Account Components

Tip

To set up the account number structure, component defaults, and other configurations, go to the General Ledger Administration Settings page, in the Account Number Structure & Component Configuration section.

An account component is defined as the most basic building block of an account, and determines the account number structure. Each account is identified using an account number, made of a unique combination of the components and settings. These components are all customized by your institution during the initial setup of J1 Finance - General Ledger.

Component Categories

General Ledger accounts allow for six components. The way you set up components depends on the needs and the level top which you want to track balances, budgets, and detail reports.

Account number structure can be based on as many as six components with up to five characters each, so all together the account number can have up to 35 characters. Some of the common components created include, but are not limited to, the following:

Organization

Fund

Department

Object

Sub-Object

Unused

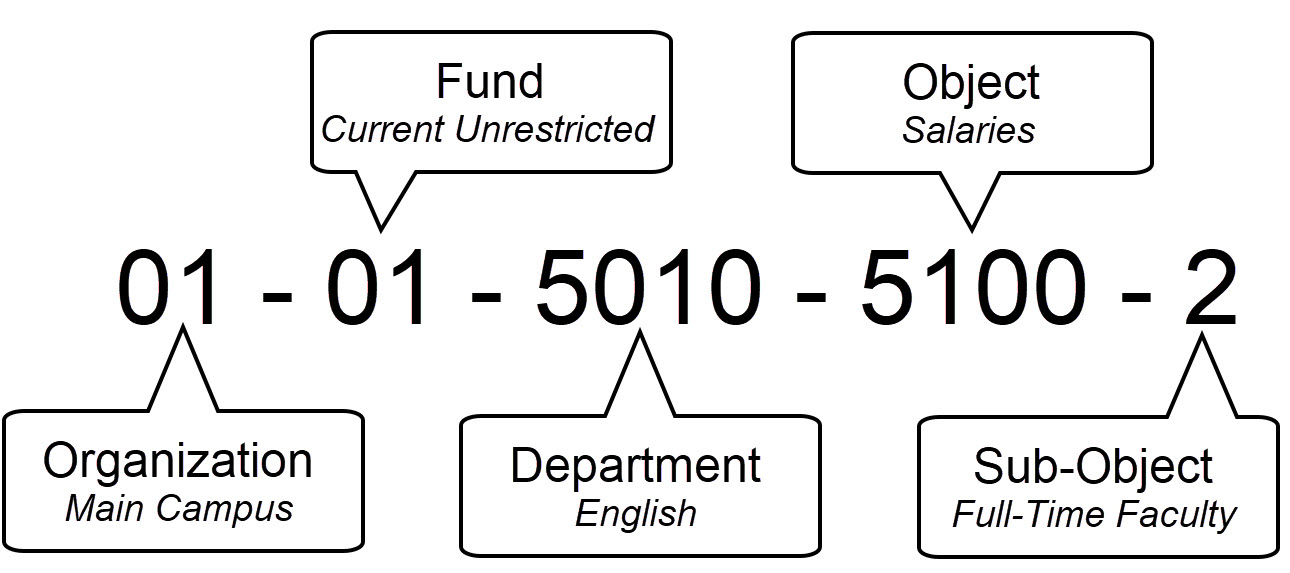

Using the common components listed above, the following sections will show examples of each component and how it would define the account structure.

The organization component would differentiate between programs and/or locations for your institution. Using this type of component can help keep separate areas of your institution distinct.

Caution

An organization code can allow you to produce separate balance sheets and income statements for each organization; however you must run the month and year close processes at the same time for all organizations at your institution.

Organization | Code |

|---|---|

01 | Main Campus |

02 | North Campus |

03 | South Campus |

04 | Medical Campus |

05 | Legal Campus |

A fund is an accounting entity with a self-balancing set of accounts consisting of assets, liabilities, fund balances, incomes, expenses, and auxiliaries.

Separate accounts are maintained for each fund to ensure observance of limitations and restrictions placed on use of resources.

Notice

As shown in the following example, funds of similar characteristics are combined into fund groups for reporting purposes.

Fund | Description |

|---|---|

01 | Current Unrestricted |

02 | Temporarily Restricted |

03 | Endowment Funds |

04 | Load Funds |

05 | Annuity and Life Funds |

06 | Agency Funds |

07 | Plant Funds |

08 | Institutional Funds |

The department component can establish different departments or areas of accounts within your accounting system. There are two types:

Expenditures: these codes refers to the department within the organization (a cost center).

Non-expenditures: these department codes group similar accounts for the purpose of creating subtotals on reports.

Notice

The table below illustrates an example for the department code structure.

Account Type | Range | Description |

|---|---|---|

Asset | 1000-1999 | Cash Accounts, Accounts Receivable |

Liability | 2000-2999 | Student Fees, Accounts Payable |

Fund Balance | 3000-3999 | Fund Balance Accounts |

Revenue | 4000-4999 | Tuition Income |

Expenditure | 5000-5999 | Department Purchases, Salaries, Travel (cost centers) |

Other | 9000-9999 | Anything that may fall into more than one category or doesn't fit in one, such as scholarships |

Notice the range of numbers for the account types provide ample room for growth in each department. The ranges ensure your accounts will sort in the order your school chooses from the GL Settings page. These ranges also help control the arrangement of accounts on your GL reports.

Depending on the account type, the object component could be used for detailed descriptions of the other components (asset, liability, fund, and revenue) or to describe the goods or services received for expenditures.

Notice

The table below illustrates an example for the object component and how it could apply to your institution.

Account Type | Range | Description |

|---|---|---|

Non-expenditures | 1000-4999 | 1010 - First Nation Bank Account 1020 - Payroll Cash Accounts 1030 - Student Tuition Income |

Expenditures | 5000-9999 | 5100 - Salaries 5200 - Supplies 6100 - Travel |

The sub-object component is used to further define and detail the object. Sub-object codes can be used with any type of account and allow for a further breakdown of the accounts.

Notice

In the following example, you can see how an object, such as Object code 5100 - Salaries, could be broken down.

Sub-Object Code | Description |

|---|---|

01 | Tenured Faculty |

02 | Full-Time Faculty |

03 | Part-Time Faculty |

04 | Teaching Assistants |

05 | Office Staff |

06 | Student Interns |

Your institution does not have to use all six components, but each component is limited to five characters.

Component 1 | Component 2 | Component 3 | Component 4 | Component 5 | Component 6 |

|---|---|---|---|---|---|

Organization | Fund | Department | Object | Sub-Object | Unused |

01 | 01 | 5000 | 5100 | 2 | - |

Using the examples above, the account structure could look something like this:

Component Definitions

Once you have your components created and ordered, you can start adding definitions to the components. For more information, see the Account Components Definitions page.

Best Practices

For your components, consider using unique and consistent codes to help with quick identification and clean reporting.

For components that use a range of numbers make sure there is ample room for growth. These ranges ensure that your accounts will sort in the desired order and easily control the arrangement of accounts on your General Ledger reports.

No. Each component is limited to a length of 5. When added together, the total length of 6 components would be 35 characters.

No. The components used with be determined by your institution and the level of detail they want to include.