Human Capital Management

Tip

Only releases with enhancements or resolved issues for this module have content below.

Preparing for Symmetry Tax Engine

Across Desktop HCM, development is underway to prepare for full integration with Symmetry tax engine in an upcoming release.

Note

For institutions not beta testing Symmetry, there are no changes to your existing processes. You can install the 2024.3 release as usual.

Undo Finalization of a Timecard

Supervisors and administrators can now use the new Undo Finalization option to reverse the finalization of a timecard. On the Manage Timecards page of the Pay and Administration hub, click the More button and select Undo Finalization to return a timecard to the Not Finalized status. This allows employees to once again add, edit, or delete entries on the timecard using the Enter Time page.

Note

Only timecards that have not been approved can have their finalization status reversed.

Leave Balance Page Shows Active Leave Types

The Leave Balances page in the Pay and Time Management hub now shows only active leave types.

New Columns for OK TRS Monthly Report

There are three new editable columns included on the OTRS Monthly tab of the OK OTRS Monthly report on the State Reporting Snapshot data window:

Email Address (employee’s email address, recommended to be personal address to avoid access issues when TRS members move between employers)

Date of Hire (date of first employment)

Date of Termination (date of separation, not prior to the last day the employee worked)

This data will be required for FY 2026 monthly reporting.

Alabama SIT Calculation Update

Overtime pay is no longer included in the wage basis when calculating Alabama State Income Tax in the Pay Run Edit.

Set a Supervisor as Inactive Using Supervisors Definitions Window

The Employee Supervisors Definition window is available to create supervisors definitions that include Active or Inactive statuses. An inactive supervisor will be disabled from approving leave requests or timecards.

To set a supervisor as inactive:

Note

A supervisor may only be successfully deactivated if they meet the following criteria:

No leave requests pending approval

Any pending timecard approvals where today's date is still within the approval cutoff period have an alternate approver assigned

Any remaining leave requests have an alternate approver assigned

From the HCM Administration hub navigate to Definitions. Select Employee Supervisors.

From the Employee Supervisors Definitions page, click the Create Definitions button.

In the Create Employee Supervisors Definitions pop-up, enter the name or ID number of the employee supervisor you want to deactivate.

Set the toggle to Inactive.

Click Create and close.

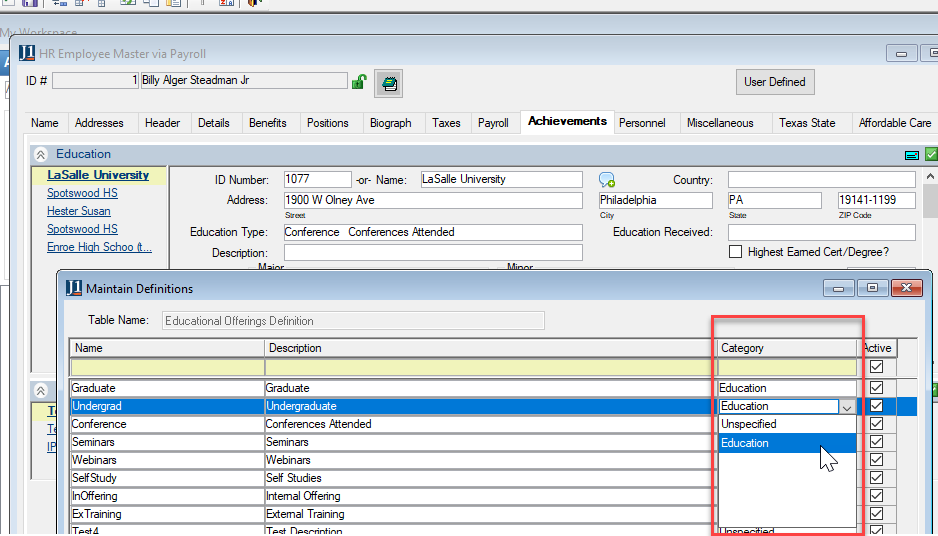

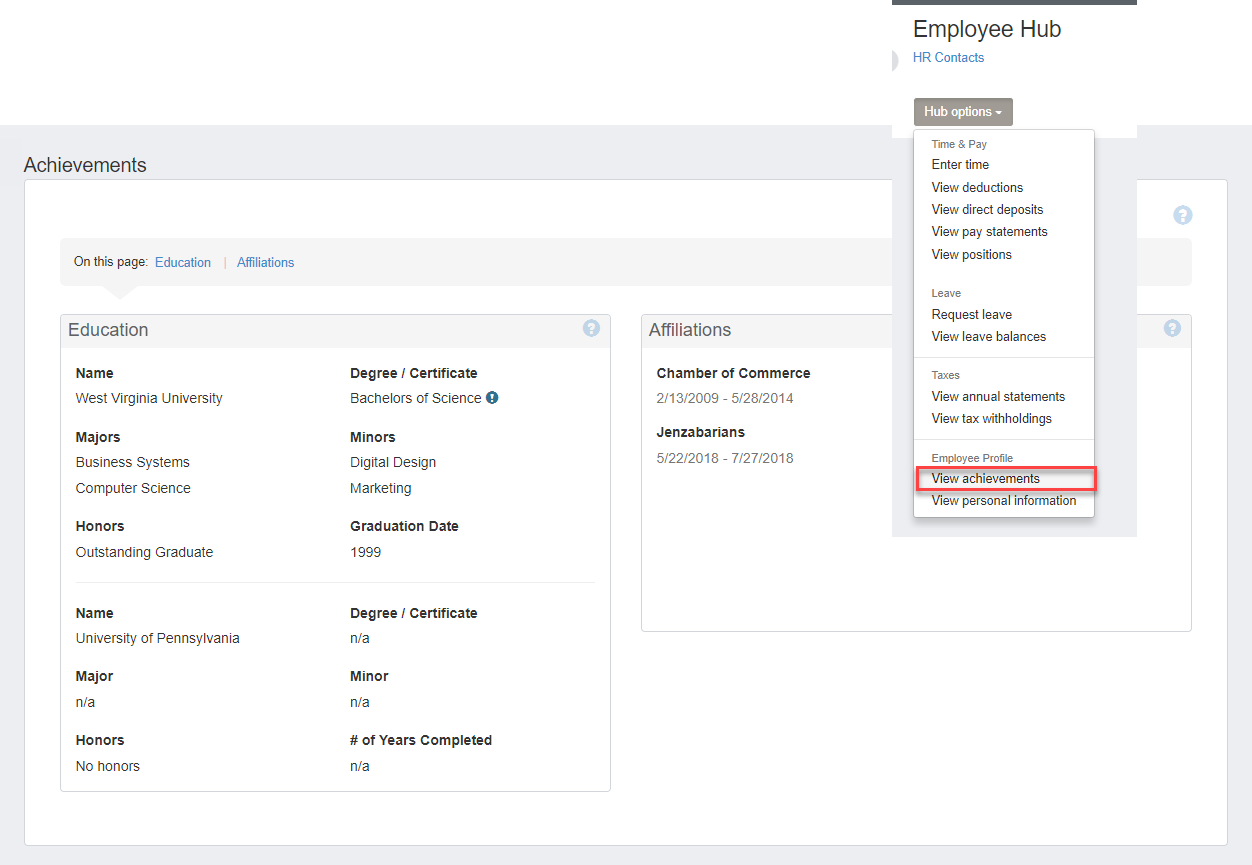

Create Affiliation Without End Date

On the Achievements tab of the HR employee Master via Payroll or HR Employee Master via Personnel windows, you can create an Affiliation without an end date. Pick a start date in the From: section and leave the To: section set to 00/00/0000.

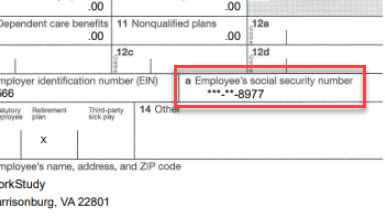

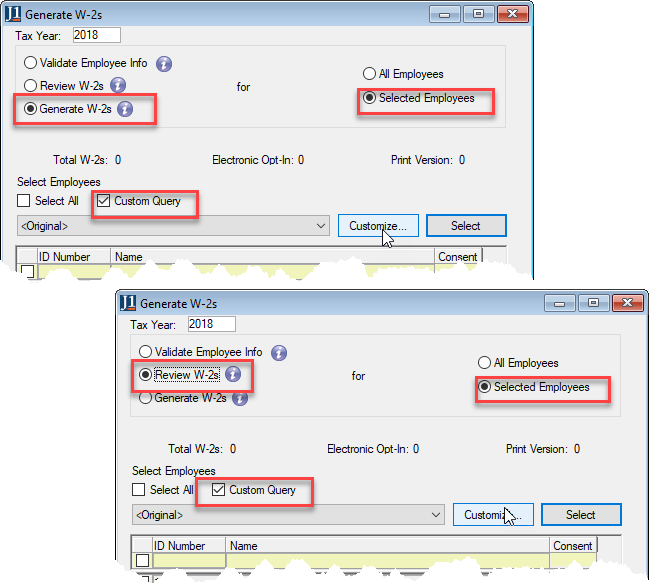

SSN Masking on the Generate W-2s Window

When using the Review W-2 and Generate W-2 options in Jenzabar One Desktop, a new Mask SSN checkbox appears on the Generate W-2s window for 2024 and future years. If selected, when you click Preview or Generate, the report will show the employee social security number masked except for the last four digits.

Notice

For example, XXX-XX-6789.

If left unselected, the social security number displays unmasked.

Notice

For example, 123-45-6789.

SSN Masking on the Generate 1095-Cs Window

When using the Review 1095-C and Generate 1095-C options in Jenzabar One Desktop, a new Mask SSN checkbox appears on the Generate 1095-Cs window for 2024 and future years. If selected, when you click Preview or Generate, the report will show the employee social security number masked except for the last four digits.

Notice

For example, XXX-XX-6789.

If left unselected, the social security number displays unmasked.

Notice

For example, 123-45-6789.

PDF Outputs Now Use InfoMaker

For the year 2024 and forward, the W-2 and 1095-C PDF form and instructions are created using InfoMaker rather than an embedded image.

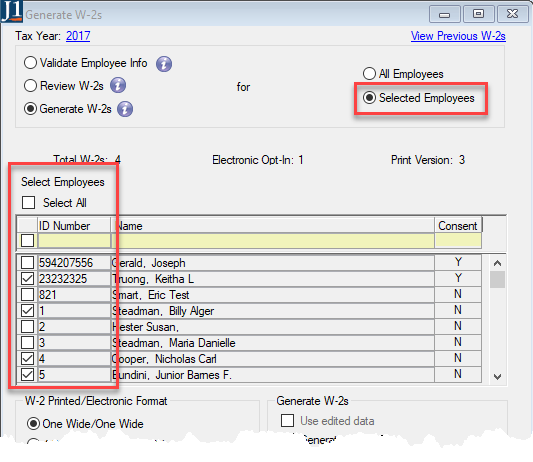

Remove Editing for Employee ID Number

In the Selected Employees section of the Generate W-2s and Generate 1095-Cs windows, employee ID numbers are no longer editable when reviewing or generating the forms. This prevents accidental changes while working with the Generate 1095-C and W-2 processes.

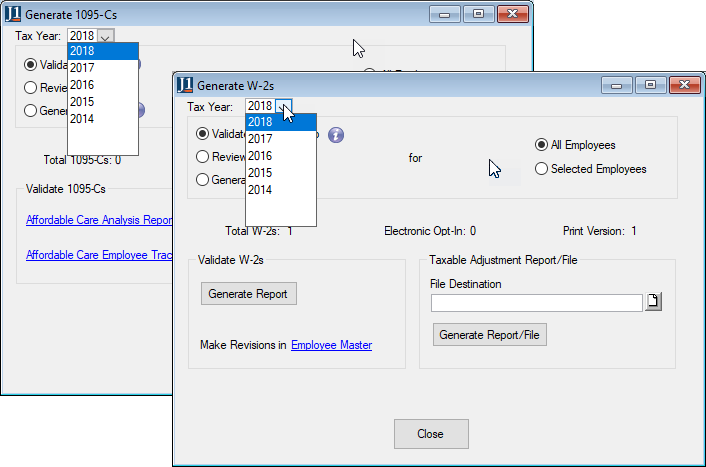

Tax Year 2024 Available

The 2024 tax year is now available in the Generate W-2 and Generate 1095-C windows.

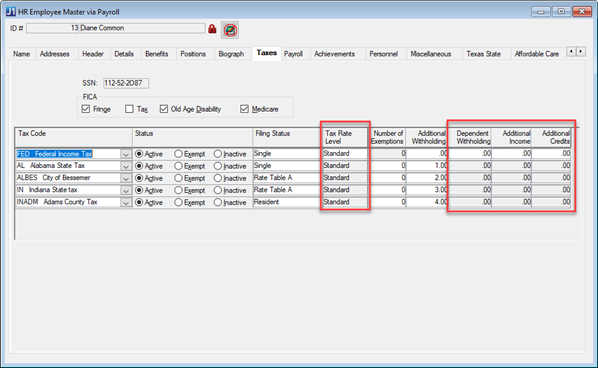

Select Standard or Optional for Montana State Tax

When a tax corresponds to Montana State Tax, you can select Standard or Optional Tax Rate Level on the HR Employee Master via Payroll, HR Employee Master via Personnel, and Separate Timecard Taxes windows. The Additional Credits field can now be used to subtract additional credits in the payroll tax calculation.

2023.3

North Dakota SIT Standard or Optional Rate Calculation

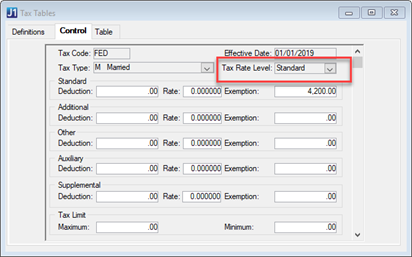

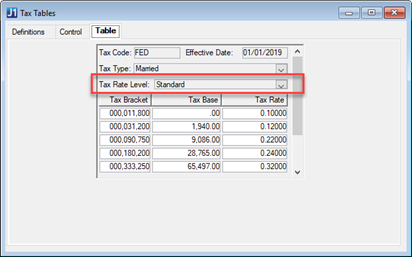

On the Control tab of the Tax Tables window, there is a new Tax Rate Level drop-down that appears when calculating the ND SIT tax code. Select an option depending on your employee's W-4 dates.

If the employee’s W-4 date is before 1/1/2020, select Standard.

If the employee’s W-4 date is on or after 1/1/2020, select Optional.

W-2 and 1095-C Forms

The 2023 tax year is available on the Generate W-2s and 1095-Cs windows and processes have been updated to reflect any government changes for this year.

IRS 2023 Filing Links

W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

W-2 Instructions: https://www.irs.gov/instructions/iw2w3

1095-C Form: https://www.irs.gov/pub/irs-pdf/f1095c.pdf

1095-C Instructions: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

For more information about working with these forms, see the Generating W-2 process guide and the Generating 1095-C process guide on MyJenzabar. You can also visit our Jenzabar Academy YouTube channel to watch Generate W-2 and 1095-C Process Overview videos.

