Fixed Asset Details

Important

Information and features vary according to the roles to which you belong and the permissions associated with those roles. For more information, contact your module manager or your campus support team.

The Fixed Assets details page allows you to review and edit asset information as it progresses through its life cycle. From this page, you can review detailed information about an asset's depreciation history, examine the invoice from which the asset was derived, or enter maintenance notes for the asset.

If more than one asset is open, you'll see a message (e.g., Viewing 1 of 4 fixed assets) and a drop-down menu that allows you to toggle between open fixed assets.

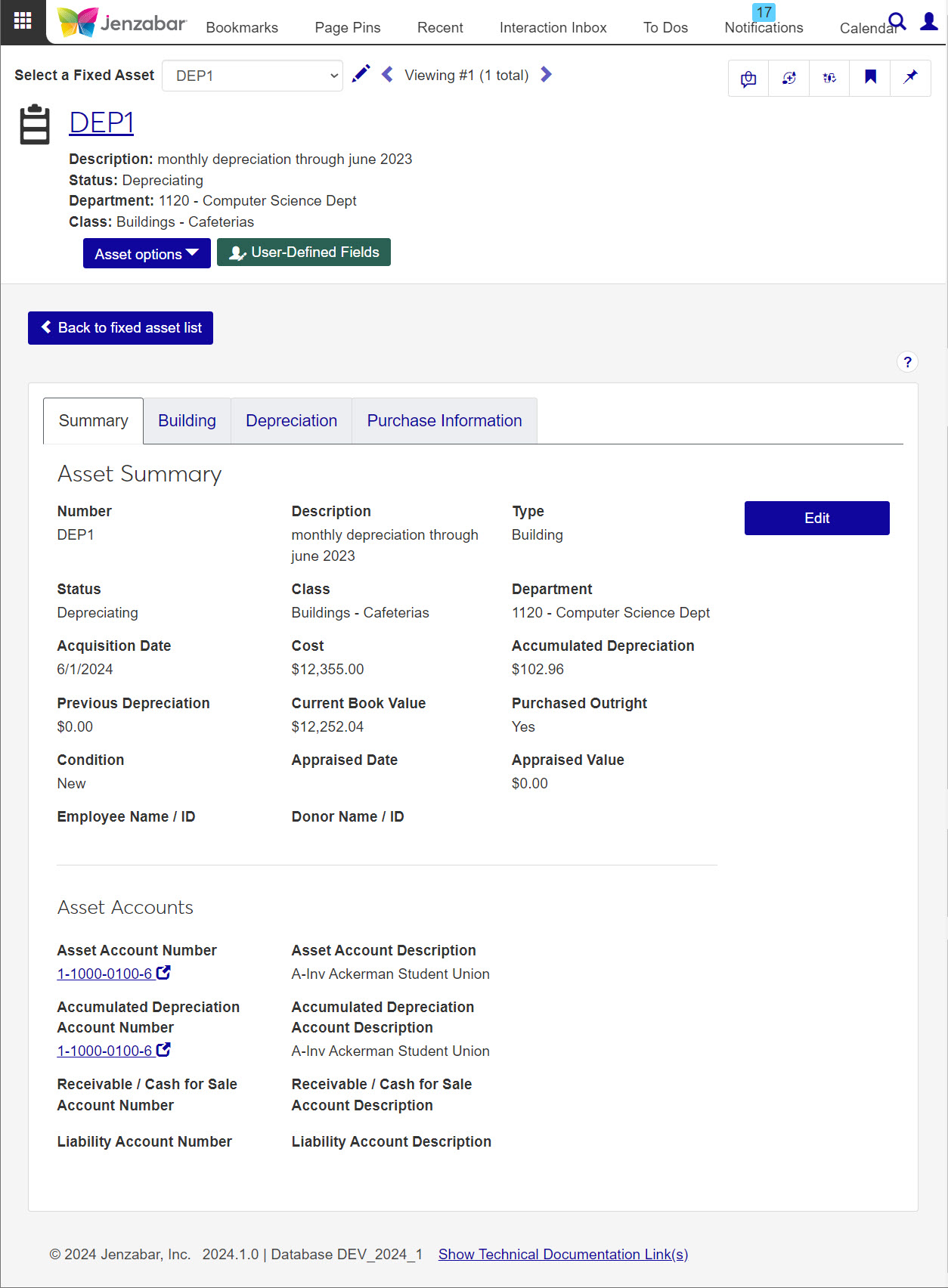

Fixed Asset Summary Tab

Use this tab to maintain asset details such as cost, type, appraisal value (if applicable), related accounts, and depreciation type and dates. You can also view the original sale information.

