notification.

the notification. Tip

Unread notifications will have a blue dot icon

at the start of the row. You can select one or more checkboxes in your Notification Center and use the Options drop-down to change notification statuses between read and unread.

at the start of the row. You can select one or more checkboxes in your Notification Center and use the Options drop-down to change notification statuses between read and unread.Click the View Details icon

to see more details about the creation of the report, and access the report.

to see more details about the creation of the report, and access the report. Click the report link under the Content section.

If a single file format of PDF was selected for the generated report, clicking the report link will open the report in a new tab of your browser. You can use the PDF browser options to save the file.

If more than one file type is selected, or if the file type is not a PDF, when you click the link, the Save As window pops up, allowing you to name the file and select where you want to save it.

Tip

All downloaded files, regardless of the number of file formats, are in a ZIP folder.

Once the file has downloaded, extract the ZIP file. The report appears in the folder in any file formats you selected when generating.

View and save file versions as needed.

d_year_close_exceptions_edit

In the General Ledger Accounting Reporting role, select "Can generate Year Close Exceptions report" in the Reports section. If this permission is not selected, users won't be able to access the Year Close Exceptions Report page.

On the Exceptions Edit Report window.

The report lists all transactions that need to be edited, deleted, and/or posted to properly run the year-end close process (i.e., those in suspended, unposted, and current status). The following information for each transaction is included:

Date

Source

Group #

Transaction Description

Account Number

Amount

Folio

Project

Status

The reason the transaction cannot be included in the year-close process (e.g., an invalid status).

Many finance reports are created using long running processes. This means that when you generate a report, you won't see an immediate result. However, you can continue working in J1 Web while your report generates. When it's ready, you will receive a notification that you can access in the Notification Center.