Federal Tax Table Updates

As of the date of release, the government has not issued a final version of Publication 15. When they do so, the tax tables will be updated. You'll be able to add any changes using a script posted on MyJenzabar.net or with future updates to the database structure utility (DSU)/default data update (DDU).

2023 Group Term Life Table Updates

As of this release, the federal government has not yet updated Group Term Life Insurance tax rates. If they do so, the Tax Table will be adjusted accordingly with a future update to the database structure utility (DSU)/default data update (DDU).

Mask SSN on W-2 PDF Output

When generating an employee W-2 on the Generate W-2 window, the Social Security Number (SSN) is now masked except for the last four digits.

Note

You will be able to define W-2 SSN masking in the Display Data Access window in a future release.

Example

Document Storage Icon on Applicant Master window

You can now use the Document Storage  icon on the Applicant Master window to access the Document Master window and see an applicant's documents.

icon on the Applicant Master window to access the Document Master window and see an applicant's documents.

Note

To grant access to the Document Master window and see this icon, use the Document Security window to add document permissions to the relevant user or group.

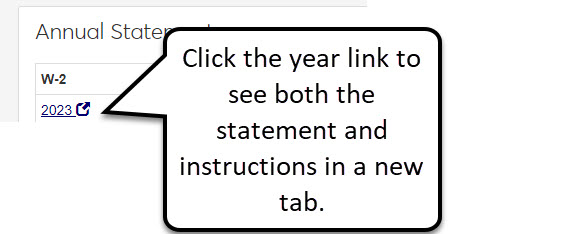

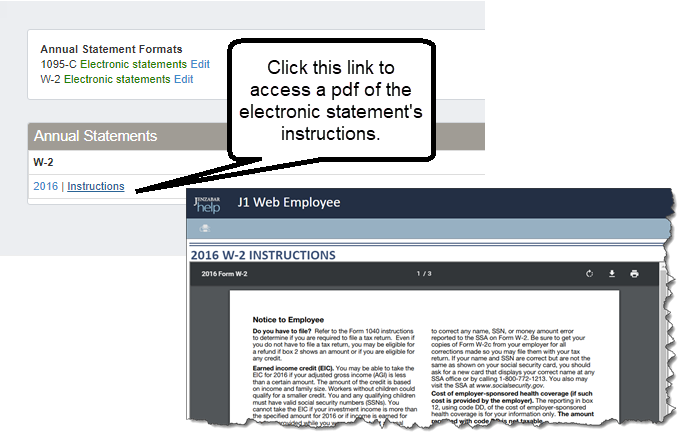

W-2 and 1095-C Annual Statements

On the Annual Statements page, employee W-2 and 1095-C statements now appear as a single year link that will open in a new tab including both the form and instructions. For all years prior to 2023, the information will appear as two separate links for the year's statement and instructions.

Note

To view statements in a browser, the employee will need to have their W-2 and/or 1095-C set to Electronic statements in the Annual Statement Methods section.

CUPA Professionals Survey Report with Web Import Tab

When you’re working with the CUPA Professionals Survey report, there is a new Web Import tab to create the required import file to submit along with the report. From the Regulatory Reporting window in Desktop, select CUPA2012-HR CUPA in the Regulatory Forms drop-down. Select the PFSURVEY part and click the Web Import tab. Click the Create the Web Import button to create the file. The CUPA Professionals Survey report itself is updated to include the currently required data.

CUPA Staff Survey Report with Web Import Tab

When you’re working with the CUPA Staff Survey report, there is a new Web Import tab to create the required import file to submit along with the report. From the Regulatory Reporting window in Jenzabar One Desktop, select CUPA2012-HR CUPA in the Regulatory Forms drop-down. Select the NONXSURVEY part and click the Web Import tab. Click the Create the Web Import button to create the file. The CUPA Staff Survey report itself is updated to include the currently required data.

Issue | Description |

|---|---|

29859 | The Generate Timecard process calculated a different pay amount than manual timecard entry. |

79667 | If there were two deductions on the same check stub description, one of them was duplicated. |

121042 | If the Begin/End time in Shift Definitions crossed over midnight an error occurred. |

159378 | Period Worked Weeks counted all timecards for the same pay period on the Affordable Care Analysis report. |

164465 | If the Payroll Control dates crossed years then the Accrual Year Category did not move to the next level. |

RN49158 | In some situations, an employee's leave request was being applied to the wrong pay period. |

RN49462 | Employees with electronic consent did not appear in the W-2 PDF preview. |

RN50295 | The Transfer Direct Deposits to Media process took longer than expected. |

RN50319 | Timecard Creation was unexpectedly creating two jobs. |

RN50637 | Accruals were not calculated correctly when benefits were rolled over at separate times. |

RN50772 | The timecard clean-up scripts released in 2022.2.0.1 have been removed from the patch script for 2022.2.0.2 and DSU 2023.1. |

RN51469 | The IPEDS New Hire Report did not include the correct date range for employees hired. |

RN51470 | The IPEDS New Hire report did not look for the correct IPED codes in nested report. |

RN51471 | When doing bulk updates directly against the PATimecardDetailHours table in SQL Server Management Studio, the PATimecardDetailDays.DailyTotalMinutes was out of sync. |

RN51473 | The Employee Roster page for both supervisor and administrator showed duplicate employee rows if the employee and/or employee's supervisor had more than one associated email. |

RN51633 | Accruals were not calculated correctly if one of the employees in the payroll batch had a benefit that rolled over. |

RN52775 | The new Colorado FAMLI tax was using gross wages but should have exempted some deductions. |

RN53255 | If an employee had an end date for their position after the selected report period they were incorrectly excluded from the IPEDS report. |

Issue | Description |

|---|---|

RN45053 | When employees requested leave for a future pay period the leave was transferred over to the timecard using the requested date instead of the first day of the pay period. This resulted in missing data in Entries accessed from the Approve Timecards and Manage Timecards pages. This only affected timecards that were using Period Summary format. |

RN45054 | Employees were not allowed to request available leave because processed leave was subtracted. |

RN48367 | Employees were able to finalize a timecard that was already approved. |

RN48534 | Employees were unable to clock out between midnight and 1AM on the first day of a new pay period. |

RN48610 | Salaried employees could not request leave prior to today's date. |

RN49775 | When an employee entered time and attempted to save the information, the save button allowed the employee to save again, thus saving a duplicate entry. Also, when an employee cleared time from an entry, they were allowed to save it, even though time greater than 0 hours is required. |

RN50030 | The employee could clock-in for two different positions by opening the Employee hub's Timecard block in two different browsers. |

RN50203 | Users had to clear their browser cache to load javascript updates, even though it should load automatically. |

RN54509 | The Overview block on the Employee hub page didn't load for employees with access to their supervisor's Person summary page and multiple positions with the same supervisor. |

W-2 and 1095-C Forms

The 2022 tax year is available on the Generate W-2s and 1095-Cs windows and processes have been updated to reflect any government changes for this year.

IRS 2022 Filing Links

W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

W-2 Instructions: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

1095-C Form: https://www.irs.gov/pub/irs-pdf/f1095c.pdf

1095-C Instructions: https://www.irs.gov/pub/irs-dft/i109495c--dft.pdf

For more information about working with these forms, see the Generating W-2 process guide and the Generating 1095-C process guide on MyJenzabar. You can also visit our Jenzabar Academy YouTube channel to watch Generate W-2 and 1095-C Process Overview videos.

Federal Tax Table Updates

As of the date of release, the government has not issued a final version of Publication 15. The tax tables have been updated based on the government’s preliminary updates. If additional changes are needed once the final numbers are issued, you will be able to update using a script posted on MyJenzabar.net or future updates to the database structure utility (DSU)/default data update (DDU).

2022 Group Term Life Table Updates

As of this release, the federal government has not yet updated Group Term Life Insurance tax rates. If they do so, the Tax Table will be adjusted accordingly using the database structure utility (DSU)/default data update (DDU).

Issue | Description |

|---|---|

149219 | In the 1095-C Request file, foreign addresses were inserted in the USAddressGrp, which caused the file to be rejected by the IRS. |

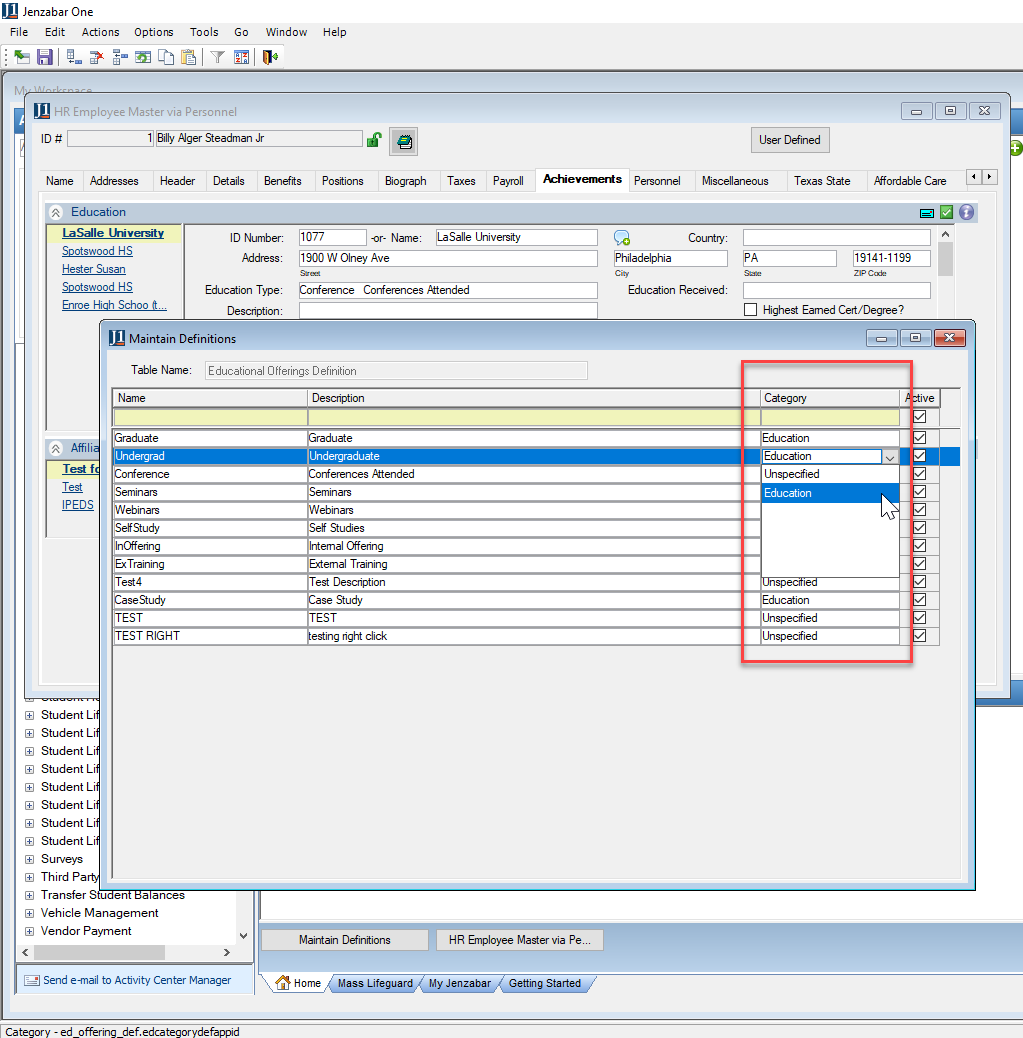

RN33266 | On the Educational Offerings Definitions window, users received an error message when attempting to save a new row after adding information in the Name and Definition columns. |

RN33270 | The Transfer Direct Deposits to Media process took longer than expected. |

RN38407 | The Applicant Diversity Report referenced biograph_master.veteran instead of MILITARY_SERVICE_MASTER. |

RN39687 | The system tried to delete J1 Web timecard records for employees when positions got reactivated with a date range that was outside of the date range when payroll had been processed for the position. |

RN39688 | The HR Accrual Standards via Payroll window sorted by APPID instead of benefit code, accrual class, and accrual year category. |

RN44067 | Colorado modified its state tax calculation to allow an employee to declare an additional credit amount to be subtracted from their annual wage base. The additional credit and additional income boxes were not editable. |

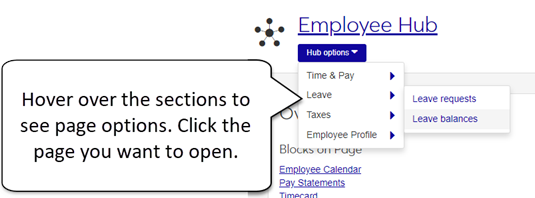

Employee Hub Hides Private Phone Numbers

When working throughout Employee, the Contact drop-down no longer displays any phone numbers designated as Private.

Note

To make a number private, select Yes in the Private drop-down on the Edit Phone Number pop-up on the Person Information Details page, Contact Info tab. You can also control the Private setting using the Addresses tab in the Desktop Name Entity window.

The Contact drop-down displays a "Phone number not available" message for individuals that either don't have a phone number or have a number marked as private.

New Unused Status for Timecards

If an active employee didn’t work during a pay period or never finalized their timecard, that timecard now is given a status of Unused when 30 days have passed after the approval cutoff date. Unused timecards won’t appear on the Approve Timecards and Manage Timecards pages, and employees will not see them on the Enter Time page. This improves overall performance when approving and managing your employees’ timecards.

Issue | Description |

|---|---|

RN38520 | Canceled leave requests were visible in the Leave Request List on the Review Leave Requests and Manage Leave Requests pages. |

RN40503 | Employees were able to cancel leave requests after the cutoff date. |

RN40529 | Leave requests couldn't be approved or denied from the Approve Timecards page. |

RN40810 | On the Employee Supervisor hub, the Employees Out Today list excluded employees with a time format of Period Summary if was not the first day of the payroll period. |

RN42718 | Users were getting duplicate clock-ins from the employee Timecard Block when using the Clock In feature. |

RN46831 | On the Timecard Block, clock-ins were attached to the previous day's timecard in some situations. |

New Checkbox for Generate 1095-Cs Window

A new Generate Checksum checkbox has been added to the Generate 1095-Cs window. If you've manually updated a Request file, selecting this checkbox allows you to internally generate a valid checksum value that is used in the Manifest file.

New Document Storage Icon

There is a new Document Storage icon  on the HR Employee Master via Personnel and HR Employee Master via Payroll windows in Desktop. Enter an employee’s ID number, and then click the icon to open the Document Master window. In the Document Master window, you can work with any available documents for the employee.

on the HR Employee Master via Personnel and HR Employee Master via Payroll windows in Desktop. Enter an employee’s ID number, and then click the icon to open the Document Master window. In the Document Master window, you can work with any available documents for the employee.

Important

The new icon is visible only if the user has access to the Document Master window. You can manage access using the Group Definition window.