Number, Description, Type, Status, Department, Class, Acquisition Date, Cost, Accumulated Depreciation, Previous Depreciation, Current Book Value, Purchased Outright, Condition, Appraised Date, Appraised Value, Employee Name/ID, Donor Name/ID. (Bolded field names in this list indicate editable fields.)

Tip

If the fixed asset's status can be updated, you can do so by choosing Asset options > Status update in the in the header. Learn more about updating statuses.

Click Edit to update information on this page (based on your roles and permissions). Only fields that can be updated here become editable.

Asset Account Number, Asset Account Description, Accumulated Depreciation Account Number, Accumulated Depreciation Account Description, Receivable / Cash for Sale Account Number, Receivable / Cash for Sale Account Description, Liability Account Number, Liability Account Description

Tip

Click on the account numbers to see more details about the account. Access to GL Accounts is based on permissions.

If an asset is in Sold, Salvaged, or Retired status, there is a third section with varied information based on the asset's status.

Sold Status: Sale Information tab with Sale Price and Sale Date

Salvaged Status: Salvage Information tab with Salvage Price and Salvage Date

Retired Status: Retirement Information section with Retirement Date field

Tip

Date must be within the current fiscal year. If an invalid date is entered, it automatically updates to the first day of the current fiscal year.

Building/Equipment/Vehicle Tab

If the asset is a Building, Equipment, or Vehicle, the second tab has specific information related to that asset type. Assets classified as "Other" do not have content on this tab.

Use this tab to review or enter building information for Building (B) assets. Information on this tab includes:

Campus

Place

Use this tab to review or enter equipment (e.g., machinery) information for Equipment (E) assets.

Model Number

Serial Number

Tag Number

Campus

Place

Space

Use this tab to review or enter vehicular information for Vehicle (V) assets. Most of the optional information below can be obtained from the Vehicle Registration or the Bill of Sale.

License Plate Number

VIN Number

Date License Expires

Driver's Name

Model / Model Year

Cylinders

Horsepower

Color Top / Color Bottom

Vehicle Number

Replaced Vehicle Number

State Garaged

State Licensed

State Sticker Number

City Garaged

City/County Sticker Number

Title on Hand

Depreciation Tab

Use this tab to review posted fixed asset transactions for items entered using the General Ledger module.

Depreciation Settings

This section is where you can review and update the details of an asset. Most information should be entered when the asset is purchased, but you may need to edit the information later.

Depreciation Allocation

This section allows you to allocate the selected asset to specific departments. You can select the departments listed here by navigating back to the Summary tab. Click Edit, then add or remove departments from the Department options.

Tip

The allocation among departments must equal 100%.

Depreciation Summary

In this section, you will see a worksheet with the depreciation process for the asset. You can view months from the current year, annual, accumulated, and remaining amounts.

Purchase Information Tab

Use this tab to review details relating to the purchase transactions (invoices) of the selected asset. The transactions will be listed and detailed on a read-only worksheet

Tip

Transactions are managed on the GL Transactions page.

How To

Depending on your permission settings and the type of fixed asset you are viewing, certain details are editable on the fixed asset details page.

Click Edit.

Fields that can be changed become editable.

Click Cancel to return to view-only mode without making any changes.

Edit fields as needed and Save. The Save button is disabled if you make changes that can't be saved (e.g., leaving a required field blank).

Tip

If the changes you made can't be saved for any reason, an error message displays on the fixed asset detail page.