Issue | Description |

|---|---|

55888 | Payroll accruals didn't advance employees into the next accrual category when the pay period spanned two calendar years (Pay Run Edit process). |

RN27982 | The carryover amount exceeded the rollover limit in certain configurations if time was taken during the payroll when the rollover occurred. |

RN32549 | Dependent care deductions entered in Box 10 of the W-2s now honors the $10,5000 limit. |

RN32759 | The Generate W-2s process ran very slowly and sometimes didn't generate the PDFs for the 4-part forms. |

RN32803 | Edited data did not appear consistently in W-2 and W-2 Summary Reports, especially when the Use Edited Data checkbox had been deselected and selected several times. |

RN33264 | Creating a new position with a position code that didn't have a full-time/part-time designation produced a system error (Review Position Requests window). |

RN33265 | Users didn't get an 'Unable to delete' message when they attempted to delete positions that had data in the PATimecardDetail table (Employee Master window > Positions tab). |

RN34168 | The Generate 1095-Cs process didn't create the media files correctly for previous years. |

RN34169 | The Generate Correction/Replacement Mag Media window let users generate files without entering the Receipt and Submission IDs. |

RN36064 | Running the Update Payroll process for employees with primary and secondary positions and benefits based on Non Secondary Gross No OT/Adj produced an error when the Separate Timecard checkbox was selected on the secondary position (Timecard Entry window). |

RN36097 | Project codes for LB transactions weren't populated during the Salary Distribution process. |

RN36099 | When a check batch generated from J1 Web was deleted from the Unused Check Batches window, the Processing Status row wasn't deleted from the timecard status history. |

New Checkbox for Generate 1095-Cs Window

A new Generate Checksum checkbox has been added to the Generate 1095-Cs window. If you've manually updated a Request file, selecting this checkbox allows you to internally generate a valid checksum value that is used in the Manifest file.

New Document Storage Icon

There is a new Document Storage icon  on the HR Employee Master via Personnel and HR Employee Master via Payroll windows. Enter an employee’s ID number, and then click the icon to open the Document Master window. In the Document Master window, you can work with any available documents for the employee.

on the HR Employee Master via Personnel and HR Employee Master via Payroll windows. Enter an employee’s ID number, and then click the icon to open the Document Master window. In the Document Master window, you can work with any available documents for the employee.

Important

The new icon is visible only if the user has access to the Document Master window. You can manage access using the Group Definition window.

Updated Tax Table for Wisconsin State Income Tax

The tax table has been updated to reflect the Wisconsin state income tax changes. These changes went into effect January 1, 2022.

Issue | Description |

|---|---|

RN27982 | The carryover amount exceeded the rollover limit in certain configurations if time was taken during the payroll when the rollover occurred. |

RN32759 | The Generate W-2s process ran very slowly and sometimes didn't generate the PDFs for the 4-part forms. |

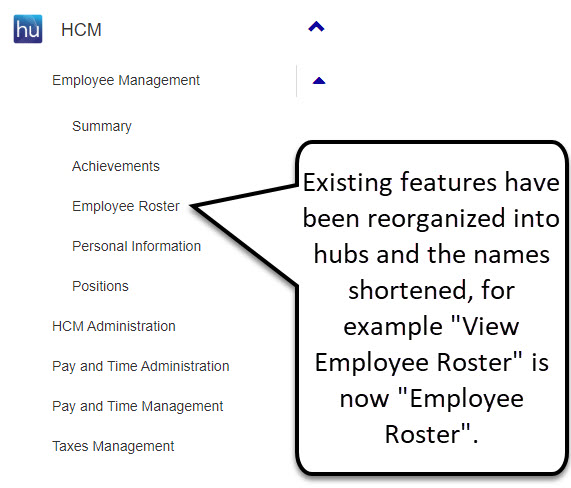

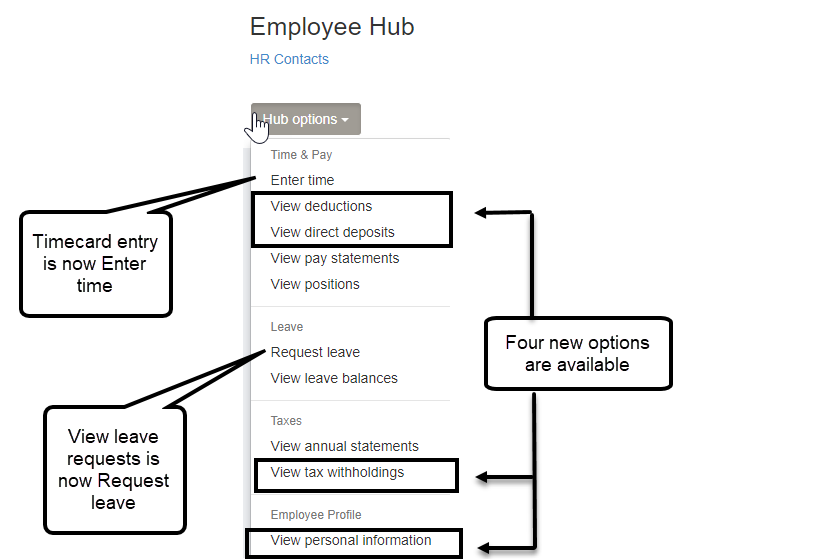

New Look and Improvements for Human Resources

Several pages have a new design, improved performance, increased accessibility, and additional functionality! Advanced filters let you find information quickly and Communication features like commenting and creating communications let you interact easily with others.

The following pages have been updated:

Employee Leave Requests

Employee Leave Balances

Employee Supervisor Approve Timecards

Employee Supervisor Review Leave Requests

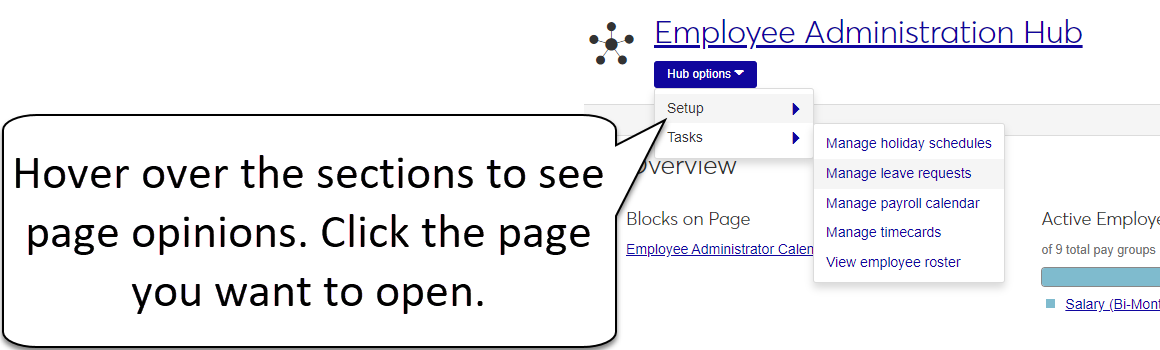

New Manage Leave Request Page

The new Manage Leave Requests page lets employee administrators sort leave requests by Supervisor, Employee, Current Status, or Date Range using the Leave Request Filter. Depending on your role, you can also request, approve, or deny leave requests.

Access the page by hovering over Tasks and selecting Manage leave requests. Administrators have access to their employee's leave requests as well as any other employees in their Pay Group.

Important

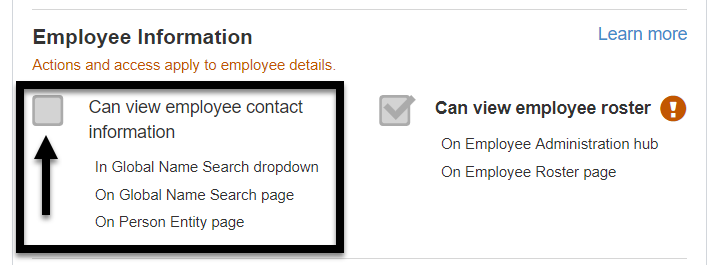

To grant an employee administrator access to the new page, click the Can manage leave requests box on the Edit Employee Administrator role page in the User Management hub.

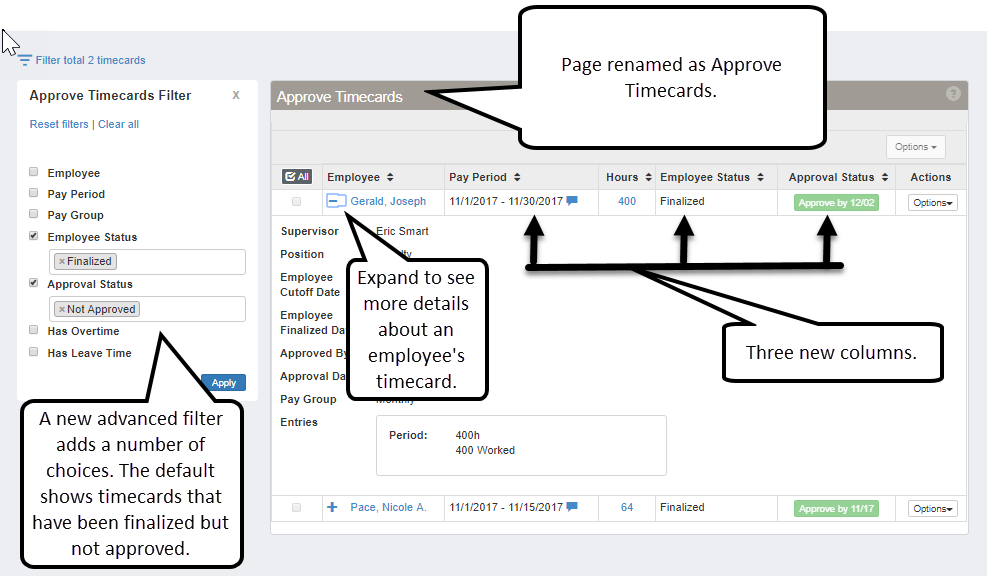

Improvements to Timecards

Timecards in J1 Web now have improved performance! The Approve Timecards and Manage Timecards pages load more quickly. You can add, edit, and delete an entry as you normally would.

Note

IT/DB Administrators: As part of this process, some default data was removed from the database. You should expect to see a smaller database table. The upgrade did not remove any of your data.

Record Leave on the Review Leave Request Page

Supervisors can now record leave from the Review Leave Request page. Previously, supervisors could only approve or deny requests on the Review Leave Request page and had to use the Approve Timecards page to record leave.

Use the Record Leave button to enter leave for current, future, and past unapproved timecards, regardless of cutoff date. If a supervisor records leave, the leave request is automatically approved. However, if the timecard approval cutoff date is past, an administrator will need to approve the timecard.

Note

You can't record leave for timecards that have been approved.

Issue | Description |

|---|---|

190871 | The Leave Requests process didn't honor the "Do Not Allow Negative Balance" setting when employees requested more time than was available. |

RN21239 | Employee timecard was creating duplicate clock-ins (Employee hub > Timecard block). |

RN28113 | The description for the Payroll Calendar setting was incorrect (Employee Administration hub > Setup > Manage administrator settings). |

RN32160, RN39423 | Time entered in J1 Web didn't save (Employee hub > Timecard block > Request leave). |

RN32706 | Employee roster lists names multiple times if the employee or their supervisor has multiple email addresses (Employee Administration hub > Tasks > View employee roster). |

RN32796 | There was a system error when supervisors tried to approve multiple timecards (Employee Supervisor hub > Approve timecards). |

RN33256 | The system used the street address instead of the email address in the email pop-up (Employee Supervisor hub > View employee roster > Click Contact for an employee). |

RN33428 | An error occurred when administrators attempted to approve and undo approval of timecards (Employee Administration hub > Tasks > Manage Timecards). |

RN36067 | Users weren't able to update Electronic Consent Text for W-2s or 1095-Cs on the Manage Annual Statement Settings page. |

RN38148 | The Approve Timecards page was unresponsive. |

RN38459 | The process to create timecards took a long time and caused the database to deadlock (Manage Timecards page). |

RN39424 | The Period Total didn't update when time was added, updated, or removed on the Manage Timecards page. |

RN39511 | Pending leave requests couldn't be approved when the Timecard Approval Cutoff Date matched today's date (Employee Supervisor hub > Review leave requests). |

Regenerate Timecards After a Pay Group Change

If an employee’s Group Code or Subgroup Code is changed on the Header tab of the HR Employee Master via Payroll window or HR Employee Master via Personnel window in Desktop, the timecard now reflects the change and appears in J1 Web in the appropriate Pay Group format.

Depending on your employees’ existing timecard entries, this change may impact and require an update. Review the following scenarios to see how this improvement works with your current timecard entries.

If the employee’s timecard didn’t have any entries for this pay period, the timecard is cleared and regenerated to reflect the new Group or Subgroup Code format.

If the timecard did have entries for this pay period, but those entries were leave requests, the timecard is cleared and regenerated to reflect the new Group or Subgroup Code format. You won’t need to reapply the leave requests.

If the changed timecard did have entries that weren’t leave requests for this pay period, the timecard won’t be changed to reflect the new Group or Subgroup Code format until the start of the next pay period.

New Coverage Codes for 1095-C

There are two new coverage codes available in the HR Employee Master via Payroll window. Use them to report individual coverage HRAs (ICHRAs) under Section 6056 on the 1095-C form.

1T: Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee's primary residence location ZIP code

1U: Individual coverage HRA offered to employee and spouse (no dependents) using employee's primary employment site ZIP code affordability safe harbor

W-2 and 1095-C Forms

The 2021 tax year is available on the Generate W-2s and 1095-Cs windows and processes have been updated to reflect any government changes for this year.

IRS 2021 Filing Links

W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

W-2 Instructions: https://www.irs.gov/instructions/iw2w3

1095-C Form: https://www.irs.gov/pub/irs-pdf/f1095c.pdf

1095-C Instructions: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

For more information about working with these forms, see the Generate W-2 process guide and the Generate 1095-C process guide on MyJenzabar. You can also visit our Help Hub Youtube channel to watch Generate W-2 and 1095-C process videos.

Federal Tax Table Updates

As of the date of release, the government has not issued a final version of Publication 15. The tax tables have been updated based on the government’s preliminary updates. If additional changes are needed once the final numbers are issued, you will be able to update using a script posted on MyJenzabar.net or future updates to the database structure utility (DSU)/default data update (DDU).

2022 Group Term Life Table Updates

As of this release, the federal government has not yet updated Group Term Life Insurance tax rates. If they do so, the Tax Table will be adjusted accordingly using the database structure utility (DSU)/default data update (DDU).

Issue | Description |

|---|---|

RN25189 | Local Kentucky tax calculations in Kentucky were not factoring the annual exemption correctly. |

RN27396 | Legal name suffixes were not displaying on W-2 forms. |

RN27563 | 1095-C ACA files failed to generate for tax year 2019. |

RN27973 | When attempting to generate W-2 4-part forms from 2019, J1 Desktop would sometimes shut down. |

Issue | Description |

|---|---|

40174 | The Federal Wage/Tax Report reported the wrong FICAO Tax Limit Maximum. It reported the value from the most recent year instead of the selected year. |

73871 | The check history position detail record for an employee was missing the position record for a timecard processed during the pay run edit for a position that was marked as requiring a separate entry. |

107018 | Taxes were inadvertently calculated when employee's gross pay was $0.00. |

124965 | The Third Party Sick Pay checkbox was not working correctly. The Third Party Sick Pay checkbox on all W2s will now be selected automatically if the HR Employee Master window, Payroll tab has a row for the year with the value of "Code J - Nontaxable sick pay". Position 489 in row RW of the media file will be populated with a 1 if this checkbox is selected. |

130809 | On the Update Payroll window, a duplicate LB batch was created (with incorrect transactions) if 1) there were two different batches for two different employees and amounts, and 2) a payroll distribution report was left open. |

RN16775 | Employees were inadvertently included on the Timecard Edit report even though their position was inactive. This happened if the position had been active when pulled into the timecard batch but was then changed to inactive. |

RN20647 | On the Edit Employee W-2 Data window, users couldn't remove values from some drop-downs after saving. This caused them to print on the W-2 even though the amount was 0.00. |

RN21125 | Edited data did not appear consistently in W-2 and W-2 Summary Reports, especially when the Use Edited Data checkbox had been deselected and selected several times. |

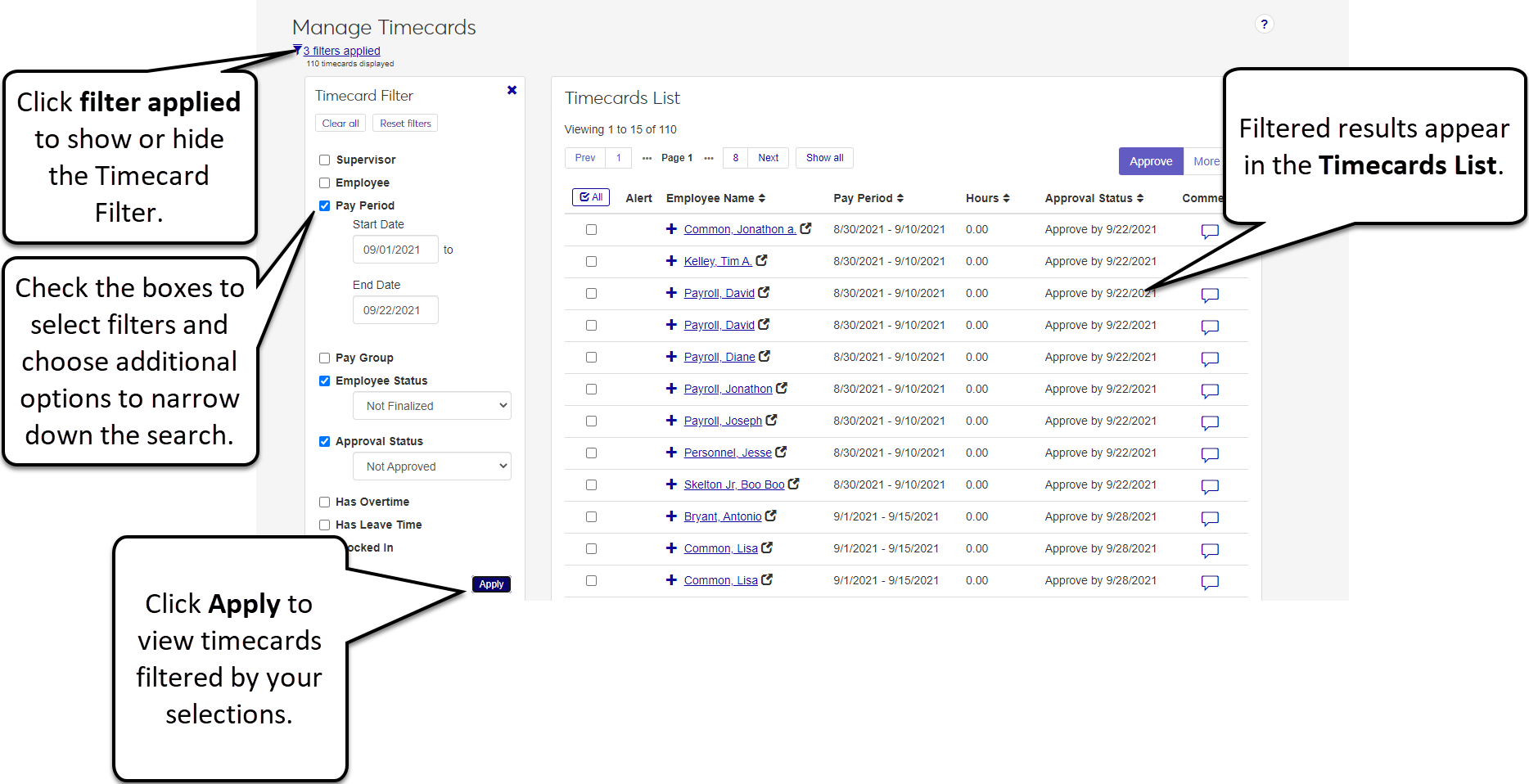

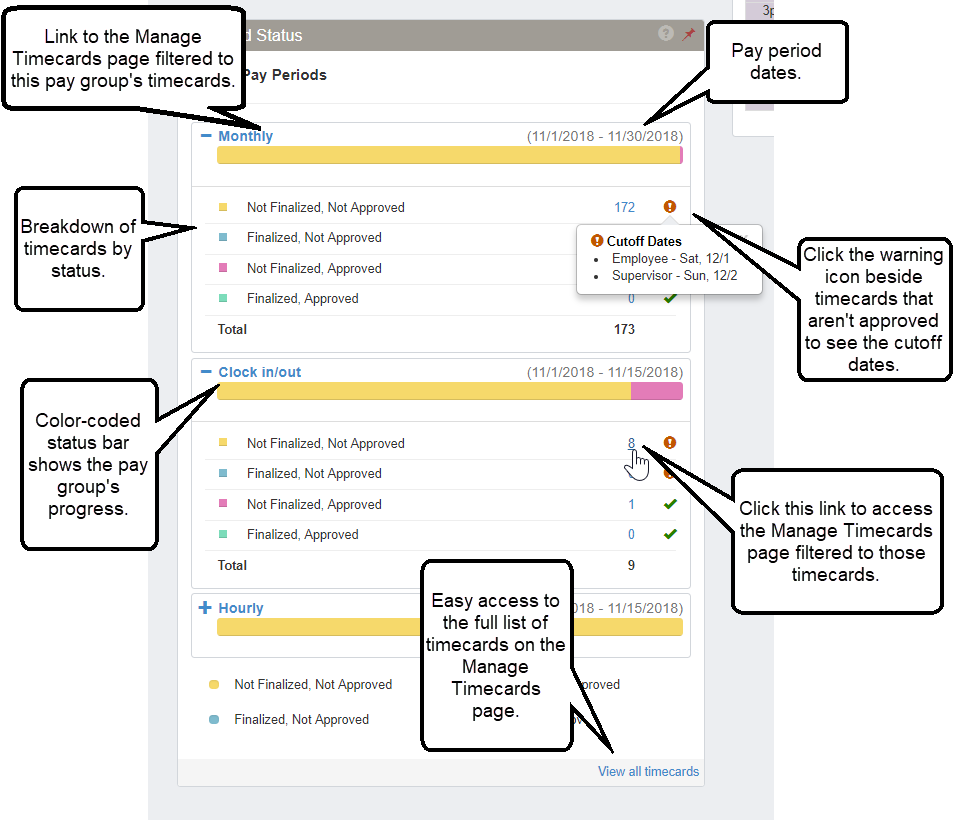

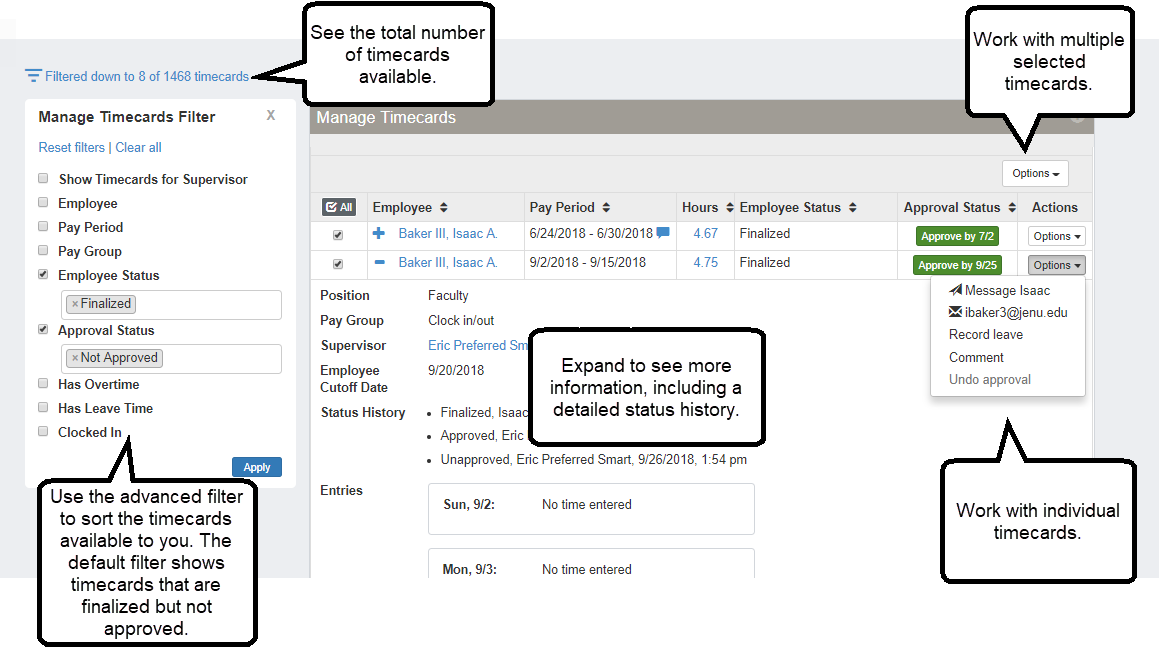

Improved Manage Timecards Page

The Manage Timecards page in the Employee Administration hub has a new look, improved performance, and additional functionality! You can now focus on exactly what you need to work with employees’ timecards in new and better ways.

Timecard Filter

The Manage Timecards Filter has been renamed Timecard Filter. The redesigned filter gives you a greater ability to sort and filter timecards. Check the boxes to work with the filters you want to apply. You can select employee timecards by supervisor, type the name of an employee to select a specific person’s timecard, or enter more details to narrow down your search.

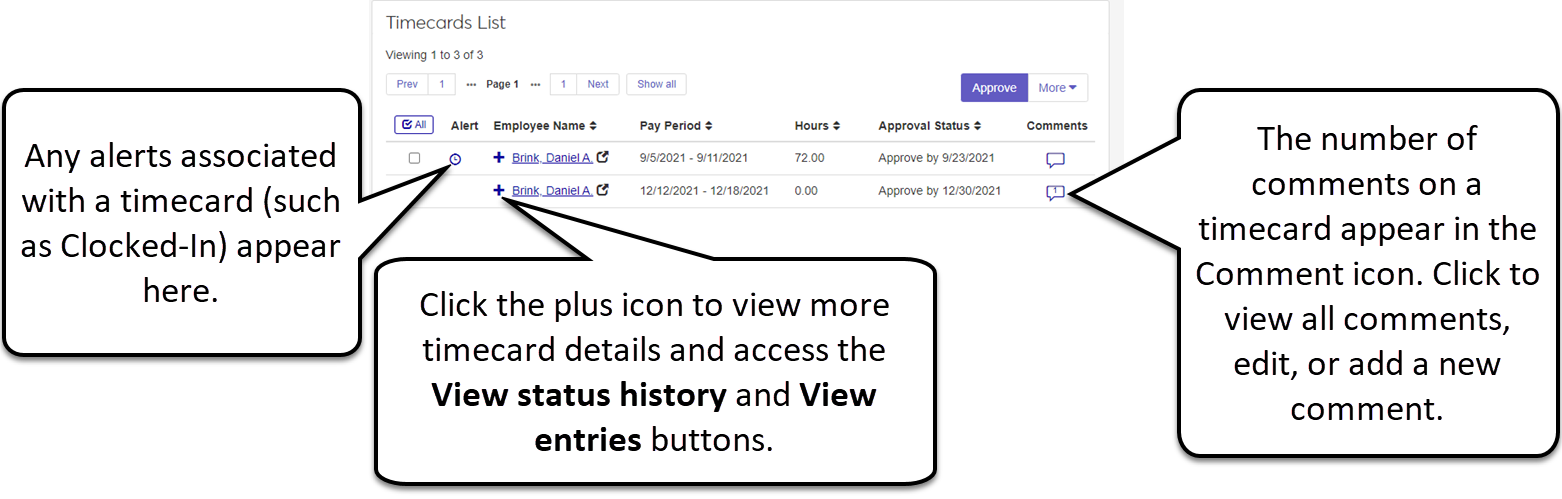

Timecards List

The Manage Timecards list has been renamed Timecards List and redesigned with improved performance and additional functions.

There are new columns to help you quickly work with individual timecards.

Alert

The Alert column shows indicators that quickly let you know relevant alerts about a timecard.

Pending Leave Request: The employee has a pending Leave Request. Click the alert to open Pending Leave Requests window, view details about the leave and relevant pay period, and Approve or Deny the leave.

Clocked In: The employee is currently clocked in. Click the alert to view confirmation of the employee’s clocked-in status.

Employee Name

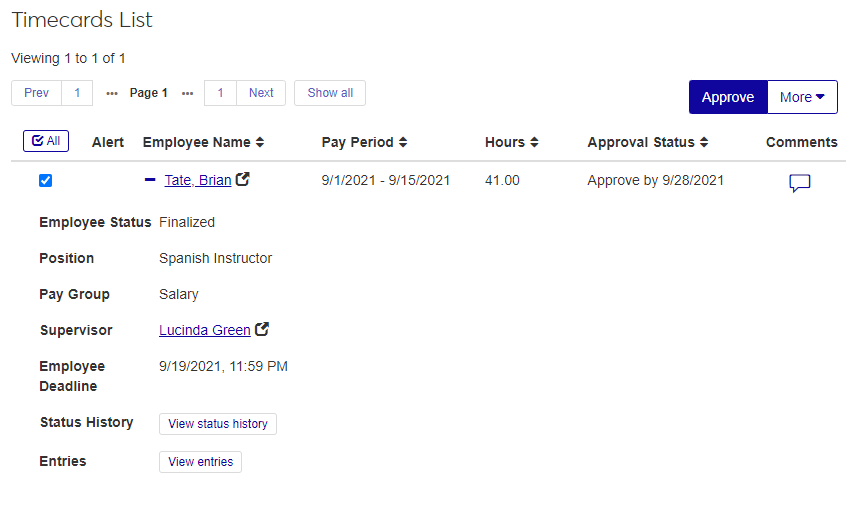

Click the plus icon beside an Employee Name to view additional information about the employee’s timecard, including Employee status, Position, Pay Group, Supervisor, Employee Deadline, Status History, and Entries.