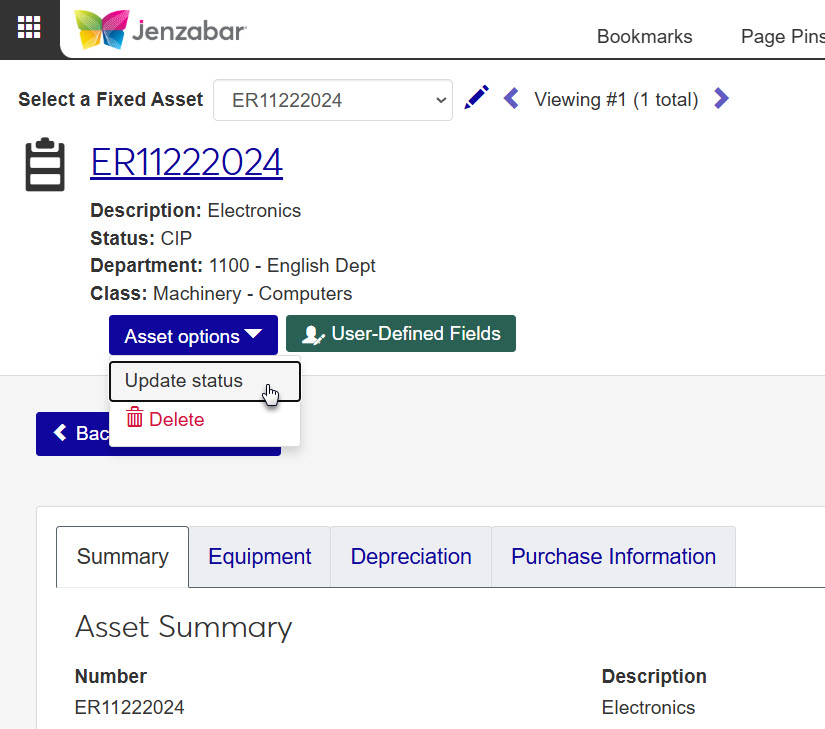

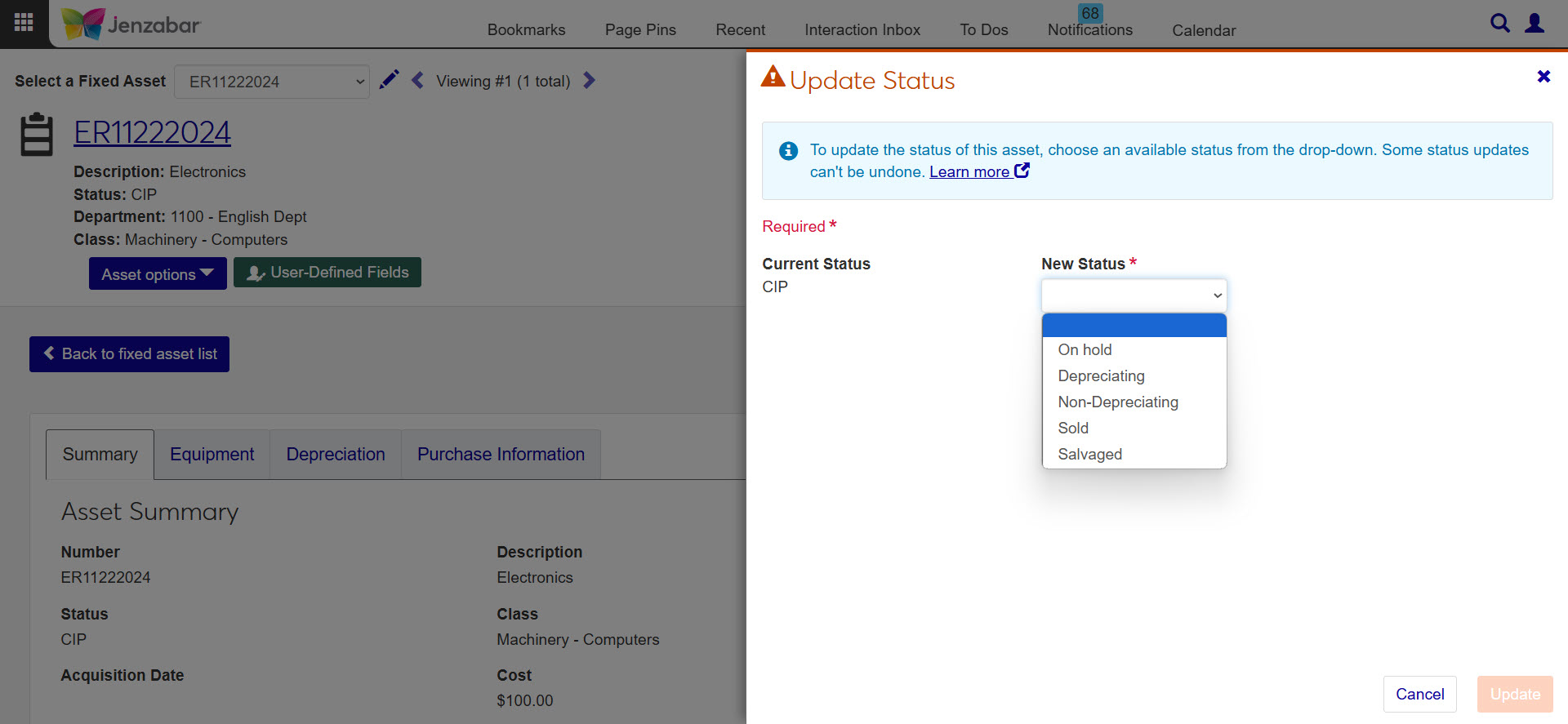

When you open an asset detail page, you will see the Options drop-down button. Select Update status.

From the pop-up window you can view the current status and a list of available statuses. Click the new status you want to apply to the asset.

Click Update.