Note

To contact an employee’s supervisor, click the name and view their information in the Person Page, Contact block. In 2021.2, the Contact button no longer appears beside supervisor names.

Click the View status history button to open the timecard’s status history and view all statuses, including who changed them and when.

Click the View entries button to see all entries on the timecard, as well as details about individual days. You can also comment on an individual timecard day or click an entry in Daily Total Hours to enter time for that day.

Pay Period

View the pay period associated with this timecard.

Hours

View the total hours associated with this pay period.

Approval Status

Quickly check if the timecard is approved, finalized, or needs action.

Comments

If the timecard includes a comment, you’ll see the number of comments in the icon. Click the icon to view comments, edit existing comments, or add a new comment to the timecard.

The Actions button has been replaced. You can now work with your timecard directly from the Timecards List by selecting a timecard and using the More drop-down options or by using the new Approve button.

Select a timecard you want to approve and click the Approve button. When you submit a timecard for approval, you’ll receive a message with information about how to proceed with the approval depending on the status of the timecard you selected. There are several scenarios you may encounter as you work with your timecards.

If your timecards can be approved, but have a warning associated with them, you’ll receive a Ready to Approve message and see the timecard’s Name, Position Title, and Warning. You can choose to still approve the timecard by clicking Yes, Approve or click Cancel to return to Manage Timecards.

Notice

For example, the timecard might have a pending leave request warning. You can ignore the warning and approve the timecard anyway or return to Manage Timecards to resolve the issue.

If your timecards cannot be approved, you’ll receive an Unable to Approve message and see the unapproved timecard’s Name, Position Title, and Reason. Click OK to return to Manage Timecards.

Notice

For example, the timecard might have no entries. You will need to return to Manage Timecards to resolve the issue.

If your selections include both timecards that are ready for approval and others that can’t be approved, you’ll be able to approve the ready timecards and still view the Name, Position Title, and Reason for those that are unable to be approved.

You can now record employee leave using the More button drop-down options. Check the box to select the employee timecard you want to record leave for. Click the More drop-down and select Record Leave from the options.

Note

This option is only available if the Use Leave Request setting is turned on.

If the timecard you selected is eligible for recording leave, the Record Leave window opens, and you can enter the details for the leave you want to record. Click the Record Leave button when you are finished. The Timecards List updates automatically to show the new total hours.

Note

You can only record leave for one employee at a time.

You can now send an email to employees directly from the Timecards List. Select the timecard associated with the employee you want to message. Click the More drop-down and select Create Communication. The Create New Communication window opens. Enter details and send your message.

Note

Select more than one timecard to send identical messages to multiple employees.

Issue | Description |

|---|---|

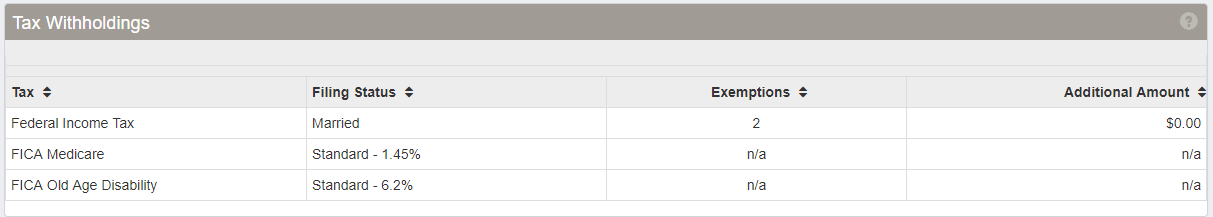

RN23896 | On the Tax Withholdings page, the Number of Exemptions for Federal Income Tax appeared even when the W4 Received Date was on or after 1/1/2020 so that the Number of Exemptions should have been n/a. |

RN25023 | When a supervisor corrected timecard entries (such as when an employee forgot to clock out), the RegHours calculation did not update. |

RN25451 RN25539 RN25540 RN25541 RN25542 RN25543 RN25544 RN25545 RN25546 RN25770 RN25772 | Each of these issues: Users were inadvertently allowed to view and edit timecards that belonged to others on the Timecard Entry page and Timecard Entry block. |

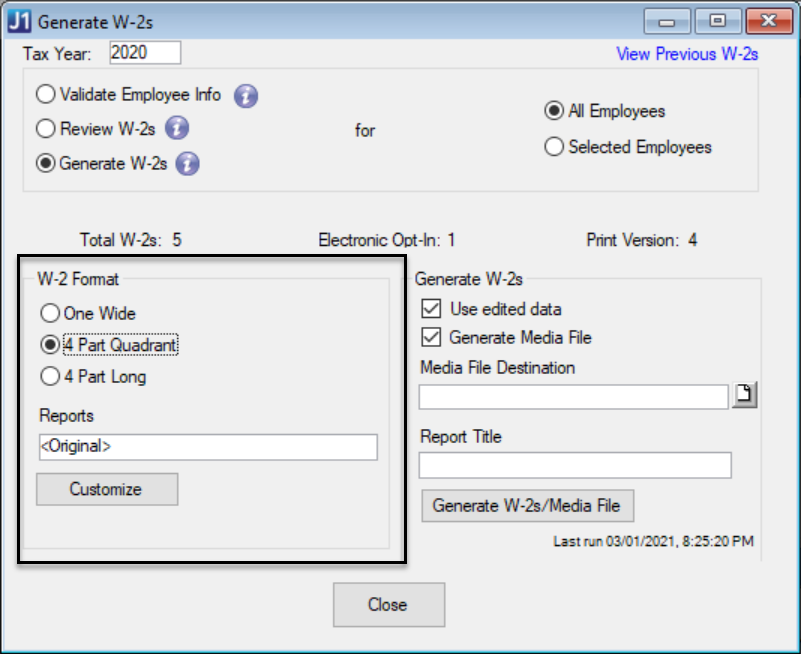

New One-Page Format Option for W-2

There is a new one-page format available for viewing, downloading, and printing W-2 forms. In this new format, you can view the W-2 form in quarters displaying Part B Federal, Part C State, and two copies of Copy 2.

In the Generate W-2s window, when you select Review W-2s or Generate W-2s, the 4 Part Quadrant radio button appears in the W-2 Format section. Select and save the new format.

Issue | Description |

|---|---|

176606 | On the Online Pay Periods window, users received an error when adding information using the Paste from Excel feature. The date format for the payroll period end date has been updated to prevent this error. |

178165 | On the Assign Hiring Officers window, users received an error message when assigning a hiring officer to a position if the Position Title contained an apostrophe. |

178400 | On the Manage Hiring Officers window, hiring officers did not receive notifications when they were assigned the Position Approval Committee role for a position that had already been submitted. |

RN11444 | On the HR Accrual Entry via Payroll (or Personnel) window, the manual accrual process did not update the employee's accrual year category as expected. |

RN15430 | When an employee had multiple direct deposit rows with at least one active receiving a portion of their pay and one prenote, a check was not produced for the remaining amount of their pay. |

RN17932 | The IPEDS Part H New Hires Report only reported employees hired between July and October instead of the entire previous year. |

RN19275 | An error message appeared when running customized Paychecks/Direct Deposits/Registers reports and legal names were not being printed on customized versions of the r_legal_employee_direct_deposit and r_legal_employee_paycheck reports. |

RN19298 | ACH direct deposit files generated from the Transfer Direct Deposits to Media window that should have included legal names were blank. This was related to the legal name permissions of the user generating the file. To resolve this issue and protect legal name information, users must now be granted legal name permissions to access the window and run the transfer process. |

RN20217 | Clients not licensed for J1 Web Employee received an error message when reviewing 1095- Cs from the Generate 1095-Cs window. A J1 Web Employee license is not required, and the error message no longer appears. |

RN20378 | The Generate 1095-Cs window loaded slowly. |

RN20645 | The plan start month was incorrectly printed as '00' on 1095-Cs for employees that qualified for Affordable Care Act benefits for part of the year (HR Employee Master window, Affordable Care tab). 1095-Cs for these employees now correctly print the plan start month selected on the prompt. |

RN20646 | When users tried to edit any W-2 information for an employee with AA, BB, or EE benefits from the Edit Employee W-2 Data window (access the Generate W-2s window and click the Edit W-2 Data button), an error message appeared. |

RN20779 | Incorrect Month of Coverage boxes were checked on 1095-C Continuation forms. |

RN21156 | The W-2 summary report occasionally showed incorrect data based on changes that were made in the Edit Employee W-2 Data window. |

RN21240 | Upgrades to the online help publishing system resulted in changes to how the W-2 and 1095-C Instructions PDFs display. The online help has been updated to accurately describe how the PDFs display and how to print them. |

RN21724 | On the Affordable Care tab of the HR Employee Master (via Payroll/Personnel) window, when codes '1L', '1M', '1N', '1P', '1O', or '1Q' were selected, employee's contribution amounts did not print in Box 15 of the 1095-C. |

RN21684 | When saving reports from the Transfer Direct Deposit to Media (Print Preview) window, the process continued to run after the report was generated and caused the application to freeze. |

RN21875 | On the HR Employee Master via Payroll window, when the W4 Received checkbox was selected and the date was after 1/1/2020, Additional Withholding amounts for federal tax were not deducted in certain situations. |

RN22380 | The 1095-C media file returned an error of "AgeNum must have a value" when submitted to the IRS if 'AnnualOfferofCoverageCd' had a value of '1L', '1M', '1N', '1O', '1P', or '1Q'. |

New Update Image Feature for Employee Profiles

You can now update images for employee profiles from the Summary page. Images must be in .jpg format, and there is no size limit for uploaded files.

Tip

Although there isn't an upload file size limit, images are saved to the size they are cropped to.

Click the Edit icon on the image placeholder next to the name to open the Update Image pop-up.

Note

Clicking the image placeholder opens the Update Image pop-up when you have the appropriate permissions. If you don't have update image permissions, or if you click the image placeholder for any other heading in the system, clicking the image placeholder does nothing. This is a change; click the name link to access the main page of the person, place, or item if you are on one of the subpages.

Select the Display image everywhere in J1 Web checkbox to make the image visible everywhere images are displayed in J1 Web.

Note

If this checkbox is not selected, the image is only visible on the Employee Summary page and the employee's Person page.

The following permission in the default System Administration Manager role allows you to update images, and you can turn it on for custom System Administrator Manager roles.

Can update images for employees (on Employee pages)

View New W-2 Format on Manage Annual Statements Page

There is a new format option in the Generate W-2s window in J1 Desktop. Employers can now decide if they want their employees to view their W-2 in a one-page format with quarters displaying Part B Federal, Part C State, and two copies of Copy 2. When selected in J1 Desktop, the employee's W-2 appears in the new format on the Manage Annual Statements page in J1 Web.

For more information, see the One-Page Format Option for W-2 enhancement in the HR section of the J1 Desktop release news.

Issue | Description |

|---|---|

RN13914 | Timecards continued to display to employees, supervisors, and administrators even when the Show Online checkbox was not selected on the Desktop Online Pay Periods window. |

RN16785 | Hourly employees were unable to enter the same type of time off in separate entries on the same day. |

RN21721 | The View Positions page did not display employee's positions if a supervisor was not assigned. |

RN23301 | On the Approve/Manage Timecards pages, the Pay Group filter showed only the pay groups the user had HR Security Group permissions to. This caused performance issues in certain situations. |

2020 Year W-2 And 1095-C Forms Available

The 2020 tax year is available on the Generate W-2s and 1095-Cs windows. Processes have been updated to reflect any government changes for this year.

IRS 2020 filing links:

W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

W-2 Instructions: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

1095-C Form: https://www.irs.gov/pub/irs-pdf/f1095c.pdf

1095-C Instructions: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

New Code for Reporting Covid-19 FFCA Benefits

According to federal guidance, qualified Covid-19 sick or family leave wages paid under the Family First Coronavirus Cares Act (FFCA) should be reported in Box 14 of the W-2 for 2020. Jenzabar has made a new code available to track these amounts.

The W-2 Box 14 COVID FFCA code can be selected in the W2 Category drop-down in the following windows:

the Detail tab of the Benefits Control window

the Payroll tab of the HR Employee Master via Payroll window

the Payroll tab of the HR Employee Master via Personnel window

After the code is selected and the Generate W-2 process is run, the amount associated with these wages is calculated and the total placed in Box 14.

2021 FICA Tax Table Updates

The following updates have been made to the Tax Table for the 2021 FICA withholdings:

The Social Security portion (FICA0) remains 6.20% on earnings up to the applicable taxable maximum amount.

FICAO taxable maximum has been increased to $142,800 from $137,700.

The Medicare portion (FICAM) remains 1.45% on all earnings.

Individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly) continue to pay an additional 0.9% in Medicare taxes.

2021 Federal Income Tax Table Updates

The standard withholding rates for Federal Income taxes have been updated. As of this release, the federal government has not yet updated the optional rates for Federal Income Tax withholding or the Non-Resident Alien withholding rates. If they do so, the Tax Table will be adjusted accordingly.

2021 Group Term Table Updates

As of this release, the federal government has not updated Group Term Life Insurance tax rates. If they do so, the Tax Table will be adjusted accordingly.

New Coverage Codes for ACA 1095-C Reporting

In the 2020 tax year, new coverage codes are required for employers to report the affordability of their ICHRA plan on 1095-C forms in compliance with the ACA Employer Mandate requirements.

On the HR Employee Master via Payroll window, Affordable Care tab, the following new codes appear in the coverage code drop-down for Year Coverage and Month Coverage:

1L. Individual coverage health reimbursement arrangement (HRA) offered to an employee with the affordability determined using the employee’s primary residence ZIP Code.

1M. Individual coverage HRA offered to an employee and their dependent(s) with the affordability set using the employee’s primary residence ZIP Code.

1N. Individual coverage HRA offered to an employee, their spouse and any dependent(s) with affordability determined by the employee’s primary residence location ZIP Code.

1O. Individual coverage HRA offered to an employee only using the employee’s primary employment site ZIP Code affordability safe harbor.

1P. Individual coverage HRA offered to an employee and their dependents (not spouse) using the employee’s primary employment site ZIP Code affordability safe harbor.

1Q. Individual coverage HRA offered to an employee, their spouse and dependent(s) and using the employee’s primary employment site ZIP Code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to an employee; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a full-time employee

The new codes also appear in the Edit Employee 1095-C Data window and in the ACA_OFFER_OF_COVERAGE_CODES table. The 1095-C form and collection process now includes ZIP Code information for box 17 based on the new codes.

Notice

Line 17 reports the applicable ZIP Code the employer used for determining affordability if the employee was offered an individual coverage HRA. If code 1L, 1M, or 1N was used on line 14, this is the primary residence location. If code 1O, 1P, or 1Q was used on line 14, this is the primary work location (employer).

Updates to Printed Reports

All reports now print student names based on your permission level to view legal or campus name. The Direct Deposit and Paychecks reports are also now available for all users. If you don’t have permission to view a student’s legal name, the report prints using campus name.

Caution

The ACH report only uses legal name. If you don’t have access, you can’t begin the report process.

Caution

If you don’t have permission to view legal name, you won’t be able to use the Transfer Direct Deposits to Media window while running Payroll.

Permission to access legal names is assigned in the Additional Name Types window. Select Legal Name and use the Permission tab to select the Group IDs you want to view legal name.

Reporting Plan Start Month on 1095-C

New federal mandates require reporting Plan Start Month on form 1095-C. The Generate 1095-C process has been updated to prompt for the month which your medical insurance plan starts. By default, this is the fiscal month set on the BU Configuration Table, but you can also set a value 01-12 (January through December) to specify a different month. The month is reported on the paper form as well as the media file.

New Feature: Payroll Process Locks

A new feature, Payroll Process Locks, is available. When the Pay Run Edit (PR code), Create Checks (CC code), or Update Payroll (PU code) payroll processes are started, the employee records in use by the process are locked. Each record is inserted as a row in a new PayrollProcessLock database table, along with the corresponding code.

If a user attempts to access an employee’s record from certain other windows, a check is run to see if that record is in the PayrollProcessLock table. If so, the user receives a message that the record is locked and can’t be accessed. This prevents the employees’ records from being changed while payroll is being processed. Users can access the Payroll Process Locks window to unlock a process or employee records. When the payroll process finishes running, the rows are removed from the table and the records are unlocked.

Payroll Process Locks Window

The Payroll Process Locks window is now part of the Payroll Process Activity Center. The window displays the payroll processes (Pay Run Edit, Payroll Update, Create Checks) currently running and the employee records locked by the process.

Existing Windows Updated to Work with Payroll Process Locks

The HR Employee Master, HR Positions, HR Benefits/Accruals, Direct Deposits, Taxes, and Timecard Entry windows have been updated to work with Payroll Process Locks. When a user accesses any of these windows and attempts to retrieve an employee’s record, a check is run against the PayrollProcessLock database table. If the employee’s record is found in the table (i.e., locked by one of the payroll processes), a warning alerts the user that the employee’s record is locked and can’t be accessed.

Select a row or rows on the Processes tab, and click Unlock to unlock the process. Access the Employees tab to view the specific employee records locked by the process. On the Employees tab, you can unlock some or all of the employee’ records.

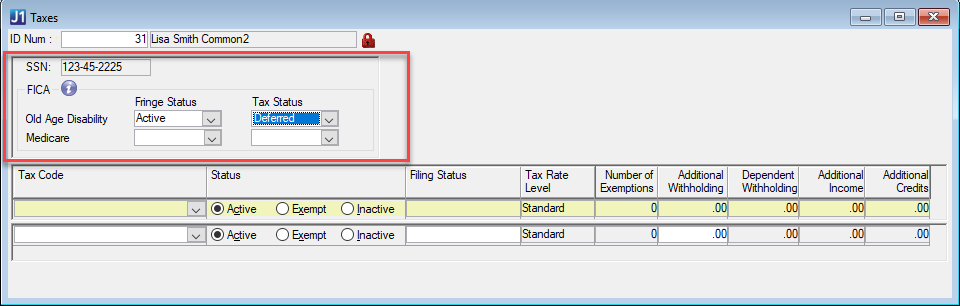

New OASDI Deferment for Government Mandate

The federal government announced a temporary suspension of the requirement to withhold the employee portion of Old Age, Survivors and Disability Insurance (OASDI). For employees making less than $104,000 per year, employers do not need to withhold the employee portion of OASDI between September 1, 2020 and December 31, 2020.

A script available on MyJenzabar.net queries the database and identifies employees making less than $104,000 in order to update their records. Download the script from MyJenzabar (Support > Jenzabar One > Module Resource Center > J1 Desktop Resources Hub > Payroll > SQL Script to Identify Employees Eligible for Temporary Suspension of OASDI).

Caution

The script identifies eligible employees but does not change their deferment status. You still need to update these employees' records in J1 Desktop.

To meet this mandate, Jenzabar made the FICA Fringe and Tax options on the Taxes and HR Employee Master via Payroll/Personnel windows (Taxes tab) Fringe Status and Tax Status drop-down options.

Fringe Status represents the employer's portion and includes Active and Inactive options

Tax Status represents the employee's portion and includes Active, Deferred, Exempt, and Inactive options

If you select Active from the Fringe Status or Tax Status drop-down, the Taxable Wages and Tax Amount are both updated.

If you select Deferred from the Tax Status drop-down, the Taxable Wages will be updated but the Tax Amount is .00.

If you select Exempt from the Tax Status drop-down, the Taxable Wages and the Tax Amount is .00.

If you select Inactive from the Fringe Status or Tax Status, no rows will exist to track Taxable Wages or Tax Amount.

To defer the employee portion of OASDI:

Run the Employees Eligible for OASDI Suspension script to identify employees making less than $104,000 (optional).

Update each employee’s record using either the Taxes window or HR Employee Master via Payroll/Personnel window/Taxes tab.

In the FICA group box, Old Age Disability row, set the Tax Status to Deferred. Taxable Wages will be updated but the Tax Amount is .00.

Note

Tax Status represents the employee’s portion and includes Active, Deferred, Exempt, and Inactive options.

Note

The Pay Run Edit process has also been updated to recognize the Deferred and Exempt statuses.

Issue | Description |

|---|---|

24037 | Invoices were not creating the P offset in certain scenarios, and out of balance batches were being posted. |

24812 | The Void Checks process allowed the user to enter a void check date before the original check date. |

68742 | The transfer new hire to employee process was using 7/31/2013 instead of the original hire date and the position start date. |

171200 | When paying on a position where the salary total had been reached for multiple employees, the ‘informational warning’ only displayed for the first ID on the Pay Run Error report. |

174715 | Adding addresses with more than 30 characters in the W-2 report produced a truncated string error. |

174729 | Zip code changes made on the Edit Employee W-2 were not updated on the printed W-2. |

175653 | The Shift code assigned to the position was not being validated on the Short Timecard Entry window. |

178400 | Notifications for 'Position Approval Committee' are not being created when a user is assigned that role to a 'Submitted' position request. |

178639 | Users could manually add inactive position codes to employees from the Organization Positions window. |

179576 | 'New Positions/Salaries for New Year' was not able to handle multiple position sequences for the same position code. |

181239 | Work with Employees via Personnel window: If the 'View only' checkbox was checked on the Details tab in Permissions (function PE 80265), the Achievements tab did not allow the user to add rows. |

185571 | When a single end date was changed on the Affiliation section of the HR Employee Master via Payroll and Personnel windows, all end dates were updated instead of just the one. |

198653 | On the Benefits Control window, a lock was being put on the BENEFITS_CTL table, the ELIG_1098T column was being set to BLANK instead of NULL, and there was no way to deselect a code once one had been selected. |

203016 | On the Edit Employee W-2, the user was not allowed to delete a state code after it was selected. |

RN10757 | New Positions/Salaries for New Year process incorrectly calculated default hours. |

RN11333 | When an OK 500MISC snapshot was created with a claim number greater than 2147483648, the web import file for that snapshot ID was blank. |

RN12341 | Zero pay employees were left off the report for direct deposits, but their account information still showed up on the hash total. |

RN15025 | ACH file had a blank name for names for some users who had legal name access. Changes were made to the payroll process for the name to be populated with a legal name regardless of the legal name access a user had. The Transfer Direct Deposits to Media process has been changed to allow only those users with legal name access to open the window. |

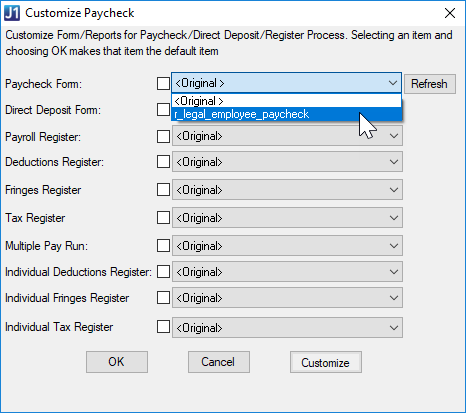

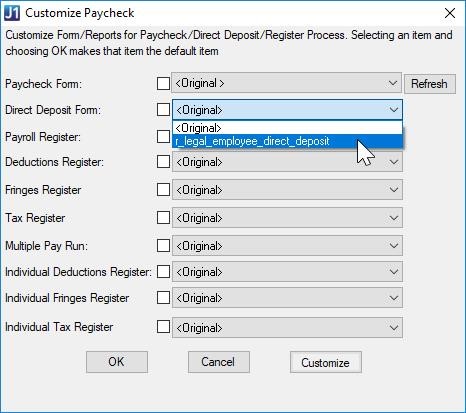

Updates to Customize Paycheck Window

New options on the Customize Paycheck window (Payroll Processing >> Paychecks/Direct Deposits/Registers >> Customize button) allow users to choose between printing employees' campus names and legal names on paychecks and direct deposit slips. Use these Paycheck Form and Direct Deposit Form options to ensure that when employees have legal names that are different from their campus names, the legal names print on paychecks and direct deposit slips.

To continue to print employees’ campus names on paychecks and direct deposit slips, don’t make any changes. The ‘<Original>’ report, which prints employees’ campus names, remains the default.

To use employees’ legal names instead of campus names:

Select ‘r_legal_employee_paycheck’ from the Paycheck Form drop-down

Select ‘r_legal_employee_direct_deposit’ from the Direct Deposit Form drop-down

Learn more about campus names and legal names.

Performance Improved on Approve/Manage Timecards Pages

Performance of the Employee Administrator Approve Timecards and the Employee Supervisor Manage Timecards pages is improved. Administrators and supervisors will still see the same timecards on these pages, but updates to the stored procedure result in the timecards loading faster.

Update to Paychecks/Direct Deposits/Registers Processes

The Paychecks/Direct Deposits/Registers processes have been updated to eliminate any rows with zero pay from the ACH file for non-prenote Direct Deposit entries. The rows with zero pay were causing a problem for some banks.

Issue | Description |

|---|---|

33097 | On the Employee Master window, Personnel tab, the work location drop-down did not always display all values for room code. |

126889 | Retirement Program Details window was allowing the creation of multiple rows per retirement program. |

139999 | When Separate timecard was checked, gift deductions were not calculated. |

186504 | The State Reporting Media File for MIPSRS did not limit the name to a length of 25 characters. |

190069 | Timecard Entry did not validate accrual time taken for all timecards entered in the batch per employee against available amount when accrual was set to not allow negative available balance. |

192481 | Error message appeared when a user edited a timecard batch (adding timecards, changing hours, etc.) and made adjustments (Timecard Entry window). |

198374 | The Maintenance Window for the OK OTRS CALENDAR State Report generated an error when trying to save an edit to the Gross Amount column. |

199093 | FED taxable amounts were doubled in the Federal Wage/Tax report. |

199017 | A database update error appeared when the Pay Run Edit report was generated and included an employee with multiple timecards in a batch and one was marked as separate. |

163357 | When pasting from excel into the Online Pay Periods window, the incorrect group code value was pasted in if the subgroup code value existed in combination with a different group code. |

199157 | The payroll administrator was able to change the group/subgroup code combination on a pay period with timecards already created, resulting in duplicate timecards being created for the employee. |

199362 | An error message appeared when a timecard entry was added for an ID number that was lower than the lowest ID number in the batch, then hours were edited on the previous timecard and saved (Timecard Entry window, Long Timecard Entry tab). |

199450 | Additional income calculations were incorrect for nonresident alien employees on W-4 forms. When an employee is a nonresident alien, the amount of addition income is now $8,100.00 (annual amount) if the employee has not submitted a new W-4 dated 1/1/2020 or later. When an employee is a nonresident alien, the amount of addition income is now $12,400.00 (annual amount) if they submitted a W-4 dated 1/1/2020 or later. |

199401 | In the Edit Employee W-2 Data window, in the Box 12 Tax Code the values for code G did not display at all, and wrong items were displaying for code H. |

199837 | Add, Copy, and Delete Row buttons were missing from the HR Employee Master via Personnel window, Biograph tab, Ethnic/Race subtab. |

200121 | State income tax calculations for Colorado schools were not varying correctly according to their employees’ W-4 dates. Employees with W-4s dated 1/1/2020 or later now use $8000 for the exemption if married and $4000 if single. Employees with W-4s dated before 1/1/20 use the $4200 exemption rate for both single and married. |

200311 | When an employee has two or more positions and the leave hours were updated for both positions (Timecard Entry window, Long Timecard Entry tab), the leave hours were zeroed out. This was due to the second SQL update statement excluding hrs and pay in the TIMCRD_OTH_PAY table. |

200535 | Federal income tax calculations showed a negative amount for nonresident aliens with a W-4 date prior to 01/01/20 and employees with a W-4 date of 01/01/20 and later with additional federal tax income listed. In addition, incorrect information is listed in the CHK_HIST_ITM_DTL table, AMT_CALC_AGNST and AMT_CALC columns for nonresident aliens with a W-4 date before 01/01/20. Anyone with a W-4 date of 01/01/20 or later and additional federal tax income listed will also have a problem. If payroll has been processed AND updated, both the CHK_HIST_ITM_DTL and IND_YTD_TAX tables should be reviewed and possibly updated manually for employees meeting these conditions. If payroll has NOT been updated, rerun the Pay Run Edit process and everything will be updated correctly. |

201054 | The IRS rejected the 1094 Manifest files due to an issue with the irs:AttachmentByteSizeNum tags. |

201163 | The Generate W-2 process required that Adobe reader be installed in order to generate the PDFs. Now any pdf reader may be used. |

201234 | When an employee has multiple payrates on a single position and the regular pay and overtime pay were updated (Timecard Entry window, Long Timecard Entry tab), the gross pay, regular pay, and overtime pay were excluded. This was due to the second SQL update statement excluding reg_payrate, reg_pay, ot_pay, and ot_payrate. |

201268 | When a timecard batch had multiple timecards and the hours were updated in one of the timecards, the timecards in the batch were resorted (Timecard Entry window, Long Timecard Entry tab). |

202743 | Federal tax calculations for the W-4, Box 4b (Additional credits) were not calculated correctly. |

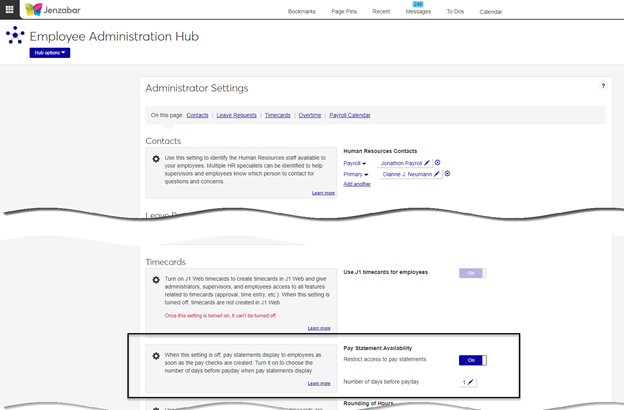

New Employee Administrator Setting

A new Employee Administrator setting allows administrators to decide when pay statements display to employees. The setting is defaulted to off, which means that pay statements display to employees as soon as the paycheck is created. (This is how pay statements work today.) When the setting is turned on, administrators can choose the number of days before payday when pay statements display to employees.

Notice

The paychecks for the May 15 payday will be created on May 10, but you don't want the pay statement to show to employees until May 14. Turn on the setting, and choose 1 in the "Number of days before payday field.

Issue | Description |

|---|---|

199180 | Alternate approvers for another supervisor were unable to approve timecards (Approve Timecards page). |

205540 | A JavaScript error with the DataGrid.js file was preventing the Employee Administrator page from loading correctly, therefore all toggles, in-line edits, and radio buttons were not displaying. |

Issue | Description |

|---|---|

139978 | Running Update Payroll with an employee in a workstudy type of position that is setup with a fund code and workstudy department would leave off one of the timecard's hours. |

139983 | The FAM/Payroll interface would not allow a user to void a check and reissue it for the same date if FA had retrieved the data. |

139987 | Elite Paint was not available on the Achievements tab, preventing addition of user defined columns to the screen. |

139988 | Update Workstudy Employees process was not processing an increase in the Eligible Amount for workstudy awards because it was actually looking at the Earnings amount on the individual wages, which was not updated prior to the report. This was changed to look at the Eligible Amount in the Student Employment Master. |

140003 | If an employee had zero hours but also had an additional amount of FED tax more than 99.00, this person and all other employees after them alphabetically would not get assigned a check number. Now the employee with zero hours will get a check number flagged as void. |

186129 | On the checks to void screen, the check number field was not the correct size. |

192047 | Third Party ID was not accepting more than a 7-digit ID Number, and needed to accept 9 digits. |

194864 | Running the Salary Distribution process ended in error causing the LB transaction group to not be created. |

195199 | When it was time for a future leave request to be attached to a current timecard because a pay period has started, an error was occurring with the J1 Timecards and Entries Creation job. |

2020 W-4 and Federal Income Tax Withholdings Changes

Caution

To comply with these federally mandated changes to how withholding information is calculated and stored, all J1 Desktop Payroll customers must upgrade to 2019.5 before running the first payroll of 2020.

The federal government updated Form W-4 for 2020 and made changes to the way that federal income tax withholdings are calculated. The new design and withholdings schema only requires that employees enter their personal information and sign the form to have the most accurate withholdings based on their salary. Employees can use optional Steps 2–4 to identify additional withholdings if necessary. Any employee who files a new W-4 after January 1, 2020 must use the new form. You can learn more about the government’s changes at irs.gov.

Jenzabar updated a number of tax-related windows and processes to give you a way to store the information and calculate employee withholdings based on the government’s changes for 2020 and going forward.

Tax Tables Window

Added a new field, Tax Rate Level, to the Control tab for taxes with the FED Tax Code. Drop-down menu options are Standard and Optional.

Added a new read-only Tax Rate Level field to the Table tab of the Tax Tables window. This field displays the information entered on the Control tab.

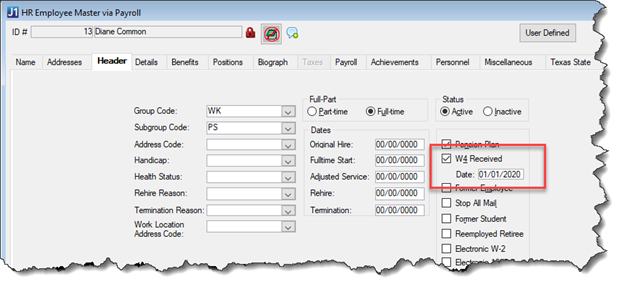

HR Employee Master via Payroll Window

Taxes Tab

Added four new columns to hold information from the new W-4 format.

Tax Rate Level. For FED taxes, Standard is the default. If the employee selected the checkbox in Step 2 on the W-4 form, choose Optional from the drop-down menu. All other tax types are standard by default and can’t be changed.

Dependent Withholding. Enter information recorded in Step 3 of the W-4 in this column.

Additional Income. Enter information recorded in Step 4a of the W-4 in this column.

Additional Credits. Enter information recorded in Step 4b of the W-4 in this column.

Note

Dependent Withholding, Additional Income, and Additional Credits are only enabled for taxes with the FED tax code.

Disabled the Number of Exemptions column for FED taxes because the government changed the way exemptions calculations are handled to no longer include standard exemptions.

Header Tab

Added a date field below the W4 Received checkbox. Because every employee who submits a W-4 after January 1, 2020 must use the new form, even if they are current employees updating their withholding information, this date must be on or after January 1, 2020.

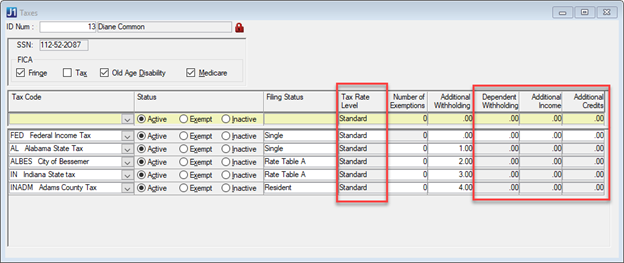

Taxes Window

Added four new columns to hold information from the new W-4 format.

Tax Rate Level. Set to Standard unless employees’ checked the checkbox in Step 2 of the W-4.

Dependent Withholding. Information recorded in Step 3 of the W-4 in this column.

Additional Income. Information recorded in Step 4a of the W-4 in this column.

Additional Credits. Information recorded in Step 4b of the W-4 in this column.

Note

Dependent Withholding, Additional Income, and Additional Credits are only enabled for taxes with the FED tax code.

Disabled the Number of Exemptions column for taxes with the FED tax code.

Generate Timecards Window

If employees decided to have additional withholdings taken in Steps 2–4 of the new W-4, those will display on the employees’ timecards.

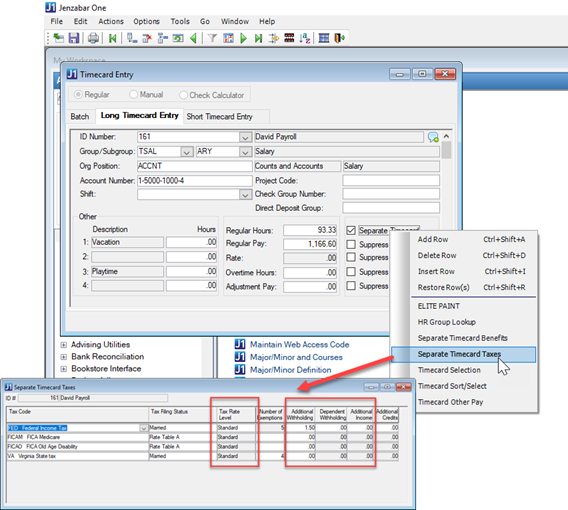

Timecard Entry Window

Long Timecard Entry Tab, Separate Timecard Taxes Option

Tax Rate Level, Additional Withholding, Dependent Withholding, and Additional Income columns have been added to the Separate Timecard Taxes window. When a new timecard is entered or updated on the Long Timecard Entry tab and the Separate Timecard checkbox is selected, the information in these new columns will be stamped on the timecard.

Additional Withholdings Display for Employees in J1 Web Employee and the Campus Portal (Staff Feature)

For schools that use the Campus Portal Staff feature or J1 Web Employee, the new withholding categories are available on Staff | Employee Information | Tax Information and J1 Web Employee | View Tax Information.

State Reporting Media Window

The magnetic media file can now be saved as a CSV file type. Previously only TXT and DOC files could be generated.

Pennsylvania Unemployment Report

The Pennsylvania Unemployment Report magnetic media file generates as a CSV file type instead of TXT.

The report now uses rows A (Identification Record), E (Employer Record), and S (Employee Record) instead of B, E, S, and T.

The E (Employer Record) Number of Employees is calculated by counting the number of employees for each month of the quarter who had a check with a pay range that includes the 12th of each month.

Oregon W-2 Media File

RS and RV records were added to the W-2 media file and can be used to record Oregon transit tax.

The category OR Transit Tax is available on the HR Employee Master via Payroll window, Payroll tab to record W-2 YTD History.

ACH File Uses Employee’s Legal Name

The ACH file generated during the direct deposit process now uses the employee’s legal name.

W-2 and 1095-C Forms

The 2019 tax year is available on the Generate W-2s and 1095-Cs windows and processes have been updated to reflect any government changes for this year.

IRS 2019 filing links:

W-2 Form: https://www.irs.gov/pub/irs-pdf/fw2.pdf

W-2 Instructions: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf

1095-C Form: https://www.irs.gov/pub/irs-pdf/f1095c.pdf

1095-C Instructions: https://www.irs.gov/pub/irs-pdf/i109495c.pdf

Federal Tax Table Updates

As of the date of release, the government has not issued a final version of Publication 15. The tax tables have been updated based on the government’s preliminary updates. If additional changes are needed once the final numbers are issued, you will be able to update using a script posted on MyJenzabar.net or future updates to the database structure utility (DSU)/default data update (DDU).

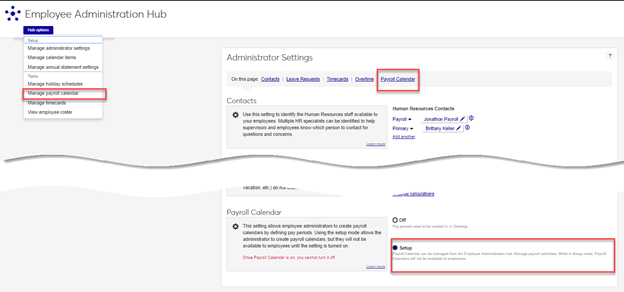

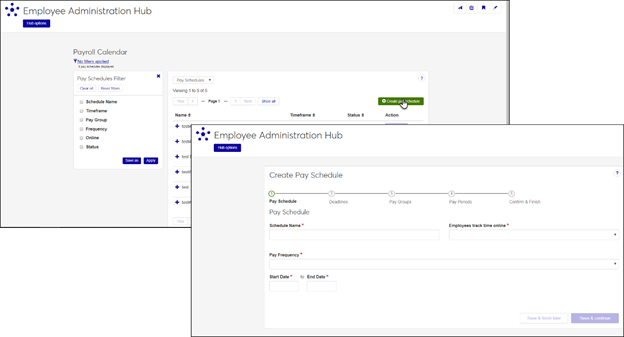

Administrator Payroll Calendar Setting and Feature

A new Payroll Calendar setting is available on the Employee Administrator Settings page. Turn the setting to Setup mode to make the Manage payroll calendar option available on the Employee Administrator hub options drop-down.

Tip

In a future release, you'll be able to turn the setting On, which will allow employees to work with the pay schedules and pay periods on their timecards.

Employee Administrators can step through the Create Pay Schedule wizard and to create pay schedules and pay periods. Once created, the pay schedules and pay periods can be edited, deleted, or published from the Payroll Calendar page.

Timecards Administrator Setting

Tip

If your school already creates timecards in J1 Web Employee, this setting is defaulted to on and you can’t turn it off. Timecards continue to work as usual.

A new Timecards setting is available on the Employee Administrator Settings page. If your school has never created timecards in J1 Web, the setting is turned off and all features related to timecards are not available. If your institution has created timecards in J1 Web, this setting is automatically turned on.

Tip

Once the J1 Web Timecards setting is turned on, it can’t be turned off.

Issue | Description |

|---|---|

192761 | The alternate approving supervisor was unable to review the timecards that belonged to a supervisor whom the currently logged in supervisor is an alternate for. |

193889 | Errors appeared on the View Positions page when an employee's position had multiple salary history rows. |

195999 | When an employee requested leave for the next pay period and then clocked in the last day of the pay period and forgot to clock out, the employee would no longer be able to access their Request leave page from the hub options on the next day due to an error. |

New 1098-T Eligible Flag on the Benefits Control Window

A new Eligible 1098_T Code on the Header tab of the Benefits Control window will allow you to flag appropriate benefits as 1098-T eligible. When a benefit has an Eligible 1098-T code, the Update Payroll process will require a 1098-T year/term.

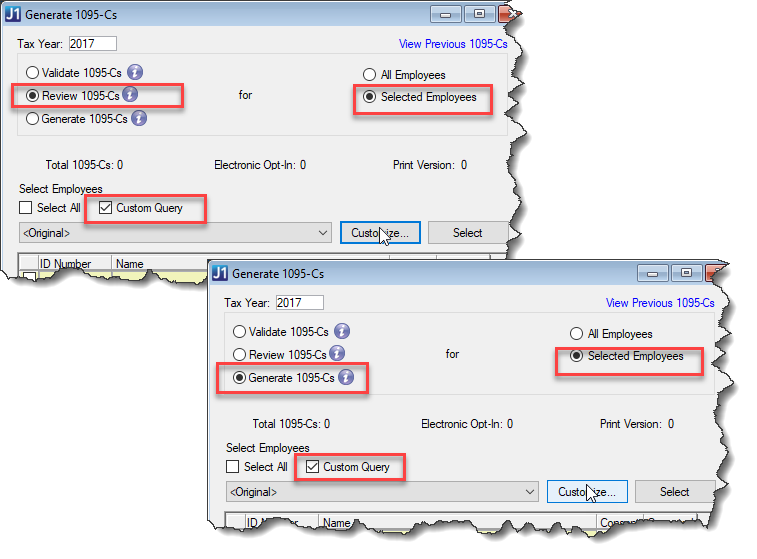

Select Employees via Query on the Generate 1095-Cs Window

Administrators can define a custom query to select which employees’ 1095-Cs get reviewed and generated.

Issue | Description |

|---|---|

139979 | From the HR Employee Master via Personnel window, when a user tried to enter a new employee and add content to the User Defined Forms – Name columns, the process didn’t insert a value for APPID resulting in an error stating that the fields were null/blank when trying to save. |

139980 | Pay Run Edit and Timecard Entry didn’t validate accrual time taken for all timecards entered in the batch per employee against the available amount when accrual was set to not allow negative available balance. |

168625 | In some cases, the GTL Batch Process was incorrectly calculating the Policy Face Value due to rounding. |

Update Payroll Process Now Looks for Benefit Codes Flagged 1098-T Eligible

When the Update Payroll process is run, the system will check the selected batch to see if any included IDs have a benefit code associated with a 1098-T flag. If a 1098-T flag is found, a 1098-T year and term is required.

Note

This update will be helpful for those workstudy students who choose to have their pay applied to their A/R balance.

New Status Rows in PATimecardDetailStatus Table

“Processing” and “Processed” status rows have been added to the PATimecardDetailStatus table to prevent web timecards already being processed from displaying on the J1 Web Employee Administrator Manage Timecards page. During the upgrade to 2019.4 a script runs to insert the status rows into the table and set a status of “Processed” for historical web timecards that exist in the CHK_HIST_TIMECARD table a TRANS_STS of “H”.

New Status Rows in PATimecardDetailStatus Table

“Processing” and “Processed” status rows have been added to the PATimecardDetailStatus table to prevent web timecards already being processed from displaying on the J1 Web Employee Administrator Manage Timecards page. During the upgrade to 2019.4 a script runs to insert the status rows into the table and set a status of “Processed” for historical web timecards that exist in the CHK_HIST_TIMECARD table a TRANS_STS of “H”.

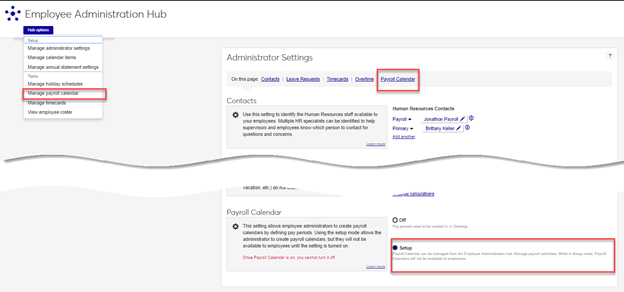

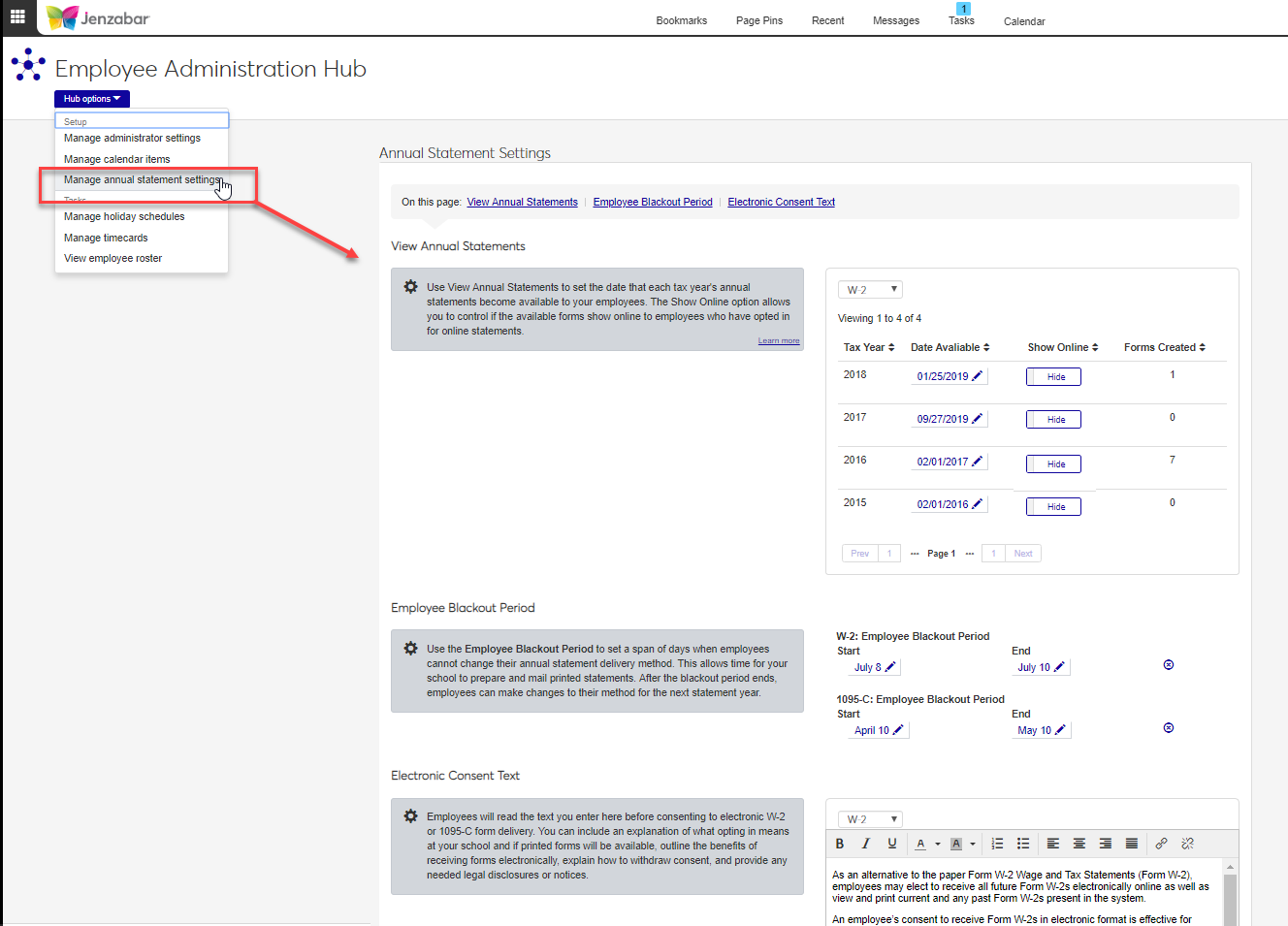

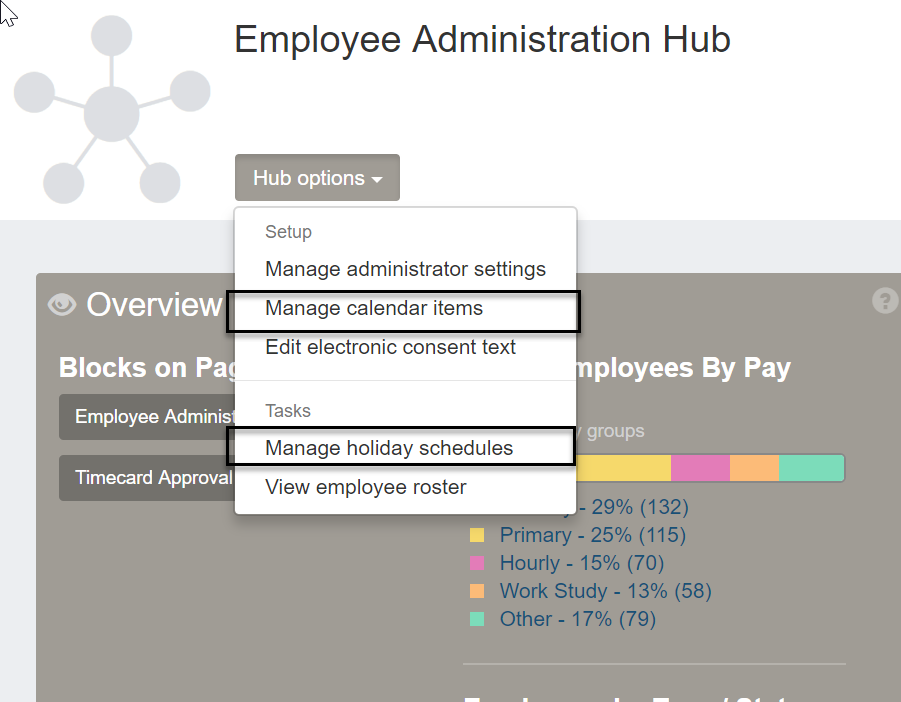

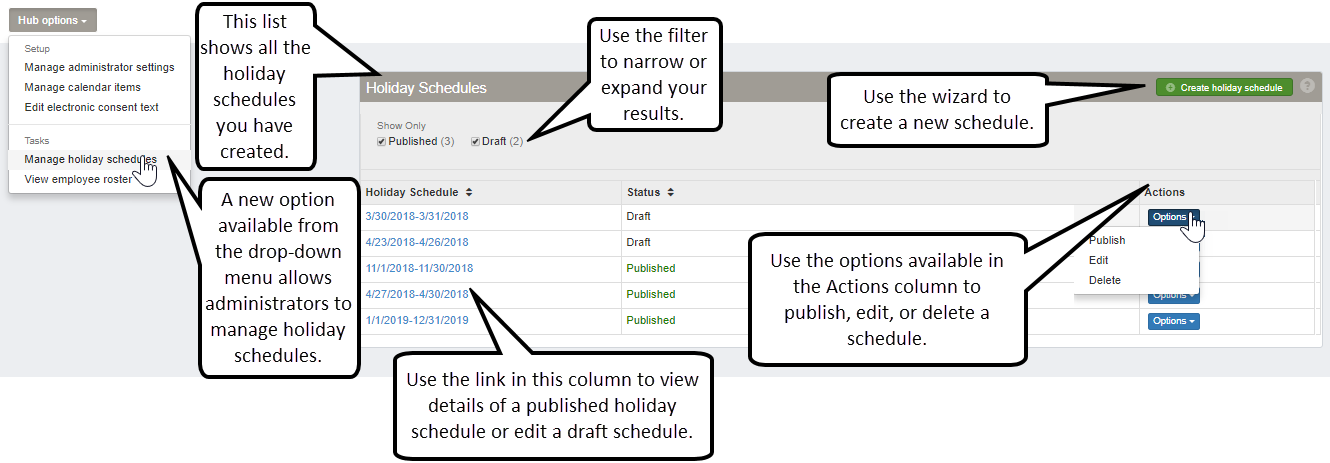

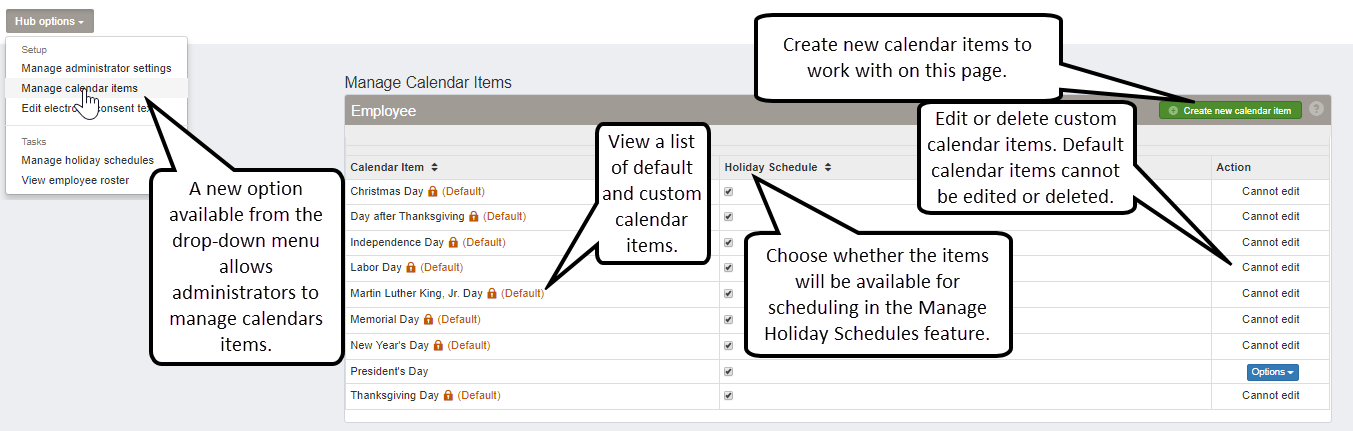

Annual Statements Settings

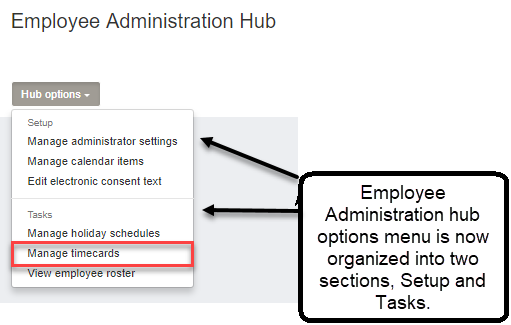

On the Employee Administration hub, the Edit electronic consent text hub option has been replaced with Manage annual statement settings. On the new Annual Statement Settings page, you can

Use the View Annual Statements setting to choose the date annual statements become available to users who have opted in to receive electronic statements.

Use the Employee Blackout Period setting to set a period of time when users can’t change the delivery method for their annual statements.

Use the Electronic Consent Text setting to edit the text that users must read and agree to before opting in for online annual statements.

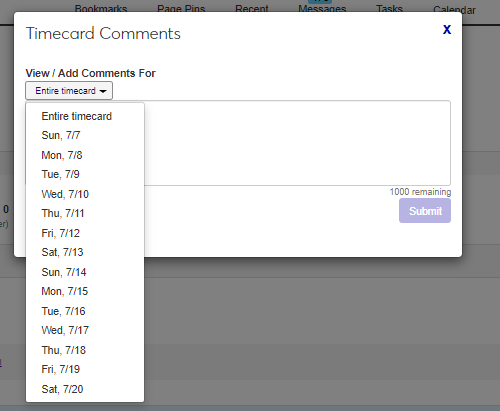

Individual Day Timecard Comments

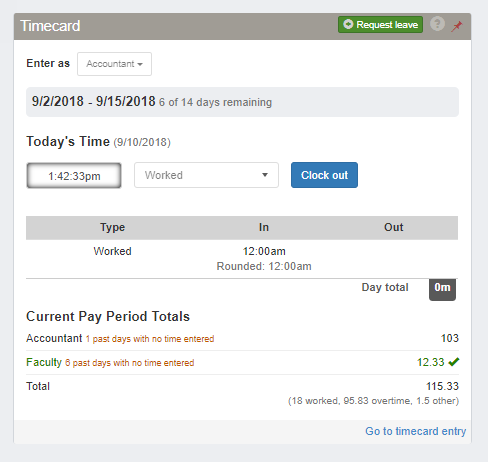

Employees, supervisors, and administrators can add timecard comments to individual days using the drop-down on clock in/out, hourly, and daily format timecards.

Change to Automatic Overtime Calculations

Automatic overtime is now calculated for all active hourly and workstudy positions, even if the employee also has a salaried position.

Change to Employee Administrator Manage Timecards Page

Timecards in processing and already processed no longer display on the Employee Administrator Manage Timecards page. “Processing” and “Processed” status rows have been added to the PATimecardDetailStatus table to prevent this.

Issue | Description |

|---|---|

178182 | When an employee double-clicked on the Clock-In button on the Employee hub's Timecard Block, the system allowed the employee to click the Clock-In button again This created multiple rows in the PATimeclock table for that employee's position when there should only be one. |

182400 | In some instances, where an employee was no longer in their position, desktop timecards (TIMCRDS) were not created when the J1 Web timecard was approved. |

Select Employees via Query on the Generate W-2s Window

Employee administrators can define a custom query to select which employees’ W-2s get reviewed or generated.

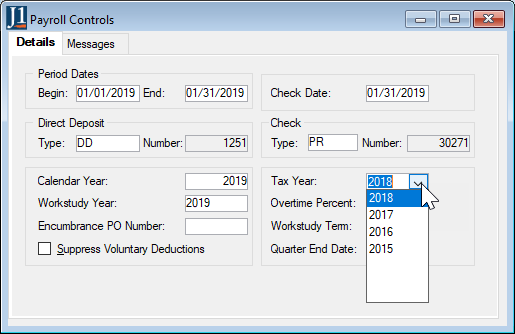

Change to Tax Year on Generate 1095-Cs/W-2s Windows